🌍 Global Events Spark Bitcoin Roller Coaster Rides

Imagine riding a roller coaster – that sudden drop that makes your stomach flip, zooming up and then plunging down again. Now, think of Bitcoin. It might seem unrelated, but Bitcoin’s value rides a similar track, especially when big news hits the globe. Whether it’s a major political event, a breakthrough in technology, or a sudden economic shift, these moments can send Bitcoin on a wild ride. Investors watch closely as their digital wallets swell or shrink with each twist and turn.

| Event Type | Bitcoin Impact Summary |

|---|---|

| Political Unrest | Often causes a spike as people look for stable investments. |

| Economic Shifts | Can lead to drops if traditional markets seem safer. |

| Technological Breakthroughs | Usually results in a jump as the future of digital currency brightens. |

This dive and soar pattern isn’t just random; it’s deeply linked to human reactions to news and changes around the world. As we start to chart these reactions, we not only get better at predicting Bitcoin’s next move, but we understand the pulse of digital currency against the backdrop of worldwide events. This relationship between Bitcoin and global dynamics showcases the intertwining of technology and human behavior, painting a complex picture of our modern world.

💹 Charting Bitcoin’s Reaction to Major World Headlines

Imagine a world where big news events, like elections or economic changes in major countries, can make the value of Bitcoin go on a wild ride. It’s like Bitcoin reacts to these events by going up and down in value, much like a roller coaster. When something big happens around the world, people might feel unsure about the future and turn to Bitcoin, seeing it as a safe place to put their money. This sudden interest can push Bitcoin’s value up. But, just as quickly, if the news changes or people start feeling confident again, they might pull their money out, causing Bitcoin’s value to drop. It’s fascinating to see how this digital currency responds to what’s happening in the world. For those diving deeper into Bitcoin, understanding all the bits and bobs, like transaction fees, is essential. A helpful resource to grasp the basics is https://wikicrypto.news/navigating-bitcoin-transaction-fees-for-beginners. This way, you can navigate the world of Bitcoin more confidently, knowing the ins and outs of moving your digital money.

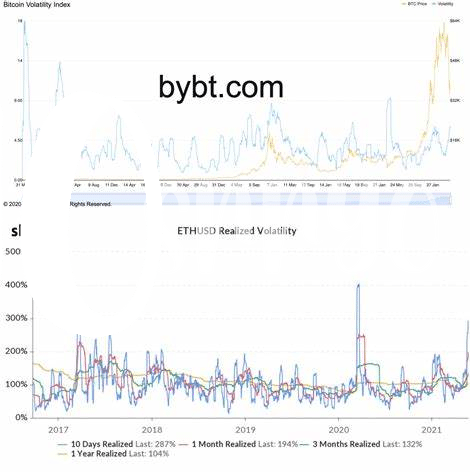

📉 Economic Policies’ Domino Effect on Bitcoin Volatility

When governments make big decisions about money, like changing interest rates or printing more cash, it can send ripples through the world of Bitcoin. Imagine throwing a stone into a pond and watching the waves spread out—that’s what these policy changes do to Bitcoin prices. While traditional stocks also feel the impact, Bitcoin reacts more like a speedboat hitting the waves, bouncing up and down more dramatically. This happens because Bitcoin is still growing up, and it’s more sensitive to these big global decisions. It’s kind of like how a teenager might overreact to news compared to an adult. So, when you’re keeping an eye on Bitcoin, don’t just watch the digital currency itself. Pay attention to the big financial moves countries are making around the world. It’s these decisions that often dictate whether Bitcoin will climb high or take a dive.

🌐 the Digital Currency World Vs. Traditional Markets

Imagine a large, bustling market where people trade everything from fruits and vegetables to shiny gold coins. Now, imagine another market, not a place you can walk around in, but one that exists entirely on the internet. This is the realm of digital currencies like Bitcoin, which is like the shiny gold coins but in digital form. Unlike traditional markets, where the opening and closing times are set, and prices can sometimes move like a lazy river, the digital currency world never sleeps. Here, prices can jump or plummet at lightning speed, making it an exciting, albeit sometimes nerve-wracking, adventure. The reasons behind these quick changes are often tied to big news stories, shifts in government policies, or even tweets from influential people. To stay informed and possibly predict what might happen next, following bitcoin regulation updates suggestions can be incredibly helpful. This lively exchange between the old and the new financial worlds shows us just how interconnected, yet distinct, they are, shaping the way we think about money in this digital age.

🔍 Spotting Patterns: When Bitcoin Shakes and Stirs

Just like the weather, Bitcoin’s movements can sometimes feel unpredictable, but there are patterns if you know where to look. Imagine Bitcoin as a ship on the ocean; some waves are small, hardly rocking the boat, while others are large enough to make even seasoned sailors queasy. These waves can be caused by a variety of events, from a big company saying they believe in Bitcoin, to countries changing their rules on how it can be used. Each event sends ripples through the Bitcoin ocean, sometimes stirring up storms of activity. What’s fascinating is how these ripples can sometimes follow a predictable path. For instance, when a big event makes people feel nervous about the traditional money world, they often run towards Bitcoin like it’s a safe harbor in a storm. By keeping an eye on these patterns, it’s like having a map and a weather forecast rolled into one, helping to navigate through Bitcoin’s ups and downs. The key is to watch how Bitcoin behaves in response to specific types of global news and economic changes, which can give clues about what it might do next.

| Event Type | Typical Bitcoin Reaction |

|---|---|

| Positive Tech News | 🚀 Price Increases |

| Negative Regulatory News | ⚡ Price Drops |

| Economic Instability | 🛡 Price Rises (seen as a safe haven) |

🚀 Future Predictions: Steering through Bitcoin’s Ups and Downs

As we look ahead, the journey of Bitcoin through the ups and downs of the financial world seems akin to a roller coaster ride with twists and turns influenced by global happenings. Imagine a future where headlines not only sway public opinion but also steer the direction of Bitcoin’s value. Learning from the patterns and trends we’ve observed, it’s like trying to predict the weather. While certain signs and data can give us an idea, the digital currency landscape is ever-changing, making the task both exciting and challenging. The integration of more stable economic policies and advancements in technology may offer smoother rides amidst the fluctuations.

Understanding the movements of Bitcoin necessitates a look at solutions that can help manage its roller coaster nature, such as improvements in how transactions are processed to deal with the scaling issue. For more on how these challenges can be addressed, consider exploring bitcoin transaction fees suggestions, which delve into potential ways to enhance the efficiency and stability of Bitcoin transactions. As enthusiasts and investors become savvier in navigating through Bitcoin’s volatility, the future holds promise for not only enduring the swings but also leveraging them for growth and innovation.