A Quick Trip down Memory Lane: Bitcoin’s Rise 📈

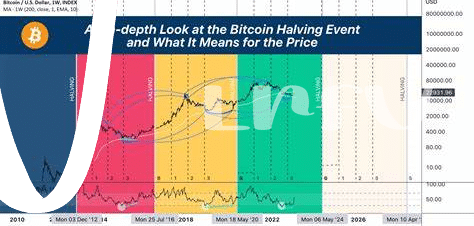

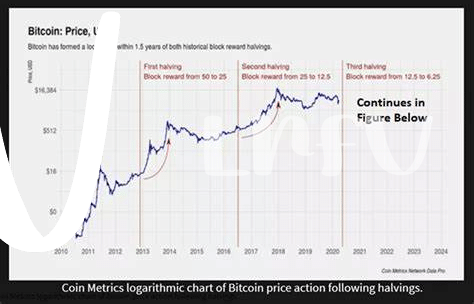

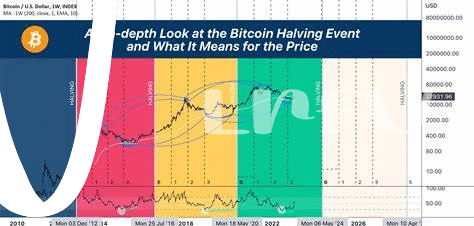

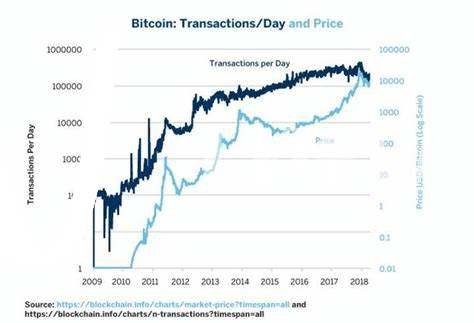

Imagine a world where a new kind of money is born, one that lives entirely on the internet – that’s Bitcoin for you. It started off as a whisper in the vast digital realm back in 2009, created by a mysterious figure known only as Satoshi Nakamoto. This wasn’t just any currency; it was a digital gold rush, an escape from traditional money controlled by governments. As years slipped by, Bitcoin grew from a digital novelty into a treasure sought by millions. Imagine turning a few dollars into thousands–that’s what happened for early adopters who saw Bitcoin not just as money, but as an idea worth betting on.

| Year | Significant Bitcoin Milestone |

|---|---|

| 2009 | Bitcoin’s Network Comes to Life |

| 2010 | First Real-world Transaction: 10,000 BTC for two Pizzas 🍕 |

| 2013 | Bitcoin Surpasses $1,000 for the First Time 🚀 |

| 2017 | Bitcoin Peaks Near $20,000 📈 |

| 2020 | Institutional Adoption Grows, New Record Highs 🏦 |

As we take this stroll down memory lane, remember, the journey of Bitcoin is a testament to the power of innovation and the belief in a decentralized future. Through its highs and lows, it has paved the way for a financial revolution that continues to unfold.

What Is Behavioral Economics? a Simple Introduction 🧠

Imagine going to a supermarket with a shopping list, planning to buy only what’s on that list. But by the time you reach the checkout, your cart is full of items that weren’t on your list. This happens because of various influences and decisions you make on the spot, like spotting a sale or a new chocolate flavor. Behavioral economics looks at how we make choices, not just when shopping but also in finance, considering how social, psychological, and emotional factors impact our decisions. It’s about understanding why we might buy a stock or, one could say, a piece of Bitcoin, not because it’s a sound investment but because everyone else is talking about it or doing it.

It gets even more interesting when we apply these ideas to the financial world, especially with Bitcoin. You’ve probably noticed how people talk about “getting in on the action” when its price goes up and how they panic when it goes down. Behavioral economics dives deep into these group behaviors and individual instincts, aiming to understand why we often act against our own financial interest driven by emotion and herd instinct, rather than logic. Through this lens, we can better grasp how and why the market moves and learn to make more informed decisions. This understanding is crucial in today’s world, especially considering how digital currencies like Bitcoin are becoming more mainstream. For those looking to dive deeper into cryptocurrency trends and education, a great resource is https://wikicrypto.news/the-rising-demand-for-cryptocurrency-education-next-year.

The Herd Mentality: When Fear and Greed Take over 🐑

Imagine walking down a bustling street and noticing everyone running in one direction. Curiosity, fear, or even a dash of excitement might nudge you to follow, even if you’re not sure why. This phenomenon isn’t just seen in crowded places but also dances through the world of Bitcoin investments. Often, investors stop relying on detailed analyses or personal convictions and start moving with the crowd. This wave of collective action stems from deep-seated emotions: fear of missing out on profits or the dread of losing it all. It’s a powerful force, capable of pushing the market in unpredictable ways.

At the heart of this movement are two emotions driving the bus: fear and greed. When news breaks that Bitcoin’s value is climbing, a sense of urgency blooms. “Buy now, or regret it later,” becomes the mantra, fueling a buying frenzy. Conversely, as soon as the wind changes direction, and prices begin to dip, fear kicks in, leading to a mass sell-off. This cycle creates a rollercoaster of peaks and troughs in the market, making it a daunting task to predict what’s next. Understanding this herd mentality is crucial for any investor looking to navigate the choppy seas of cryptocurrency markets with a cool head.

Navigating the Waves: Understanding Market Sentiments 🌊

Imagine the stock market as a vast ocean, with Bitcoin investments being both the ships and the waves. Sometimes the water is calm, and investments smoothly sail towards their goals. Other times, the market becomes a stormy sea, with waves of sentiment crashing against our decision-making. It’s in these choppy waters that understanding the underlying emotions of investors can be like having a navigational map. Fear, excitement, and news can cause ripples that turn into tsunamis, affecting how everyone buys or sells. Deciphering this ebb and flow is crucial for anyone looking to maintain a steady course through the unpredictable world of Bitcoin investments.

For those exploring the best practices for incorporating Bitcoin into their everyday transactions, making an informed choice on choosing between software and hardware bitcoin wallets in 2024 becomes invaluable. Just like understanding market sentiments, selecting the right wallet can significantly impact your Bitcoin journey. Whether it’s reacting to market trends or opting for the most secure way to store your digital currency, being well-informed enables you to navigate the complexities of the crypto space with confidence. Insight into these areas not only empowers investors but also lays the groundwork for a more stable and informed Bitcoin ecosystem.

Real Stories: How Emotions Shape Bitcoin Investments ❤️

Imagine a friend, Joe, who always loved stories about treasure hunts. When he first heard about Bitcoin, it felt like a modern-day adventure. Excited, he jumped in, driven by tales of overnight millionaires. Then there’s Sarah, who watched cautiously from the sidelines, nervous about losing her hard-earned savings. She only decided to buy some Bitcoin after hearing her colleagues talk about it every day. Their decisions were swayed not just by numbers on a screen but by the stories they heard and the emotions they felt – a vibrant illustration of how deeply our feelings can dive into the realm of investments.

| Investor Profile | Emotion | Action |

|---|---|---|

| Joe – The Enthusiast | Excitement | Invests early, driven by tales of quick riches |

| Sarah – The Cautious | Fear, then FOMO (Fear of Missing Out) | Delays, then invests influenced by peer discussions |

These stories reveal a universal truth: emotions play a huge part in our financial decisions. Whether led by the thrill of adventure, like Joe, or nudged by the fear of missing out, like Sarah, our emotional responses to the stories around us can profoundly shape our investment journeys. Understanding this can help us navigate the highs and lows of Bitcoin investing with a bit more wisdom and a little less panic.

Strategies to Keep Your Cool in a Volatile Market 🧊

Imagine sailing in the open sea, where waves represent the highs and lows of the Bitcoin market. Now, maintaining a steady course amidst these tumultuous waters requires a blend of wisdom, patience, and the right tools. One key strategy is setting clear goals and sticking to them 🧭. Whether you’re aiming for long-term investment or short-term gains, having a defined target helps you avoid making decisions based on temporary emotions. Another vital tactic is diversifying your investments 🌐. Just like not putting all your eggs in one basket, spreading your investments across different assets can cushion the blow if the Bitcoin market takes an unexpected turn.

Moreover, education is your best ally in navigating these waters. Keeping abreast of market trends and understanding the underlying technologies can empower you to make informed decisions. For those looking to dive deeper, consider enrolling in educational courses on bitcoin and cryptocurrency technologies in 2024. These programs cover various aspects, from the basics of blockchain to advanced strategies for optimizing bitcoin payment channels for small transactions in 2024. [Link to the course]. Remember, in the ever-evolving world of Bitcoin, knowledge is not just power—it’s your lifeline.