Increased Accessibility 🎉

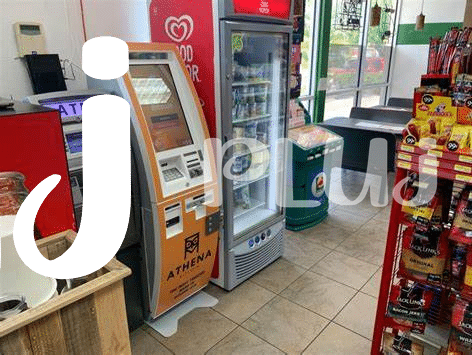

Bitcoin ATMs have revolutionized access to cryptocurrency in Saint Lucia, making it easier for individuals to buy and sell digital assets. These ATMs are conveniently located in various public places, providing users with a simple and familiar way to engage with Bitcoin. With increased accessibility, more people can now participate in the growing digital economy, leveling the playing field for financial inclusion in the region.

Growing Acceptance 🌟

Bitcoin ATMs are gaining traction in Saint Lucia as more businesses and consumers recognize the convenience and benefits they offer. The increasing number of Bitcoin ATMs in the country reflects a growing acceptance of cryptocurrency as a legitimate form of payment. This trend is not only making digital currencies more accessible but also contributing to their mainstream adoption. As more people become familiar with the simplicity and efficiency of using Bitcoin ATMs, the future of cryptocurrency adoption in Saint Lucia looks promising.

Financial Privacy Concerns 🤔

With the rise of Bitcoin ATMs in Saint Lucia, comes the concern of financial privacy. Users may be apprehensive about the level of anonymity provided by these machines. While transactions are recorded on the blockchain, the personal information of individuals conducting these transactions may still be vulnerable to privacy breaches. This has sparked a debate among users about the trade-off between convenience and privacy when using Bitcoin ATMs.

Transaction Fees 💸

Bitcoin ATMs offer a convenient way for individuals to buy and sell cryptocurrencies, but one aspect that users need to consider are the associated transaction fees. These fees vary depending on the specific ATM operator and location, and can sometimes be higher than fees charged by traditional exchanges. It’s important for users to be aware of these costs to ensure they are making informed decisions when using Bitcoin ATMs for their transactions. As the popularity of cryptocurrencies continues to rise, understanding and managing transaction fees will be key in maximizing the benefits of this technology.

For more information on the legality of Bitcoin ATMs, check out this informative article on are bitcoin ATMs legal in Moldova?.

Security Risks 🔒

When using Bitcoin ATMs in Saint Lucia, it is essential to be aware of potential security risks. These risks can include the possibility of scams, hacking attempts, or even physical theft. It’s crucial to exercise caution and ensure that you are using a reputable Bitcoin ATM provider to minimize these security concerns. Being proactive in safeguarding your transactions and personal information can help mitigate the risks associated with using Bitcoin ATMs in an increasingly digital world.

Regulatory Challenges 🚫

Increased accessibility has been a major boon for users of Bitcoin ATMs in Saint Lucia, but regulatory challenges have posed significant obstacles to their widespread adoption. The evolving legal landscape and varying regulations across different jurisdictions create uncertainty for both operators and users. Ensuring compliance with anti-money laundering (AML) and know your customer (KYC) regulations can be time-consuming and costly, leading to a slower growth rate for Bitcoin ATMs in the region.

Are bitcoin atms legal in Saint Kitts and Nevis? 🎫 Learn more about the regulatory environment surrounding Bitcoin ATMs in Rwanda here: Are bitcoin ATMs legal in Rwanda?