🚀 the Dawn of Digital Gold: Bitcoin’s Journey

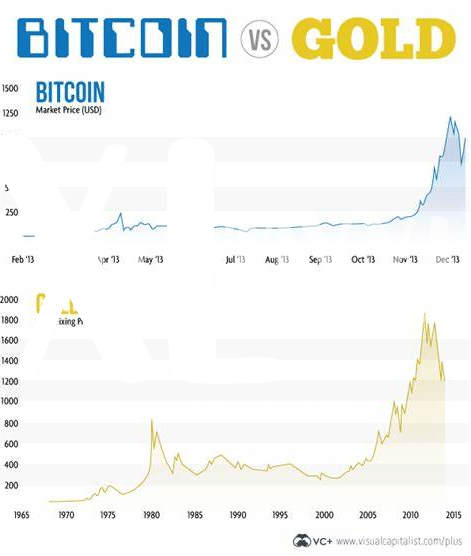

Imagine a world where gold isn’t dug from the earth but mined from computers. This is the story of Bitcoin, a digital treasure that began captivating the world’s imagination more than a decade ago. Its journey is a tale of innovation and resilience, growing from an experiment among tech enthusiasts to a global phenomenon. Unlike traditional gold, which has been valued for millennia, Bitcoin introduced a new way to think about value and trust, using complex codes and decentralized networks.

What truly sets Bitcoin apart is its foundation on blockchain technology, making every transaction transparent and secure, yet completely independent of any central authority. This digital marvel has not only challenged the way we view money but has also opened the doors to a new era of financial freedom and digital innovation. As we look back at Bitcoin’s journey, we see not just the birth of a new form of gold but the dawn of a revolution that redefines wealth for the digital age.

| Year | Significant Milestone |

|---|---|

| 2009 | Bitcoin’s Creation |

| 2010 | First Real-world Transaction |

| 2017 | Price Surges and Mainstream Attention |

| 2021 | Widespread Institutional Adoption |

| 2024 | Global Acceptance and New Peaks |

💡 What Makes Bitcoin Stand Out from Traditional Gold?

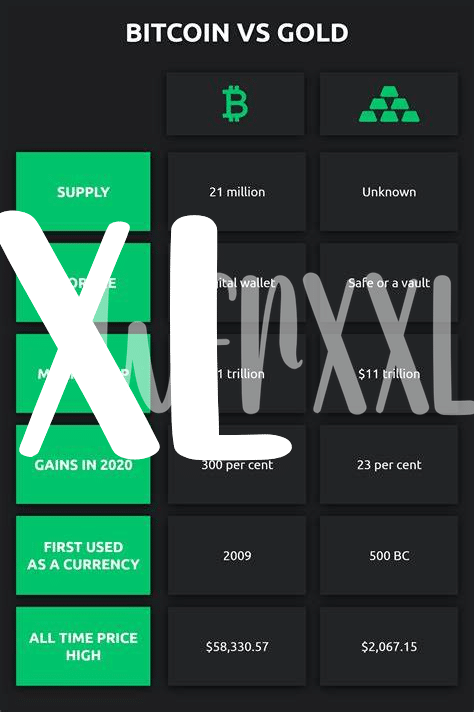

Imagine a treasure that you can carry across borders without anyone noticing; that’s Bitcoin for you. Unlike gold, which has been the go-to store of value for centuries, Bitcoin brings a lot of new tricks to the table. For starters, it’s digital, meaning you can move it around the world in a flash, without the need for heavy security or the risk of it getting stolen from your luggage.

While gold sits quietly in a vault, Bitcoin is out there making waves. Its ability to work as both a currency and an investment makes it unique. Plus, its digital nature means it’s accessible to anyone with an internet connection, breaking down the barriers that traditional gold has built over the years. As we dive deeper into 2024, the acceptance of Bitcoin is growing, not just among individuals but also businesses. For more insights on how the digital world is adapting to Bitcoin, check out https://wikicrypto.news/cryptocurrency-adoption-a-catalyst-for-bitcoins-value-surge, where the journey of Bitcoin wallets in this new era is thoroughly explored.

🌍 Global Acceptance: How Countries View Bitcoin in 2024

In 2024, the world is witnessing a fascinating transformation as countries are embracing Bitcoin like never before. Think of it as a global handshake, where nations, once hesitant, are now opening their doors to this digital currency. 🌏💼 The beauty of Bitcoin is its borderless nature, enabling fast and secure transactions across continents without the need for traditional banking systems. From bustling markets in Asia to tech-savvy cities in Europe and beyond, Bitcoin is becoming a household name, weaving its way into the very fabric of daily commerce. Countries are recognizing its potential not just as an investment but as a revolutionary way to boost their economies, making it a hot topic at economic forums worldwide. 📊💬 This wide acceptance heralds a new era where Bitcoin is not just an outsider looking in but a key player in the global financial playground, promising to reshape our understanding of money in an interconnected world.

💼 Bitcoin and Big Businesses: a Love Story?

In the bustling world of big business, where traditional investments reign supreme, Bitcoin has emerged as an unexpected darling, weaving its way into the fabric of corporate finance with an allure akin to a modern-day love story. Giants across various sectors, once skeptical, are now embracing Bitcoin, seeing it as a hedge against economic instability and a beacon of innovation in an ever-evolving digital landscape. This shift towards digital assets highlights a broader acceptance of Bitcoin’s potential to revolutionize not just personal finance but also the way companies approach their investment strategies. With its unique blend of security, privacy, and potential for growth, Bitcoin offers businesses a chance to diversify their portfolios in ways previously unimaginable. For those looking to understand this trend and how it intersects with changes in the global economic landscape, especially considering the evolving nature of Bitcoin wallets, a deep dive into what are bitcoin wallets in 2024 can shed light on the shifting paradigms. As we stand on the cusp of 2024, the love story between Bitcoin and big business appears to be just beginning, hinting at a future where digital gold plays a central role in corporate finance strategies.

🛡️ Security and Privacy: Bitcoin Vs. Gold

When thinking about keeping our savings safe, the old-school choice might have been to buy some gold and keep it under the mattress. But hey, we’re in 2024 now, and things are changing. Bitcoin is like your digital piggy bank, but instead of needing a physical key, you use a super-secret code (think of it as a digital combination lock) that only you know. This makes a lot of people breathe easier because, unlike gold that needs a big heavy safe and constant worrying about thieves, Bitcoin lives in the cloud. Sure, you’ve got to be smart about where you keep your digital keys, but isn’t it cool that your wealth can zip around the globe with you, tucked safely in your digital pocket?

| Feature | Bitcoin | Gold |

|---|---|---|

| Physical Presence | None (Digital) | Yes (Physical form required) |

| Storage Security | Encrypted digital wallets | Physical safes or security vaults |

| Privacy | High (Use of anonymous or pseudonymous addresses) | Low to Medium (Physical transactions can be tracked) |

| Portability | Extremely high (Internet access is all you need) | Low (Physical movement is cumbersome and risky) |

And let’s talk privacy. In the world of gold, to buy or sell it, you pretty often have to walk into a shop or involve a third party, which means there’s a paper trail. On the flip side, Bitcoin transactions can be like wearing an invisibility cloak. You can send or receive Bitcoin without ever having to share your real name or address, keeping your business just that – your business. This level of privacy and the security of knowing that your wealth can be as mobile and private as you want it to be? It’s one of the many reasons people are calling Bitcoin the new gold of our generation.

📈 Predicting the Future: Where Next for Bitcoin?

Peering into the future of Bitcoin feels a bit like gazing into a crystal ball, where the reflections show a spectrum of possibilities. Some financial wizards think Bitcoin is on a skyward trajectory, ready to shake up our wallets and world economies 🌐 in ways we’re just beginning to grasp. Imagine a future where digital wallets bulge with Bitcoin, not just for buying your morning coffee but for big stuff, like houses or cars. It’s a shift that could change how we think about money itself. Yet, this glowing vision isn’t without its thunderclouds. Skeptics wave caution flags, warning about bumps in the digital road that could jostle Bitcoin’s journey.

Understanding what sends the value of Bitcoin on its roller-coaster rides is crucial. Changes in technology, market demands, and even global events play their parts. For those scratching their heads, wondering why the value zigzags, a closer look at what impacts Bitcoin value in 2024 can shed some light. Each factor, from government regulations to technological innovations, weaves into a complex tapestry that forecasts Bitcoin’s fate. Whether it soars like a rocket or takes a dive, Bitcoin’s adventure is sure to keep us on our toes, watching, waiting, and wondering about what the next chapter holds.