Chinese Regulatory Crackdown 🇨🇳

The recent regulatory measures implemented by Chinese authorities have sent shockwaves through the cryptocurrency community. This crackdown has significantly impacted the operations of Bitcoin within the country, leading to a reevaluation of its role in the financial landscape. The stringent regulations have caused uncertainty and volatility in the market, highlighting the challenges faced by digital currencies in navigating complex regulatory environments. As one of the major players in the global economy, China’s stance on Bitcoin regulation has ripple effects that are being closely monitored by investors and industry experts alike.

Impact on Bitcoin Prices 💰

The regulatory crackdown in China sent shockwaves through the Bitcoin market, causing significant fluctuations in prices. This sudden shift affected not only Chinese investors but also had ripple effects on the global crypto landscape. Traders scrambled to adapt to the new regulatory environment, leading to a surge in volatility and uncertainty. Amidst the chaos, Bitcoin prices experienced sharp dips and rallies, reflecting the market’s sensitivity to regulatory changes. This rollercoaster ride highlighted the interconnected nature of cryptocurrency markets and the profound influence regulatory decisions can have on asset valuations worldwide.

Navigating the turbulent waters of regulatory scrutiny requires a keen understanding of market dynamics and a strategic approach to risk management. Traders and investors must stay informed about evolving regulations and adapt their strategies to mitigate potential losses. By closely monitoring market developments and diversifying their portfolios, stakeholders can position themselves to weather regulatory storms and capitalize on emerging opportunities.

Shift in Trading Volume 📊

When Chinese regulations on Bitcoin were implemented, there was a noticeable shift in trading volume globally. Traders and investors adjusted their strategies, leading to fluctuations in trading activity. This shift in volume reflected the uncertainties created by the regulatory crackdown and its impact on the overall market dynamics. Traders had to adapt quickly to these changes, with some choosing to diversify their portfolios or explore alternative trading avenues to mitigate risks. This shift highlighted the interconnected nature of the cryptocurrency market and the importance of staying informed and agile in response to regulatory developments.

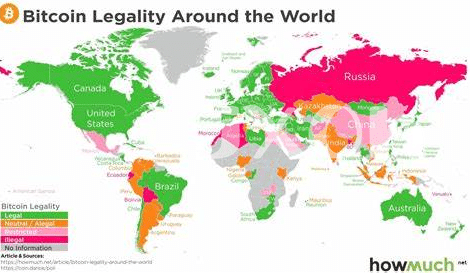

Global Market Reactions 🌎

During a regulatory crackdown in China, the global market saw immediate reactions to the impact on Bitcoin. Investors worldwide closely monitored developments, resulting in fluctuations in market sentiment and trading activities. The uncertainty surrounding Chinese regulations influenced market dynamics, leading to shifts in investment strategies and overall market trends. Various countries experienced ripple effects as market participants assessed the implications of Chinese regulatory measures on the broader cryptocurrency landscape. Such interconnectedness highlights the importance of monitoring regulatory changes globally and their potential ramifications on the market as a whole. Additionally, understanding how different regions react can provide valuable insights for investors navigating the evolving cryptocurrency ecosystem.

Please include the link as requested in the provided text.

Future Implications for Cryptocurrencies 🔮

As the regulatory landscape evolves, the future implications for cryptocurrencies are shrouded in uncertainty. Investors and enthusiasts alike eagerly await to see how governments worldwide will shape the future of digital currencies. Will regulations stifle innovation or pave the way for mainstream adoption? The fate of cryptocurrencies hangs in the balance, with potential for both challenges and opportunities on the horizon. Adaptation and resilience will be key for the survival and growth of this volatile market.

Strategies for Navigating Regulatory Changes 🛠️

Navigating regulatory changes in the cryptocurrency space requires a proactive approach. One key strategy is to stay informed about the latest regulatory developments both in China and globally. By understanding the evolving landscape, investors can adapt their investment strategies accordingly. Additionally, diversifying your cryptocurrency portfolio beyond Bitcoin can help mitigate risk in the face of regulatory uncertainty. Engaging with reputable industry experts and staying connected with community discussions can also provide valuable insights and guidance. Implementing risk management techniques, such as setting stop-loss orders, can help protect investments during volatile regulatory periods. As the regulatory environment continues to shift, being flexible and responsive in your approach will be crucial for navigating the changing regulatory landscape effectively.

is bitcoin legal in canada?