Introduction to Technology in Bitcoin Aml Compliance 🌐

Technology plays a pivotal role in ensuring that Bitcoin AML compliance is effectively implemented and maintained. Through innovative tools and software solutions, financial institutions and regulatory bodies in Fiji can leverage technology to streamline their AML processes and enhance the monitoring of cryptocurrency transactions. These advancements not only improve the efficiency of compliance procedures but also contribute to a more robust and secure financial ecosystem.

Current Challenges in Fiji’s Aml Regulations 🇫🇯

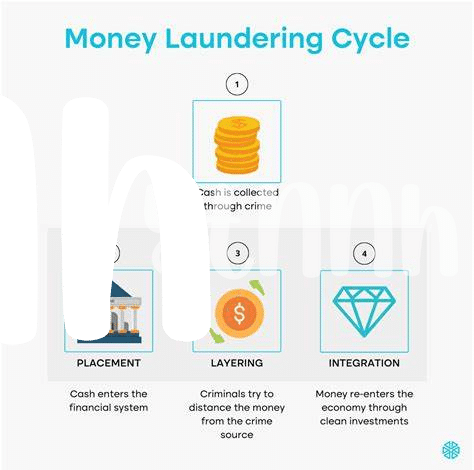

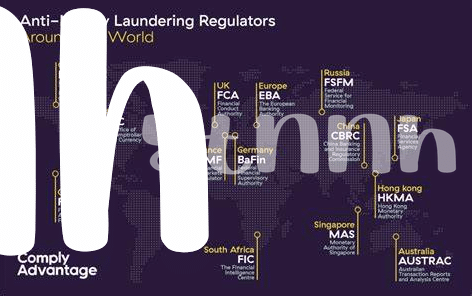

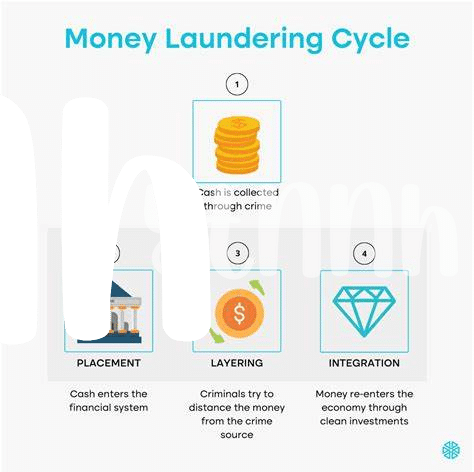

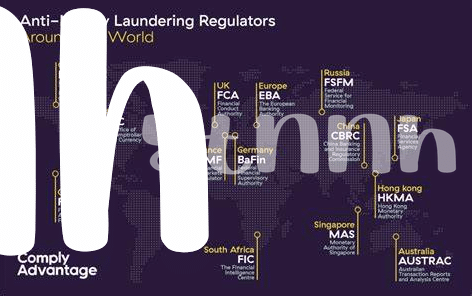

Fiji’s AML regulations face unique challenges in the realm of combating money laundering activities within the Bitcoin ecosystem. The lack of specific legislative frameworks tailored to address the nuances of virtual assets poses a significant hurdle for regulatory authorities. Equally concerning is the evolving nature of financial crimes, which often outpace the capabilities of current AML measures. Implementing effective detection mechanisms for illicit transactions remains a pressing issue, requiring innovative solutions that can keep pace with the rapidly changing landscape of digital currencies.

The Role of Blockchain Technology in Aml 🧱

Blockchain technology has revolutionized Anti-Money Laundering (AML) practices by providing a secure and transparent platform for financial transactions. Its decentralized nature eliminates the need for intermediaries, ensuring the integrity of AML processes. Through the use of cryptographic techniques, blockchain enables immutable and auditable records of transactions, enhancing compliance efforts. By leveraging blockchain technology, AML compliance procedures become more efficient and less susceptible to fraudulent activities.

As organizations increasingly adopt blockchain solutions, the integration of this technology into AML practices is paramount. The inherent features of blockchain, such as immutability and transparency, offer a robust foundation for combating money laundering activities. Through real-time tracking and verification of transactions, blockchain technology strengthens AML measures, safeguarding financial systems against illicit practices. Embracing blockchain in AML not only enhances compliance processes but also reinforces trust and security in the digital financial landscape.

Implementing Kyc Procedures with Technology 🔒

Implementing Know Your Customer (KYC) procedures with technology ensures a streamlined process for verifying the identity of individuals involved in Bitcoin transactions. By leveraging digital solutions, such as biometric authentication and data analytics, financial institutions in Fiji can enhance the accuracy and efficiency of their KYC processes. This not only helps in complying with regulatory requirements but also contributes to detecting and preventing illicit activities within the cryptocurrency space. Incorporating advanced technological tools not only simplifies the KYC procedures but also minimizes the risk of identity fraud and ensures a more secure environment for conducting Bitcoin transactions.

Enhancing Transaction Monitoring Using Tech 💸

Transaction monitoring is a critical aspect of ensuring compliance with anti-money laundering regulations. By leveraging advanced technology solutions, financial institutions in Fiji can significantly enhance their ability to detect suspicious activities and mitigate potential risks. With real-time monitoring tools and artificial intelligence capabilities, tracking and analyzing transactions becomes more efficient and effective. This proactive approach not only strengthens the overall AML compliance framework but also helps in preventing illicit financial activities within the Bitcoin ecosystem. Additionally, the use of tech-driven transaction monitoring systems provides a more comprehensive view of financial activities, enabling quicker identification of potential red flags and ensuring timely reporting to regulatory authorities for further investigation and action.

Future Trends in Technology for Aml Compliance 🚀

As technology continues to evolve, future trends in AML compliance are set to be transformative. One such trend is the increased adoption of artificial intelligence (AI) and machine learning algorithms to enhance monitoring and detection capabilities. These technologies can analyze vast amounts of data in real-time, enabling financial institutions to identify suspicious activities more efficiently than traditional methods. Additionally, advancements in blockchain technology are expected to further streamline AML processes by providing transparent and immutable records of transactions. As regulators and industry players continue to embrace innovation, the future of AML compliance is poised for a digital revolution.

To read more about Bitcoin AML regulations in different countries, you can explore the bitcoin anti-money laundering (AML) regulations in Finland and compare them with the bitcoin anti-money laundering (AML) regulations in Equatorial Guinea.