Introduction to Turkish Lira and Bitcoin 🌍

The Turkish Lira and Bitcoin have emerged as key players in the global financial landscape, each with its unique characteristics and impact. The Turkish Lira, being the official currency of Turkey, reflects the country’s economic stability and growth. On the other hand, Bitcoin, a decentralized digital currency, operates independently of any government or central authority. Despite their differences, both the Turkish Lira and Bitcoin have gained significant attention from investors, traders, and policymakers worldwide. Understanding the dynamics between these two currencies can provide valuable insights into the broader financial markets and global economic trends. As we delve into the relationship between the Turkish Lira and Bitcoin, it becomes evident that their interactions hold implications that extend beyond the scope of traditional financial analysis.

Factors Influencing the Relationship 💹

Factors influencing the relationship between Turkish Lira and Bitcoin include economic stability, geopolitical events, market demand, and regulatory changes. The fluctuation of the Turkish Lira against the US Dollar can impact the value of Bitcoin for Turkish investors. Global economic conditions and interest rates also play a significant role in influencing the relationship between these two currencies. Moreover, political developments within Turkey, such as government policies and elections, can affect investor sentiment towards both the Turkish Lira and Bitcoin. Additionally, market demand for alternative investments or speculative trading can lead to increased correlation between the Turkish Lira and Bitcoin prices. Regulatory changes in either the cryptocurrency or traditional financial sectors can create shifts in the relationship dynamics between the Turkish Lira and Bitcoin, influencing investment strategies and risk assessments. Overall, a combination of economic, political, and market-related factors collectively influence the correlation between the Turkish Lira and Bitcoin prices.

Historical Trends and Patterns 📈

In exploring the historical trends and patterns of the Turkish Lira and Bitcoin relationship, a fascinating journey unfolds. Over the years, we observe fluctuations in the value of these currencies, often influenced by global economic conditions, geopolitical events, and market sentiments. The patterns reveal moments of correlation and divergence, shedding light on the intricate dance between these two entities.

By delving into past data, we can identify recurring cycles and behaviors that offer insights into potential future movements. These historical trends serve as a valuable guide for understanding the dynamics between the Turkish Lira and Bitcoin, providing a foundation for informed analysis and decision-making in the ever-evolving financial landscape.

Impact of Current Events on Prices 📉

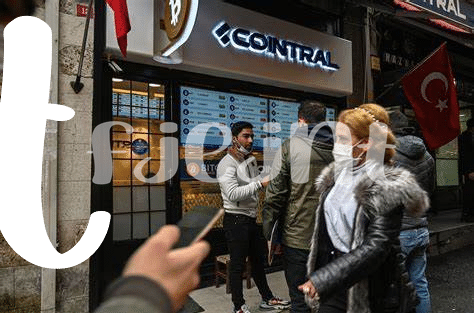

Current events play a crucial role in shaping the prices of both the Turkish Lira and Bitcoin. Fluctuations in the value of these currencies can often be attributed to external factors such as political instability, economic policies, or global market trends. For example, recent news about regulatory changes or government interventions can lead to sudden drops or surges in the prices of both assets. Understanding how these events impact the market is essential for investors and traders looking to make informed decisions about their holdings.

To delve deeper into the impact of current events on the prices of Turkish Lira and Bitcoin, it’s important to analyze specific cases such as foreign exchange controls. These measures can have a significant effect on the flow and exchange of cryptocurrencies within certain regions, ultimately affecting their value. An interesting case study on this topic can be found in Turkmenistan, where recent exchange control measures have influenced the trading dynamics of Bitcoin. For more insights on how foreign exchange controls are affecting Bitcoin in Uganda, check out this article on WikiCrypto News: foreign exchange controls affecting bitcoin in Uganda.

Analysis of Market Reactions 🔄

In examining the dynamic interplay between the Turkish Lira and Bitcoin, it becomes evident that market reactions play a crucial role in shaping their relationship. The ever-changing nature of the cryptocurrency market often results in rapid responses to external events, leading to fluctuations in both the Turkish Lira and Bitcoin values. These reactions highlight the sensitivity of both currencies to various factors, from geopolitical tensions to economic indicators, underscoring the complex web of influences that dictate their correlation.

Moreover, the simultaneous analysis of market reactions to both the Turkish Lira and Bitcoin offers valuable insights into investor sentiments and overall market sentiment. By studying the patterns of how these two currencies respond to external stimuli, traders and researchers can gain a deeper understanding of the underlying mechanisms driving their relationship and make more informed decisions regarding their investments in these volatile markets.

Future Outlook and Potential Implications 🔮

The future outlook for the relationship between the Turkish Lira and Bitcoin holds both challenges and opportunities. As global economic landscapes continue to shift and evolve, it is crucial to assess how these changes may impact the dynamics between traditional currencies and digital assets. The potential implications of this analysis extend beyond just financial markets, touching upon broader themes such as technological innovation, regulatory developments, and geopolitical considerations. By closely monitoring and interpreting the evolving relationship between the Turkish Lira and Bitcoin, stakeholders can better position themselves to navigate the complexities of an increasingly interconnected financial ecosystem. Understanding the future implications of these market dynamics is essential for making informed decisions and strategic planning in an era defined by rapid change and uncertainty.foreign exchange controls affecting bitcoin in Turkmenistan