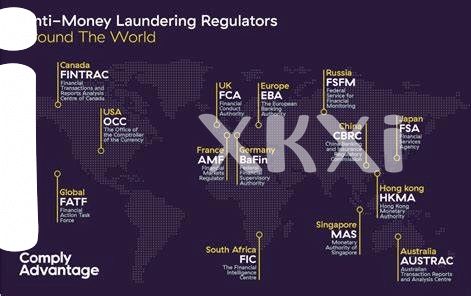

Regulatory Landscape 🌍

In Lebanon, the regulatory landscape surrounding Bitcoin operations is constantly evolving and challenging to navigate. With diverse perspectives and diverse stakeholders involved, it’s crucial for companies to stay abreast of the latest legal requirements and compliance standards. By understanding and adapting to the regulatory nuances, businesses can operate within the boundaries set by authorities while fostering growth and innovation in the cryptocurrency space. The dynamic nature of regulations emphasizes the importance of proactive engagement and strategic planning to ensure long-term sustainability and success in the ever-changing landscape.

Kyc Procedures 📋

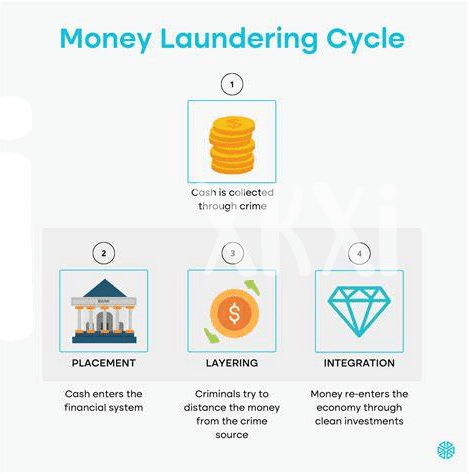

When it comes to Know Your Customer (KYC) procedures, thorough verification processes are essential for Lebanese Bitcoin operations. KYC not only ensures compliance with regulations but also helps in building trust with customers. Implementing robust KYC measures involves verifying customers’ identities, assessing their risk profiles, and monitoring transactions for suspicious activities. By following diligent KYC practices, businesses can mitigate risks related to money laundering and terrorist financing. Emphasizing the importance of KYC reinforces a culture of transparency and accountability within the Bitcoin ecosystem. Integrating advanced verification technology can streamline the KYC process, making it efficient for both businesses and customers. Ongoing evaluation and enhancement of KYC procedures are crucial in maintaining compliance and security standards.

Transaction Monitoring 🔄

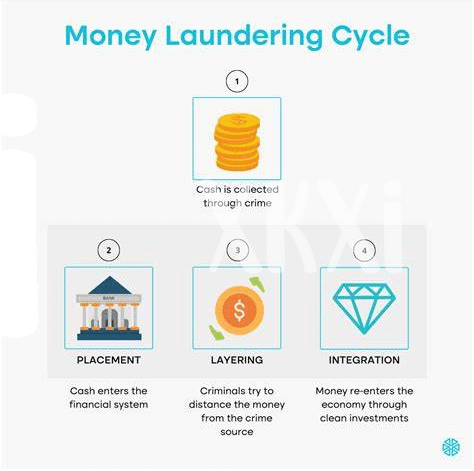

Effective transaction monitoring is crucial in ensuring compliance with anti-money laundering regulations. By closely tracking and analyzing financial transactions, businesses can flag any suspicious activities and report them promptly. This proactive approach not only helps in preventing potential illicit activities but also strengthens the overall integrity of the financial system. Implementing robust transaction monitoring processes provides a layer of security that is essential in the world of evolving financial technologies. It allows businesses to stay ahead of potential risks and demonstrates a commitment to adherence to regulatory requirements while safeguarding their operations and reputation.

Suspicious Activity Reporting 🚨

In order to maintain a robust compliance framework, implementing effective Suspicious Activity Reporting 🚨 procedures is essential. Prompt identification and reporting of any uncharacteristic or potentially illicit activities can help mitigate risks and ensure adherence to regulatory requirements. By establishing clear protocols and criteria for recognizing suspicious transactions, businesses can foster transparency and integrity within their Bitcoin operations. Moreover, cultivating a culture that prioritizes vigilance and accountability among employees is paramount in safeguarding against financial crimes and enhancing overall AML compliance efforts.

For further insights on enhancing AML compliance in the cryptocurrency sector, check out this informative article on the future of Bitcoin AML regulations in Kiribati at bitcoin anti-money laundering (AML) regulations in Kiribati.

Ongoing Employee Training 🎓

Ongoing Employee Training is a crucial component in ensuring effective AML compliance within Lebanese Bitcoin operations. By providing regular training sessions to employees, companies can keep them updated on the latest regulatory requirements, industry trends, and best practices. This ongoing education empowers staff members to recognize potential risks, understand their reporting obligations, and stay vigilant in monitoring transactions for any suspicious activity.

Additionally, continuous training helps foster a culture of compliance within the organization, where employees are encouraged to ask questions, seek guidance, and actively participate in maintaining a secure and transparent financial environment. Investing in the education and development of staff members not only enhances their individual knowledge and skills but also strengthens the overall compliance framework of the company for long-term success.

Technology and Automation 🤖

Technology and automation play a vital role in enhancing the efficiency and accuracy of AML compliance in Lebanese Bitcoin operations. By leveraging advanced software solutions and automated systems, businesses can streamline their compliance processes, improve data analysis capabilities, and detect suspicious activities more effectively. The integration of AI-powered tools and blockchain technology can provide real-time monitoring of transactions, enhance risk assessment procedures, and ensure regulatory compliance. Implementing robust technology-driven solutions not only increases operational effectiveness but also strengthens overall compliance efforts in the dynamic landscape of cryptocurrency transactions. For further insights into Bitcoin AML regulations, refer to the bitcoin anti-money laundering (AML) regulations in Latvia.