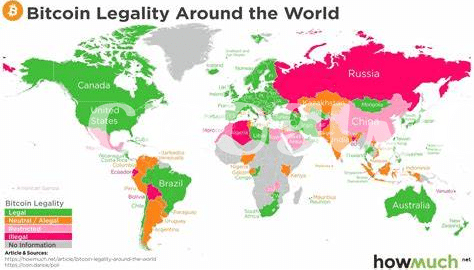

Legal Status 📜

In Panama, the legal status of Bitcoin remains a topic of ongoing discussion. While there is no specific legislation declaring it illegal, there is also no clear regulatory framework that officially recognizes it as a legal form of currency. This ambiguity leaves businesses and individuals unsure about the legal implications of using Bitcoin within the country. As a result, navigating the legal landscape surrounding Bitcoin adoption in Panama requires caution and an understanding of the existing laws to mitigate any potential risks.

Regulatory Framework 🏛️

Panama’s regulatory framework surrounding Bitcoin is a key aspect to consider for its adoption within the country. Understanding the legal guidelines and policies set forth by the government is crucial for individuals and businesses looking to participate in the cryptocurrency market. By exploring the regulatory landscape and potential challenges facing Bitcoin adoption, stakeholders can better navigate the evolving ecosystem. This transparency and clarity are essential for fostering trust and promoting wider acceptance of digital currencies within Panama.

Bitcoin Acceptance 💰

Panama has seen a gradual rise in businesses and individuals embracing digital currencies as a form of payment. From small shops to larger enterprises, Bitcoin acceptance is becoming more common, reflecting a growing trend towards digital payment methods. This shift in consumer behavior is not only driven by the convenience of using Bitcoin but also by a desire to stay ahead in the evolving financial landscape. As more businesses start accepting Bitcoin, the potential for its mainstream adoption in Panama continues to expand, highlighting a shift towards a more digitally integrated economy.

Tax Implications 💸

Bitcoin adoption in Panama has potential tax implications that require careful consideration. Individuals and businesses engaging with Bitcoin must navigate complex tax laws to ensure compliance and mitigate risks. Understanding the tax treatment of cryptocurrencies is crucial for avoiding penalties and maintaining financial health. By staying informed about evolving regulations and seeking expert advice, stakeholders can better navigate the tax landscape in Panama. To delve deeper into the implications of Bitcoin recognition in various economies, such as New Zealand, check out this insightful article: is bitcoin recognized as legal tender in niger?.

Challenges Ahead ⚠️

As Panama navigates the landscape of Bitcoin adoption, several challenges loom on the horizon. Among these are concerns regarding consumer protection and fraud, as the decentralized nature of cryptocurrencies can make transactions vulnerable to malicious actors. Additionally, the lack of clear regulatory guidelines poses uncertainties for businesses and individuals looking to engage with Bitcoin. Addressing these challenges will be crucial in establishing a secure and stable environment for the widespread acceptance of cryptocurrencies in Panama.

Future Outlook 🔮

Looking to the future, the adaptation and integration of Bitcoin into Panama’s financial landscape hold promising potential. As awareness and understanding of cryptocurrencies increase, we can anticipate further developments in regulatory clarity and acceptance by businesses. The evolving digital economy may pave the way for innovative payment solutions and investments, influencing how Panamanians engage with financial services. However, challenges such as cybersecurity risks and compliance with international standards will also need to be addressed to ensure sustainable growth in Bitcoin adoption within the country’s legal framework and economic ecosystem. Embracing these changes offers opportunities for Panama to position itself at the forefront of digital currency advancements.

insert a link to is bitcoin recognized as legal tender in nigeria? with anchor is bitcoin recognized as legal tender in new zealand? using the