Bitcoin’s Surge 💰

The surge in Bitcoin’s popularity has captured the attention of investors and enthusiasts alike, propelling the digital currency into the spotlight. With its decentralized nature and potential for rapid growth, Bitcoin has become a symbol of the changing financial landscape. Its meteoric rise reflects a growing interest in alternative forms of currency and investment opportunities, challenging traditional financial systems. As more individuals and businesses embrace Bitcoin, its impact on global economies continues to evolve, paving the way for a new era of digital transactions.

Swiss Regulatory Environment 🇨🇭

The Swiss Regulatory Environment surrounding Bitcoin has evolved steadily as the cryptocurrency gained prominence. Switzerland is known for its progressive stance towards digital currencies, with authorities implementing regulations to provide clarity and security for businesses operating in this space. This proactive approach has positioned Switzerland as a favorable destination for blockchain and cryptocurrency ventures, attracting a growing number of companies seeking a conducive regulatory environment for their operations.

As the regulatory landscape continues to evolve, stakeholders in Switzerland’s cryptocurrency industry are navigating the legal framework with a greater sense of certainty. The Swiss government’s efforts to strike a balance between innovation and compliance have laid a solid foundation for the sustainable growth of Bitcoin and other digital assets within the country. With clear guidelines in place, businesses in Switzerland can engage in cryptocurrency activities with confidence, fostering further adoption and innovation in the blockchain space.

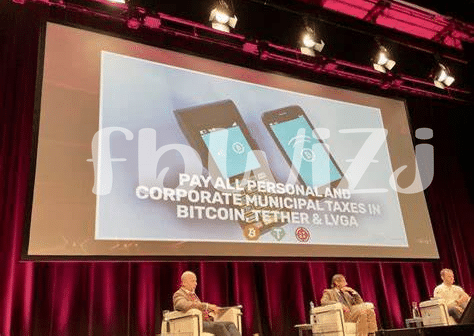

Taxation Considerations 📊

– Switzerland’s tax approach to Bitcoin transactions adds a layer of complexity for businesses navigating the adoption landscape. The classification of Bitcoin is key, with varying tax treatments depending on whether it’s seen as a digital asset or currency. While purchases with Bitcoin aren’t subject to value-added tax, capital gains tax implications arise from its fluctuating value. Proper record-keeping is essential, as accurate reporting and compliance with tax laws are crucial for businesses leveraging Bitcoin in Switzerland. Balancing innovation with regulatory tax requirements is a delicate yet necessary aspect for businesses to consider in their Bitcoin strategies.

Acceptance by Swiss Businesses 🏢

Bitcoin adoption among Swiss businesses has been steadily increasing as more companies recognize the benefits of using digital currency. From small startups to established corporations, many businesses in Switzerland are now accepting Bitcoin as a form of payment. This shift in attitude is not only driven by the potential for cost savings and faster transactions but also reflects a growing acceptance of cryptocurrencies in the mainstream economy.

For businesses in Switzerland, integrating Bitcoin payments into their operations can offer a competitive edge and appeal to tech-savvy consumers. With the regulatory environment becoming more favorable and an increasing number of businesses embracing digital currencies, the future looks promising for Bitcoin adoption in Switzerland. To delve deeper into the legal implications and considerations for businesses in this evolving landscape, one must examine the unique opportunities and challenges that come with incorporating Bitcoin into everyday transactions. To learn more about how different countries view Bitcoin’s legal status, check out this article on is bitcoin recognized as legal tender in Tanzania?.

Legal Frameworks for Transactions ⚖️

Bitcoin transactions in Switzerland operate within a well-defined legal framework that provides clarity and security for businesses engaging in cryptocurrency dealings. The Swiss authorities have taken a progressive approach, establishing guidelines that promote transparency and compliance in this evolving digital landscape. These regulations aim to safeguard consumers and businesses while fostering innovation and growth within the blockchain ecosystem. With defined laws governing transactions, businesses can navigate the complexities of cryptocurrency exchanges with confidence, knowing that their operations are aligned with legal standards and expectations.

As businesses embrace Bitcoin as a means of payment and investment, understanding and adhering to the legal frameworks for transactions is crucial for long-term success and sustainability. Compliance with these regulations not only ensures legal protection but also enhances trust and credibility in the eyes of customers and partners. By operating within the established legal boundaries, Swiss businesses can leverage the benefits of Bitcoin adoption while mitigating potential risks and liabilities associated with non-compliance. The evolving legal landscape presents opportunities for innovation and expansion, shaping a conducive environment for the continued growth of cryptocurrency transactions in Switzerland.

Future Possibilities and Challenges 🚀

Bitcoin’s increasing adoption in Switzerland opens up a realm of exciting future possibilities and challenges for businesses. As more companies incorporate Bitcoin into their operations, the potential for streamlined transactions and increased efficiency becomes evident. However, navigating the evolving legal landscape and ensuring compliance with regulations will be key challenges to consider. Additionally, as the use of cryptocurrencies continues to rise, businesses must stay vigilant against cyber threats and market volatility to safeguard their financial interests and maintain trust with customers.

Link to: is bitcoin recognized as legal tender in suriname?