Aml Regulations 📜

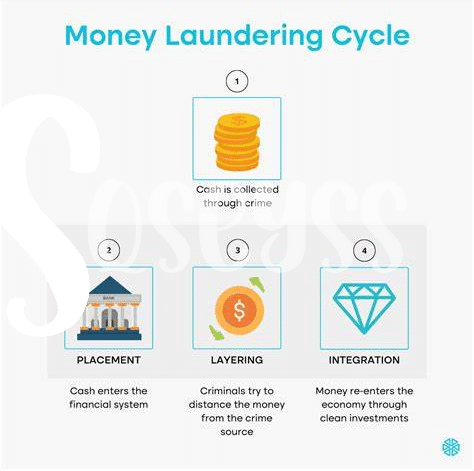

AML regulations are crucial for Bitcoin startups in Georgia to navigate. Understanding and adhering to these regulations is essential for maintaining compliance and building trust with stakeholders. By following AML guidelines, businesses can help prevent money laundering and other illicit activities in the cryptocurrency space. Staying informed and up-to-date on AML regulations ensures that startups are operating within the legal framework and contributing to a more secure and transparent financial ecosystem. Working hand in hand with regulators can provide valuable insights and guidance for startups to effectively implement AML practices and safeguard their operations.

Compliance Challenges ⚖️

Navigating the intricate landscape of AML regulations can pose significant hurdles for Bitcoin startups in Georgia. Adopting robust compliance measures ⚖️ is paramount to ensure adherence to regulatory standards and foster trust among stakeholders. Implementing sophisticated monitoring tools and conducting regular audits are essential in addressing the dynamic challenges that arise in the realm of cryptocurrency transactions 📊. Streamlining KYC procedures 🕵️♂️ and embracing advanced identity verification technologies can enhance the efficiency of compliance processes. To effectively manage risks, startups must develop comprehensive risk mitigation strategies 🔒 that align with the evolving regulatory environment. Collaboration with regulators 🤝 facilitates mutual understanding and promotes a culture of transparency within the industry. For further insights on compliance strategies under German AML regulations, you can refer to this informative resource.

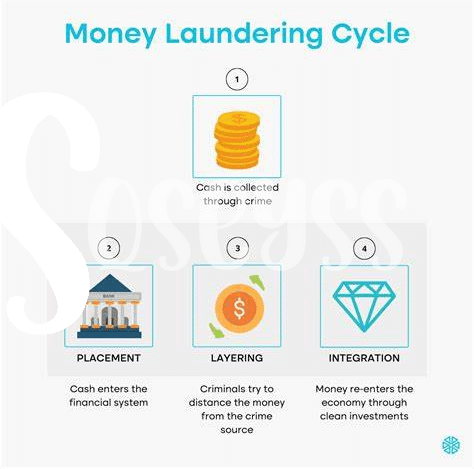

Cryptocurrency Transactions 📊

Cryptocurrency transactions involve the transfer of digital assets between parties, typically in a decentralized and anonymous manner. These transactions are recorded on a public ledger known as the blockchain, providing transparency and security throughout the process. However, the anonymity of cryptocurrency transactions has posed challenges for AML compliance, as it can be difficult to trace the source and destination of funds. To address this issue, many Bitcoin startups in Georgia are implementing advanced monitoring tools and blockchain analysis techniques to enhance transaction visibility and ensure compliance with AML regulations. By leveraging innovative technologies and collaborating with industry experts, these startups are paving the way for secure and compliant cryptocurrency transactions in the region.

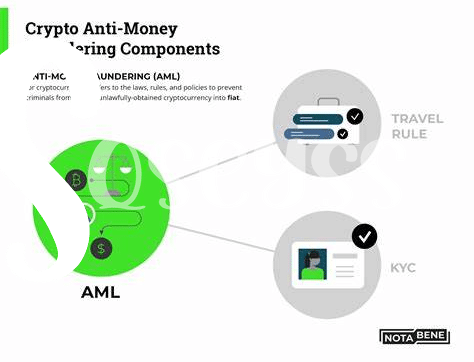

Kyc Procedures 🕵️♂️

When it comes to Know Your Customer (KYC) procedures in the Bitcoin startup scene in Georgia, thorough verification processes are crucial for maintaining compliance with anti-money laundering (AML) regulations. By collecting and verifying customer identity information, such as government-issued IDs and proof of address, startups can establish a level of trust with their users and mitigate the risk of illicit activities. Implementing efficient KYC procedures not only safeguards the business from potential regulatory penalties but also builds credibility within the industry. For more insights on navigating AML challenges in the Bitcoin sector, refer to a comprehensive guide on bitcoin anti-money laundering (AML) regulations in Germany.

Risk Mitigation Strategies 🔒

To effectively navigate the challenges surrounding potential risks, it is crucial for Bitcoin startups in Georgia to adopt proactive measures that prioritize robust risk mitigation strategies. By implementing stringent security protocols, encrypting sensitive data, and regularly monitoring transactions, these startups can significantly reduce the likelihood of falling victim to fraudulent activities or security breaches. Furthermore, fostering a culture of awareness and continuous training among team members can further strengthen the overall risk mitigation framework, ensuring that the company remains vigilant and poised to address any emerging threats promptly and effectively.

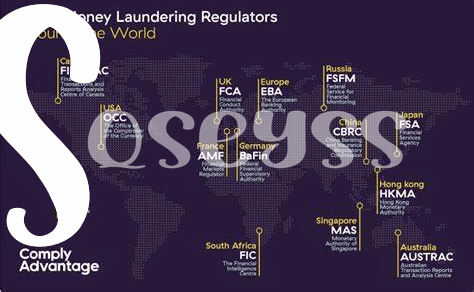

Collaboration with Regulators 🤝

Within the realm of navigating the AML landscape, actively engaging in collaboration with regulators stands as a pivotal strategy for Bitcoin startups in Georgia. Establishing open lines of communication and fostering a transparent relationship can facilitate a smoother compliance process and provide regulators with deeper insights into the unique challenges faced by cryptocurrency-based businesses. By partnering with regulators, startups can work hand in hand to develop frameworks that balance innovation with regulatory requirements, ultimately contributing to a more robust and sustainable operational environment.

Furthermore, ongoing collaboration ensures that Bitcoin startups remain proactive in addressing emerging regulatory developments, thereby enhancing preparedness and adaptability. By fostering a culture of cooperation and mutual understanding, startups can demonstrate a commitment to compliance and contribute to the overall maturation of the crypto industry within Georgia. Ultimately, consistent dialogue and collaboration with regulators serve as pillars of strength, guiding startups through the intricate terrain of AML regulations and positioning them for long-term success.

Bitcoin anti-money laundering (AML) regulations in Gabon