The Big Entrance: Central Bank Digital Currencies (cbdcs) 🌍

Imagine a new kind of money, one that’s digital and comes straight from the people who control our regular money – think of it as money’s modern twist. This is where Central Bank Digital Currencies (CBDCs) step onto the world stage, shaking up how we think about spending, saving, and investing. Around the globe, from vast countries to tiny islands, central banks are experimenting with this novel concept. It’s like they’re planting seeds for futuristic money trees that could one day grow in everyone’s digital wallet.

This isn’t just a small change; it’s a leap into the future of finance. CBDCs promise to make transactions faster, cheaper, and more secure, bringing the digital ease many of us love into the realm of official currency. But what does this mean for the everyday person? In a nutshell, it could transform everything from buying groceries to paying taxes, making the whole process as easy as sending a text message. Here’s a quick comparison to see how CBDCs stack up against traditional cash:

| Feature | Traditional Cash | CBDCs |

|---|---|---|

| Physical Form | Yes | No |

| Transaction Speed | Instant (in person) | Almost instant (digital) |

| Transaction Cost | Varies | Generally lower |

| Security | Variable | Enhanced |

The dawn of CBDCs is not just a new chapter for money; it’s the start of a whole new book.

Bitcoin’s Role in Today’s Digital Currency World 🌐

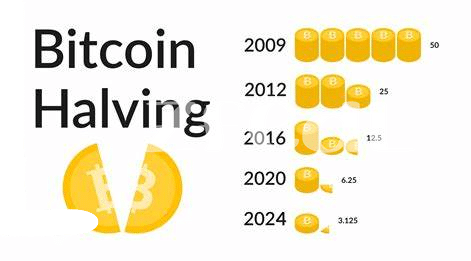

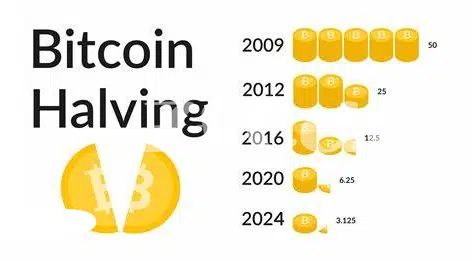

In the vast and colorful landscape of digital currency, Bitcoin stands tall as a pioneering tower. It’s much like the first ray of sunlight breaking through the dawn of the digital age, illuminating paths for others to follow. Since its inception, Bitcoin has not just been a form of currency but has shaped the very notion of what digital money could and should be. It has stirred a revolution, heralding an era of financial self-sovereignty where individuals hold power over their assets, free from the constraints and oversight of traditional financial institutions. Its journey from an obscure internet novelty to a valuable asset sought by millions has woven a complex narrative of innovation, resilience, and, at times, sheer unpredictability. This unique position Bitcoin occupies is not just about its value in the market; it’s about the conversations it starts, the movements it propels, and the possibilities it unveils for the future. As we navigate through the evolution of digital currencies, Bitcoin remains a critical chapter in this unfolding story, a testament to the power of pioneering ideas in shaping the future of finance. For anyone keen to dive deeper into this fascinating world, exploring resources like https://wikicrypto.news/the-rise-of-crypto-philanthropists-bitcoins-leading-role can offer valuable insights and knowledge.

Comparing Apples and Oranges: Cbdcs Vs Bitcoin 🍏🍊

When we look at central bank digital currencies (CBDCs) and Bitcoin, we’re basically exploring two very different worlds. 🌍🔍 On one hand, CBDCs are like the new, shiny cars straight from the official dealership – they’re backed by the country’s government, promising a form of digital money that’s reliable and stable. Think of them as a direct extension of the paper money in your wallet, but in a digital form. Unlike traditional money though, they’re designed to move through the digital world swiftly and securely, all under the watchful eye of the government’s central bank.

On the flip side, Bitcoin dances to its own beat. 🌐💃 It’s the rebel of the currency world, born on the internet and governed by a community, not a central authority. This digital gold has made waves for its role in empowering users with a decentralized, peer-to-peer financial system. It’s like the cool, mysterious motorbike that operates outside of the traditional rules of the road. While both aim to modernize the way we think about and use money, their approaches couldn’t be more different. This marks the beginning of an interesting relationship – one where the steady, reliable nature of CBDCs meets the wild, pioneering spirit of Bitcoin. 🚀✨

Possible Turbulence: Cbdcs Impacting Bitcoin’s Value 🌪️

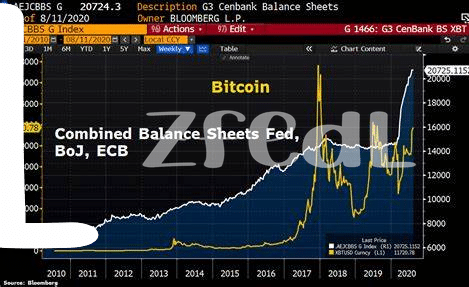

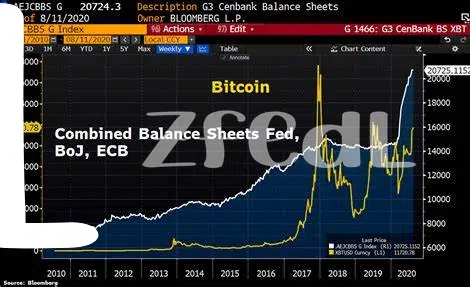

As central bank digital currencies (CBDCs) make their grand entrance onto the world stage, they might just stir up the waters for Bitcoin. Imagine the financial world as a vast ocean; until now, Bitcoin has been one of the biggest and most dazzling fish in that sea. But with CBDCs swimming into the scene, the ripples caused could potentially affect Bitcoin’s value. It’s a bit like when a new, flashy player enters a game, and suddenly, everyone’s eyes are on them, wondering how the game will change. Coupled with governments’ backing, CBDCs offer a level of security and stability that Bitcoin, with its wild price swings, can’t always match. This could lead some people to lean towards CBDCs, seeing them as a safer harbor in stormy seas, potentially impacting Bitcoin’s demand and value.

However, for those navigating these choppy waters, it’s vital to stay informed and ready for any scenario. That’s where bitcoin educational resources in 2024 come into play, offering a compass to guide Bitcoin enthusiasts. While CBDCs might present a new challenge, the resilience and innovative spirit that have defined Bitcoin’s journey so far suggest it could find ways to thrive. After all, Bitcoin has weathered many storms, and each challenge offers opportunities for growth and adaptation. Perhaps the emergence of CBDCs might encourage further innovation within the Bitcoin space, sparking new ways for it to enhance its value and appeal in a world with CBDCs. As with any journey, the key is to have the right resources at your disposal, ensuring you’re well-prepared to navigate the future, regardless of the weather.

Opportunities Ahead: Bitcoin and Cbdc Collaboration 🤝

Imagine a world where giants learn to dance together, combining their strengths for a greater good. That’s the potential scene as the new digital coins from central banks (called CBDCs) and the trailblazer of digital currency, Bitcoin, start to play in the same sandbox. While they may seem like rivals at first glance, there’s a silver lining if we look closer. CBDCs could actually make Bitcoin stronger in ways we haven’t thought possible. They might introduce more people to the concept of digital money, creating a larger playground for Bitcoin to shine. Plus, their entrance could lead to new rules and tools that make transactions smoother, safer, and faster for everyone. We’re talking about a future where the solid reliability of CBDCs meets the fearless flexibility of Bitcoin, leading to innovative solutions we can only start to imagine.

| Aspect | CBDCs | Bitcoin |

|---|---|---|

| Introduction to Digital Currency | ✅ | 🔥 |

| Transaction Speed | ⚡ | ⚡ |

| Innovation Potential | 🌱 | 🚀 |

Navigating the Future: Strategies for Bitcoin Holders ⛵

As the seas of the digital currency world become more turbulent, Bitcoin holders find themselves at a crucial crossroads. With the arrival of Central Bank Digital Currencies (CBDCs), the traditional stronghold Bitcoin has held in the digital currency ecosystem faces new challenges. Yet, this isn’t the end of the road; rather, it’s a new chapter. Smart navigation involves embracing adaptability and education. Staying informed on the latest trends and understanding the nuances between Bitcoin and CBDCs can empower holders to make informed decisions. Diversifying investments to include both might not just be a savvy move, but a necessary one for weathering potential storms ahead. 🌍⛵🤝

Moreover, in this evolving landscape, committing to the broader community through philanthropy could also play a pivotal role in reinforcing Bitcoin’s relevance. bitcoin recovery tools in 2024 can offer a glimpse into how individuals can contribute to a resilient Bitcoin ecosystem that not only survives but thrives amidst the rise of CBDCs. Engaging in these practices not only aids the collective but can also forge a path of recovery and solidarity, highlighting the unique strengths of Bitcoin in contrast to its digital counterparts. 🍏🌪️