What Is Bitcoin Halving? 🤔

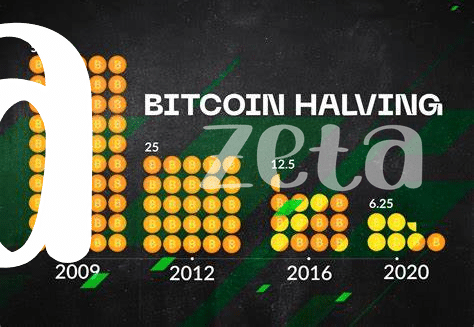

Imagine you’re playing a video game where gold coins are rare and valuable. Every so often, the game makes these coins twice as hard to find. This is a bit like a special event in the Bitcoin world known as “halving.” It’s a clever trick built into Bitcoin’s design to control how new bitcoins are made. Picture a grand digital clock ticking away; every four years, it strikes a magic number, and suddenly, the reward miners get for solving complex puzzles on the computer (and hence securing the network) is cut in half. Initially, miners received 50 bitcoins for their efforts, but after the first halving, they got only 25. This process aims to mimic the scarcity and value increase that gold experiences as it becomes harder to find. By reducing the reward for mining new blocks, the creation of new bitcoins slows down, making them more scarce and, ideally, more valuable over time.

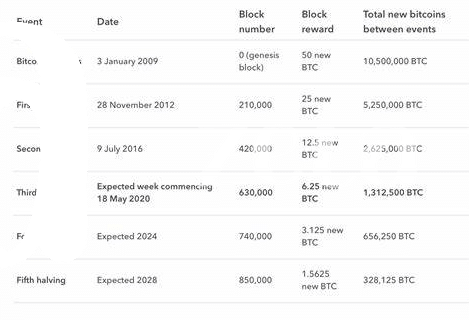

Here’s a simple table to visualize past Bitcoin halving events and the rewards before and after:

| Halving Event | Reward Before Halving (BTC) | Reward After Halving (BTC) |

|---|---|---|

| 1st Halving (2012) | 50 | 25 |

| 2nd Halving (2016) | 25 | 12.5 |

| 3rd Halving (2020) | 12.5 | 6.25 |

This process isn’t just about making bitcoins rare. It also beautifully balances the need to introduce new bitcoins into the world without flooding the market too quickly, aiming for a stable and steady increase in value overtime.

Before the Halving: the Anticipation 📈

In the world of Bitcoin, the buzz around the halving event is kind of like waiting for a big, global party where everyone’s invited but no one knows exactly how it’s going to turn out. People start talking and speculating months in advance. “Will the price go up?” “Is now the best time to buy?” These questions fill online forums, and everyone seems to have an opinion or a theory. It’s a period filled with excitement and a bit of nervousness, as investors and enthusiasts alike try to predict the market. This anticipation drives some to buy more Bitcoin, hoping that its value will skyrocket after the halving event.

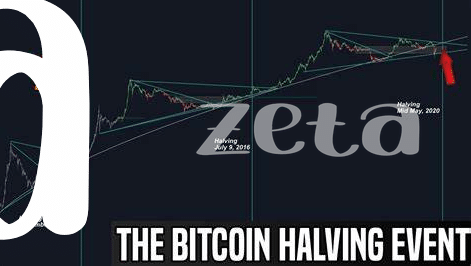

As the big day approaches, the atmosphere in the crypto community becomes electric. Every past halving has written a new chapter in Bitcoin’s history, so the expectations are high. Will this time follow the trend and boost the value of Bitcoin? Nobody knows for sure, which only adds to the intrigue. People from all over the globe tune in to witness the event, ready to analyze every movement in the market. It’s a unique mix of uncertainty and optimism, a financial phenomenon that draws in novices and experts alike, sparking discussions that range from the technical aspects of the halving process to its potential impacts on the broader economy. Amid this speculation, some look to diversify their knowledge and understand more about the crypto realm, with resources like https://wikicrypto.news/decoding-the-basics-bitcoin-futures-trading-explained serving as a beacon for those eager to learn.

The Halving Moment: What Actually Happens? ⏳

Imagine it’s a big celebration in the Bitcoin world, happening roughly every four years, much like the Olympics, but for the digital currency community. This special event is all about cutting down the rewards that the very clever people, known as miners, get for solving complex puzzles to validate transactions and add them to the blockchain. When the halving hits, these rewards are sliced in half 🍕. It’s like a magic trick that not only affects how much new Bitcoin comes into existence but also aims to keep inflation in check and make Bitcoin more scarce, and as you might guess, often more valuable over time. At this moment, miners find themselves in a new reality where their rewards for keeping the Bitcoin network running are reduced, making everyone hold their breath to see how things will unfold. This pivotal event is celebrated and watched closely, as it marks a transition into a phase that could potentially lead the way to new highs or challenge the community to adapt to the leaner rewards 🚀🌌.

After the Dust Settles: Immediate Effects 🌪️

Imagine the arena right after a big game; the excitement still buzzing in the air, traces of the event lingering. That’s a bit like how things are right after a Bitcoin halving. The immediate aftermath isn’t a silent, empty space but one brimming with reactions and ripples. First off, everyone’s eyes are glued to the price. It’s a roll of the dice whether it zigs up or zags down, as miners earn half what they used to for verifying transactions. This sudden change can make them rethink their operations. For those who’ve kept their ears to the ground, anticipating this moment, strategy shifts are already in motion. Some might pause, considering their next move in this newly adjusted landscape. Meanwhile, the broader community buzzes with discussions, predictions, and countless back-of-the-napkin calculations on what’s next. Amidst all this, newcomers scratching their heads about what a halving really means might find clarity by exploring bitcoin educational resources for beginners. It’s a crucial time, like the soil after a storm – different for everyone, but undeniably fertile ground for change.

Long-term Changes: the Bigger Picture 🌍

When we step back and look at the big picture, the halving isn’t just a momentary event; it’s like planting a tree that will grow over time 🌱. Initially, it might not seem like much has changed, but as days turn into years, the landscape begins to transform. The scarcity created by halving makes Bitcoin more like gold, not just in its shine but in value, too. People start to see it as a savings vehicle, a way to protect against money losing its value over time. Meanwhile, miners, the folks who create Bitcoin, have to adapt. Since they get fewer Bitcoins for their work, only the most efficient can thrive, leading to advancements in technology and greener ways to mine.

| Aspect | Before Halving | After Halving |

|---|---|---|

| Public Perception | Interesting digital currency | Valuable digital gold 🏆 |

| Miner’s Earnings | Higher quantity of Bitcoin | Quality over quantity, pushing for innovation 🛠️ |

| Market Dynamics | Volatility and speculation | Stability through scarcity, attracting long-term investors 🚀 |

The ripple effects extend far beyond just the price. As excitement builds, more people jump onto the Bitcoin bandwagon, not wanting to miss out. This widespread adoption furthers Bitcoin’s legitimacy and encourages businesses to start accepting it as payment, weaving it deeper into the fabric of our daily lives. With each halving, Bitcoin takes a step closer to its goal of being a universally accepted form of money, changing how we think about and use money forever.

Beyond Bitcoin: Impact on the Crypto World 🌐

When bitcoin undergoes a halving, it doesn’t just affect the miners and investors directly involved with bitcoin; the ripples extend far and wide across the entire cryptocurrency ocean. 🌐 Think of it like throwing a big rock into a pond. The splash is what everyone watches, but the waves that follow reach every corner. In the world of crypto, other currencies often look up to bitcoin as the big brother, setting trends and mood. So, when bitcoin has a halving event, it sends out a signal that can alter the strategies of other cryptocurrencies. Some may adjust their operations to align with the new bitcoin landscape, hoping to catch some of the positive vibes or avoid any potential downturns.

This shift isn’t just theoretical; it has practical implications for the entire blockchain ecosystem. For instance, changes in bitcoin’s mining rewards and value can encourage innovative technologies and approaches in other projects, aiming for sustainability and efficiency. Moreover, for those looking to dive deeper into how these events might influence market strategies and controversies, an exploration into bitcoin controversies for beginners could offer some intriguing insights, mirroring the complexities and considerations that ripple through the crypto world post-halving. 📊🔄