Fast and Low Fees 💲

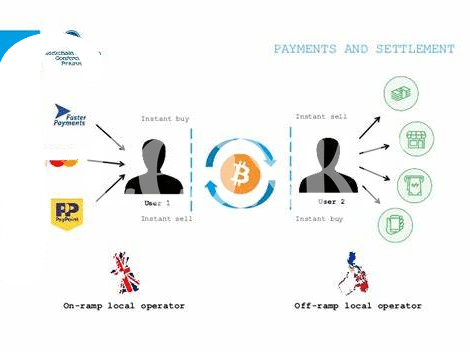

Bitcoin offers a cost-effective and efficient solution for international transfers in Seychelles. Users benefit from rapid transaction speeds, allowing for swift cross-border payments without the delays associated with traditional banking systems. Moreover, the low fees associated with Bitcoin transfers make it an attractive option for individuals looking to save money on international transactions. By bypassing intermediaries typically involved in cross-border transfers, Bitcoin provides a direct and economical way to send and receive funds globally. This combination of speed and affordability positions Bitcoin as a viable alternative for international transfers in the Seychelles and beyond.

Security and Privacy 🔒

Bitcoin offers a unique advantage in terms of security and privacy. Transactions are encrypted and decentralized, which means that personal information is not linked to individual transactions. This level of anonymity provides a sense of privacy that traditional banking systems sometimes lack. Additionally, the blockchain technology underlying Bitcoin ensures that transactions are secure and tamper-proof. Users can feel confident that their funds are protected and that their financial information remains confidential. Embracing Bitcoin for international transfers in Seychelles opens up a new realm of secure and private transactions, giving individuals more control over their financial interactions.

Global Reach 🌍

Bitcoin’s global reach opens up new opportunities for individuals and businesses in Seychelles, allowing them to transact with partners and customers worldwide without the constraints of traditional banking systems. This borderless nature of Bitcoin enables fast and efficient cross-border transfers, regardless of geographical distances. Whether sending funds to a neighboring country or a distant continent, Bitcoin bridges the gap and facilitates seamless transactions on a global scale. Embracing this aspect of Bitcoin empowers users in Seychelles to engage in international trade and commerce with ease, transcending the limitations imposed by traditional financial institutions. The decentralized nature of Bitcoin ensures that these transactions are conducted securely and efficiently, further bolstering its appeal as a viable option for international transfers.

Volatility and Risk 💸

Bitcoin’s value can fluctuate dramatically, posing a significant risk for those engaging in international transfers. The high volatility means that the amount sent or received could change rapidly, sometimes resulting in unexpected losses or gains. This unpredictability can make it challenging to budget or plan for transfers, especially in countries like Seychelles where the local currency may not be as stable. Additionally, the potential for hacking or fraud in the digital realm adds another layer of risk when utilizing Bitcoin for cross-border money transfers. Understanding and mitigating these risks is crucial for individuals and businesses looking to leverage the benefits of cryptocurrency. For more insights on the legal landscape of Bitcoin cross-border transfers, check out this informative article on bitcoin cross-border money transfer laws in Serbia.

Regulatory Challenges 🚫

Bitcoin’s journey for international transfers might hit roadblocks due to various regulatory challenges. Navigating through different countries’ regulations can be complex, with some nations outright banning or restricting cryptocurrency transactions. These hurdles can contribute to delays or even blockages in the seamless transfer process, posing significant obstacles for users in Seychelles looking to utilize Bitcoin for cross-border transactions. The evolving landscape of laws and policies surrounding digital currencies adds an additional layer of uncertainty and risk to the already volatile nature of cryptocurrencies. 🚫

Limited Adoption and Acceptance 🤷♂️

Bitcoin’s potential for cross-border money transfers in Seychelles is hindered by limited adoption and acceptance. While some individuals and businesses see the benefits of using Bitcoin for international transactions, many others remain wary due to its volatility and the lack of regulatory clarity. Limited access to services that facilitate Bitcoin transactions further restricts its widespread adoption in Seychelles. Despite the growing global interest in cryptocurrency, the local market in Seychelles has been slow to embrace Bitcoin as a mainstream means of transferring funds. This hesitance is partly attributed to a lack of understanding about how cryptocurrencies work and concerns about potential scams or security risks. Additionally, the limited availability of merchants who accept Bitcoin as a form of payment adds to the challenges faced by those looking to utilize this digital currency for international transfers.

To better understand the legal framework surrounding Bitcoin cross-border money transfers, individuals in Seychelles can refer to the bitcoin cross-border money transfer laws in Saudi Arabia using the bitcoin cross-border money transfer laws in Senegal.