🚀 the Big Jump: When Did Tech Giants Invest?

Imagine a big splash in a calm lake – that’s similar to the impact when some of the biggest names in the tech world decided to dive into the Bitcoin pool. These pivotal moments didn’t all occur at once. Instead, they unfolded over the past few years, with the noticeable uptick in interest starting around 2017. This period saw Bitcoin’s meteoric rise from a digital curiosity to a serious financial asset, capturing the attention of tech giants who saw potential not just for profit, but for innovation. The investments made by these behemoths were not pocket change. For instance, companies like Tesla made headlines in early 2021 by investing a whopping $1.5 billion into Bitcoin, signaling a confidence in the cryptocurrency that seemed to beckon others to follow suit. Amidst these big moves, various other tech leaders have discreetly (or not so discreetly) allocated portions of their assets into Bitcoin, betting on its long-term value. Below is a table highlighting some key investments by tech giants in Bitcoin over recent years:

| Company | Investment Year | Investment Amount ($) |

|---|---|---|

| Tesla | 2021 | 1.5 Billion |

| MicroStrategy | 2020-2021 | Over 2.4 Billion |

| Square (now Block) | 2020 | 50 Million |

This bold move by tech giants not only served as a heavy endorsement but also brought Bitcoin into the consideration set of traditional investors, blurring the lines between the high-tech and the financial mainstream like never before.

💸 Reasons Behind the Big Bet on Bitcoin

Imagine putting your money into a magic pot that grows overnight. That’s how some of the world’s biggest tech companies view investing in Bitcoin. It all started with a daring belief in a future where digital currency plays a starring role. These tech giants, armed with vast resources and a keen eye for innovation, saw Bitcoin not just as a digital currency, but as a groundbreaking investment with the potential to offer massive returns. The amounts invested are staggering, easily running into billions of dollars, highlighting their confidence in Bitcoin’s future. Their investments aren’t just about making more money; it’s about shaping the future of finance, betting on a system that favors transparency, efficiency, and global access. For anyone curious about where the digital money world is headed, especially the tech behind it, check out this fascinating read on the evolution of Bitcoin hardware wallets and how they’re securing our digital future at https://wikicrypto.news/the-evolution-of-bitcoin-hardware-wallets-whats-new-in-2024. This big bet on Bitcoin by technology leaders underscores their eagerness to explore and influence an exhilarating frontier of finance, despite the rollercoaster ride of risks and rewards it entails.

💡 How Much $ Are We Talking about Here?

When it comes to the big players in the tech world dipping their toes into the Bitcoin pool, we’re talking about serious money. It’s not just pocket change or a small side experiment. Imagine a mountain made entirely of cash; that’s the kind of scale we need to think about. These tech giants have invested millions, if not billions, into Bitcoin. This isn’t a hobby or a fleeting interest; it’s a bold statement of belief in the future of digital currency.

The exact numbers can be mind-boggling. For instance, one of the big headlines was when a very well-known electric car company announced a staggering $1.5 billion investment in Bitcoin. And they’re not alone. Other tech behemoths have followed suit, each with their own hefty investments, signaling a strong conviction in Bitcoin’s potential. This wave of big-money bets has not only shown confidence in Bitcoin’s staying power but has also played a part in mainstreaming cryptocurrency, making it a topic of dinner table conversations worldwide.

🔍 the Ripple Effect on the Crypto Market

When big tech started pouring money into Bitcoin, it was like a celebrity endorsement for the crypto world. Suddenly, everyone from your next-door neighbor to big-time investors wanted a piece of the action. This surge of interest and investment made the crypto market’s roller coaster ride even wilder. Prices soared to breathtaking highs and plunged to nail-biting lows, sometimes all in the span of 24 hours. This whirlwind didn’t just affect Bitcoin; it spilled over to other cryptocurrencies, boosting their visibility and value. For anyone looking to dive into this exciting but turbulent world, understanding how to protect their investment is crucial. A great starting point is learning about cold storage methods for securing your bitcoin in 2024, ensuring your digital treasure chest remains safe amidst the storms. In essence, the big tech’s leap into Bitcoin didn’t just change their fortunes—it stirred the entire crypto ocean, making waves felt by currencies across the board.

🚧 Risks and Rewards: a Two-sided Coin

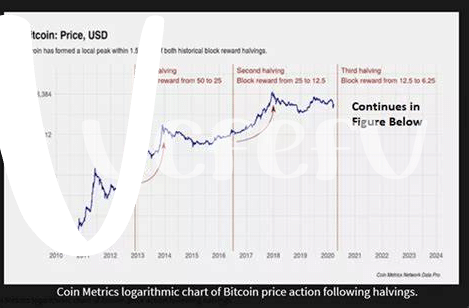

Taking a dive into the high-stakes world of investing in Bitcoin, the tech giants have found themselves on a rollercoaster ride of ups and downs. Just like any thrilling ride, the decision to put money into Bitcoin comes with its share of excitement and fear. On one hand, the potential for huge profits is tantalizing. Bitcoin’s value has seen sky-high peaks, making it an attractive asset for those looking to invest big and possibly win big. This allure isn’t just about the possible financial gain; it’s also about being part of a cutting-edge technological movement, setting trends in the digital world.

However, with high reward comes high risk. The world of cryptocurrencies is known for its volatility, where the value of Bitcoin can swing wildly in a matter of days or even hours. This unpredictability can cause some serious heartburn for investors. There’s also the issue of security. Despite advancements, the digital nature of cryptocurrencies makes them susceptible to hacking and fraud. Plus, regulation remains a grey area, posing potential legal challenges down the line. The table below highlights the key risks and rewards facing tech giants in their Bitcoin adventure:

| Rewards | Risks |

|---|---|

| Potential for immense profits | Market volatility leading to possible losses |

| Being at the forefront of technological innovation | Security concerns due to hacking |

| Shaping the future of digital currency | Unclear regulations possibly affecting operations |

So, deciding to invest in Bitcoin is a bit like signing up for an extreme adventure—it could be the ride of a lifetime or a challenging test of one’s nerve and resilience.

📈 Predicting the Future: What Comes Next?

Peeking into the crystal ball to predict what’s on the horizon for tech giants investing in Bitcoin feels like stepping into a shiny, digital future 🔮✨. As the waves made by these colossal tech titans ripple out, they hint at a landscape transformed by blockchain’s boundless potential. The big question everyone’s asking is, “What comes next?” Well, imagine a world where digital currencies like Bitcoin aren’t just commonplace but pivotal to the world economy. As more people and companies trust and invest in Bitcoin, we could see it becoming as easy to use as traditional money, but way cooler because it’s like sending cash in an email 🚀💡. This trust could lead to even more tech giants throwing their hats into the ring, investing big and driving innovation to make Bitcoin and other cryptocurrencies safer, faster, and more reliable. Speaking of safety, ensuring the security of digital assets has never been more crucial. For those looking ahead, bitcoin in literature and film: a cultural study in 2024 could be an essential guide to safeguarding your digital gold in this rapidly evolving landscape. So, fasten your seatbelts; we’re in for an exciting ride in the world of cryptocurrency!