Legal Framework 📜

Peru’s legal framework surrounding cryptocurrency and Bitcoin compliance is crucial in ensuring a secure and regulated environment. Understanding and adhering to the established laws and regulations within the country is essential for businesses operating in the Bitcoin sector. The legal framework provides guidelines on licensing requirements, compliance procedures, and enforcement measures, offering clarity and stability for both businesses and consumers in the industry. Stay informed and up-to-date with any regulatory changes or updates to maintain a compliant and trustworthy operation within Peru’s Bitcoin sector.

Kyc & Customer Due Diligence 🔍

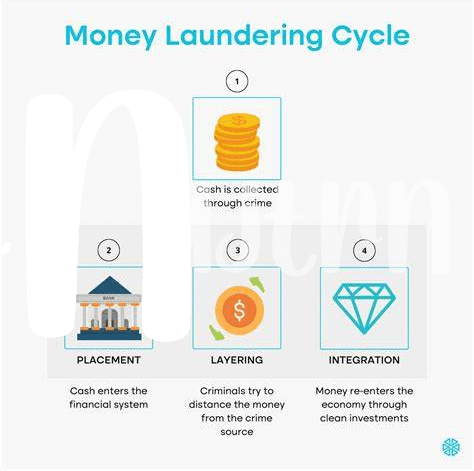

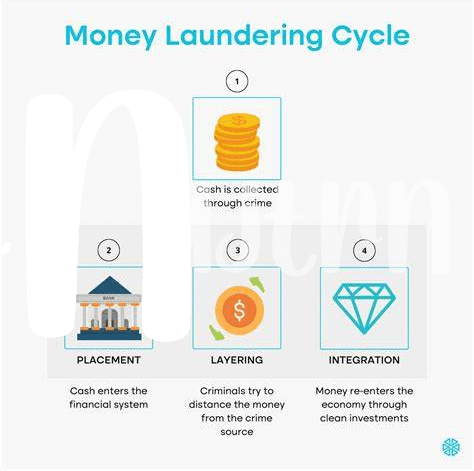

When it comes to ensuring compliance in Peru’s Bitcoin sector, conducting thorough KYC (Know Your Customer) procedures and rigorous customer due diligence are essential steps. By verifying the identity of users and assessing the risks they pose, businesses can mitigate potential money laundering activities effectively. Implementing robust processes for KYC and due diligence not only helps in maintaining regulatory compliance but also builds trust and strengthens the integrity of the sector. Keep in mind that these practices are crucial elements in safeguarding against illicit financial activities and ensuring a secure environment for cryptocurrency transactions.

Transaction Monitoring 🔒

Transaction monitoring is a crucial aspect of safeguarding against potential risks in the bitcoin sector. By closely observing the flow of transactions, companies can identify and investigate any suspicious activities, which is essential for maintaining compliance with regulations. Implementing robust transaction monitoring processes not only enhances security measures but also builds trust with regulatory authorities and customers. It serves as a proactive defense mechanism that helps detect, prevent, and report any illicit activities, ultimately contributing to a safer and more transparent financial environment. Leveraging advanced technology tools and staying updated on the latest trends in transaction monitoring are key strategies for effectively combating financial crimes and ensuring the integrity of operations within the bitcoin sector.

Reporting Requirements 📊

Reporting requirements are a crucial aspect of ensuring transparency and accountability in the Bitcoin sector. By implementing robust reporting mechanisms, businesses can effectively track and document all relevant financial transactions. This not only helps in identifying potential illicit activities but also aids in complying with regulatory standards set forth by authorities. Meeting reporting requirements is essential in maintaining trust and integrity within the industry, fostering a culture of compliance and responsibility.

Moreover, staying up-to-date with evolving reporting regulations is key to adapting to the dynamic landscape of AML compliance. Incorporating advanced technological solutions can streamline the reporting process, making it more efficient and accurate. This continuous dedication to fulfilling reporting requirements demonstrates a commitment to upholding ethical practices and safeguarding the integrity of the Bitcoin sector against financial crimes. By following best practices in reporting, businesses contribute to a safer and more secure ecosystem for all stakeholders involved.

Training & Awareness 🎓

Training and awareness play a crucial role in ensuring AML compliance within Peru’s Bitcoin sector. By providing comprehensive training programs to employees, businesses can enhance their understanding of regulatory requirements and suspicious activities to watch for. Additionally, raising awareness among staff regarding the importance of adhering to AML protocols can create a culture of compliance within the organization. Regular training sessions and updates on evolving regulations help reinforce the significance of maintaining vigilance in detecting and preventing money laundering activities in the Bitcoin sector.

Technology Solutions 🔧

When it comes to technology solutions for AML compliance, having the right tools in place is crucial for effectively monitoring and analyzing transactions in the Bitcoin sector. Utilizing advanced software programs can streamline the process of identifying suspicious activities, ensuring compliance with regulatory requirements, and minimizing potential risks. These solutions offer features such as real-time monitoring, automated alerts, and data analysis capabilities, enabling businesses to stay ahead of evolving AML regulations and protect against illicit financial activities.

For further information on AML regulations in the Bitcoin sector, you can refer to the bitcoin anti-money laundering (AML) regulations in Palau by visiting the bitcoin anti-money laundering (AML) regulations in North Korea.