Brief History of Aml Policies 📜

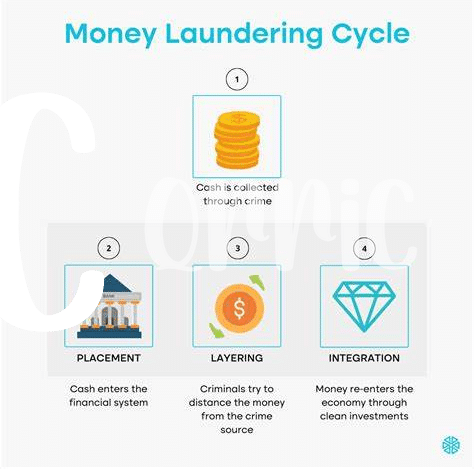

Throughout history, Anti-Money Laundering (AML) policies have continuously evolved to combat financial crimes and illicit activities. These policies trace their roots back to the need for transparency and regulatory oversight in the financial sector. Over time, the global financial landscape has witnessed the emergence of diverse AML frameworks aimed at safeguarding economic systems from misuse and exploitation. Understanding the historical development of AML policies provides essential context for assessing their effectiveness in addressing modern challenges and adapting to new technologies such as Bitcoin.

Impact of Bitcoin on Regulations 💰

The emergence of Bitcoin has spurred significant changes in regulatory frameworks around the world, including Equatorial Guinea. As this innovative digital currency gained popularity, regulators scrambled to adapt their Anti-Money Laundering (AML) policies to encompass the unique challenges posed by cryptocurrencies. The decentralized nature of Bitcoin raised concerns about anonymity and illicit financial activities, prompting authorities to reassess existing regulations and explore new ways to ensure compliance within the rapidly evolving landscape of digital assets.

This shift in focus towards cryptocurrency regulations has not only impacted how financial transactions are monitored and verified but has also reshaped the enforcement mechanisms employed by regulatory bodies. By delving deeper into the intricacies of AML policies in the context of Bitcoin, Equatorial Guinea is navigating uncharted waters where traditional regulatory frameworks must be reexamined to effectively address the complexities of this emerging asset class.

Challenges in Implementation 🛑

Navigating the intricate web of regulatory frameworks can pose significant hurdles, especially in a landscape where traditional policies may not seamlessly apply to the realm of Bitcoin. The challenge lies in balancing the innovation that cryptocurrencies bring with the need for oversight and security. Equatorial Guinea faces the task of adapting existing anti-money laundering measures to encompass the decentralized nature of Bitcoin transactions, requiring a tailored approach that upholds transparency and mitigates illicit activities while fostering financial inclusion.

Future Outlook for Equatorial Guinea 🌍

In considering the future outlook for Equatorial Guinea, it is crucial to anticipate the evolving landscape of AML policies in relation to Bitcoin. As the country navigates the intersection of digital currencies and regulatory frameworks, there lies a potential for both challenges and opportunities in shaping a sustainable approach to combating financial crimes. The proactive adaptation of policies to accommodate the unique characteristics of cryptocurrencies like Bitcoin could pave the way for increased transparency and security within the financial sector of Equatorial Guinea. By staying informed about global trends and drawing insights from successful AML models, Equatorial Guinea can position itself for a more resilient and compliant future in the digital economy.

Comparison with Global Aml Standards 🌐

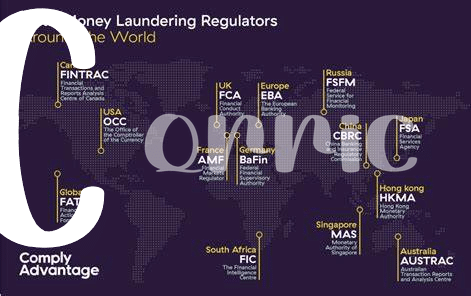

When looking at Equatorial Guinea’s AML policies in comparison with global standards, it becomes evident that there are both similarities and disparities. While the country has made efforts to align with international AML frameworks, such as the FATF guidelines, there are still areas that require further enhancement to meet the evolving nature of financial crimes and emerging technologies like Bitcoin. The challenge lies in balancing the need for innovation and financial inclusion while safeguarding against illicit activities that threaten the integrity of the global financial system.

As the landscape of financial transactions continues to shift towards digital assets, Equatorial Guinea can benefit from studying best practices and experiences of other countries in implementing AML measures effectively. By learning from both successes and shortcomings observed globally, the country can tailor its AML framework to address specific challenges while staying abreast of technological advancements and emerging trends in financial crime prevention.

Recommendations for Effective Policy Evolution 📈

When suggesting recommendations for effective policy evolution in Equatorial Guinea, it is crucial to prioritize collaboration and knowledge-sharing with other countries that have successfully implemented AML regulations for Bitcoin, such as Eswatini and Denmark. By leveraging their experiences and best practices, Equatorial Guinea can tailor its policies to suit its specific context while aligning with global standards. Moreover, investing in robust training programs for regulatory authorities and financial institutions will be essential to enhance awareness and compliance levels. Emphasizing continuous monitoring and evaluation mechanisms can also ensure that the AML policies remain effective and adaptive to the evolving landscape of cryptocurrencies.

In addition, fostering partnerships with international organizations and blockchain experts can provide valuable insights and technical support for designing and implementing sophisticated AML frameworks. By nurturing a conducive environment for dialogue and innovation, Equatorial Guinea can position itself as a proactive player in the global fight against financial crimes linked to Bitcoin transactions.