🚀 Bitcoin’s Early Bird Advantage in Adoption

Imagine being the first person to plant a flag on uncharted land. That’s essentially what Bitcoin did in the world of cryptocurrency. By being the first to hit the market, it naturally attracted a lot of attention and curiosity, drawing in early adopters and investors. People began to see it not just as a novel tech but as a potential future of money. This head start gave Bitcoin a significant advantage, allowing it to build a strong, loyal community and establish itself as a household name. Even as newer currencies like Ethereum emerged with fresh features and potential uses, Bitcoin’s pioneering status continued to give it an edge in both recognition and trust. This early adoption has not only paved the way for its current status but has also set a foundation that’s tough for others to shake.

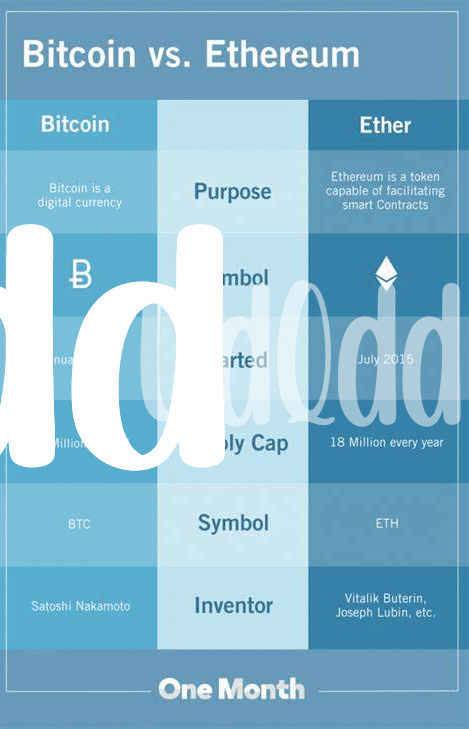

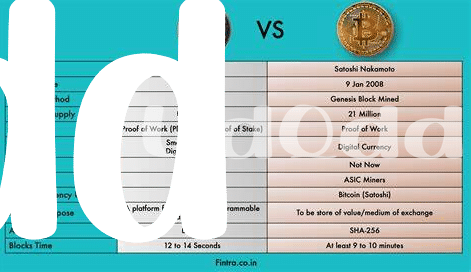

Here’s a simple comparison of their journey in numbers:

| 🏁 Starting Year | Bitcoin | Ethereum |

| Launch | 2009 | 2015 |

| 🌍 Global Recognition | High | Growing |

| 📈 Early Adoption Phase | 2009-2012 | 2015-2018 |

💡 Ethereum’s Unique Offerings and Slow Catch-up

Ethereum, though entering the crypto scene later than Bitcoin, has brought some innovative features that have caught the attention of both developers and investors. Unlike Bitcoin, which primarily serves as digital gold, Ethereum introduced smart contracts, allowing developers to build decentralized applications (dApps) on its platform. This opened up a myriad of possibilities from decentralized finance (DeFi) to non-fungible tokens (NFTs), pushing the boundaries of what blockchain technology could achieve. Yet, despite these advancements, Ethereum has found it challenging to overshadow Bitcoin’s dominance in both adoption and recognition. The slow transition to Ethereum 2.0, aimed at addressing scalability and energy consumption, is seen as a necessary step for it to level the playing field.

Understanding the core technology that powers these cryptocurrencies can be quite the task for newcomers. If you’re looking to get a grasp on these concepts, starting with the fundamentals can make your journey easier. A great resource to begin with is https://wikicrypto.news/understanding-blockchain-the-ultimate-guide-for-beginners. It breaks down complex topics into easily digestible information, setting a solid foundation for your investment decisions. As Ethereum continues to evolve and expand its ecosystem, it’s exciting to see how it will grow in its role within the blockchain landscape, potentially closing the gap with Bitcoin in the future.

🌐 Global Perspectives on Crypto Popularity

Around the world, people are getting excited about cryptocurrencies like Bitcoin and Ethereum, but they’re not all popular in the same places or to the same extent. Bitcoin, the first of its kind, has grabbed the spotlight in many countries, becoming a household name. Think of it like the first person to arrive at a party – they naturally get a lot of attention. Ethereum, although packed with potential and unique features, like being able to support apps and contracts that can take care of themselves, has been a bit like the next guest to arrive. While it offers something different and intriguing, it’s had to work harder to catch the eyes and ears of the global crowd. 🌍💬 Looking at how different countries have warmed up to these digital currencies, it’s clear there’s a fascinating mix of enthusiasm and caution. In some places, Bitcoin is the go-to choice for folks dipping their toes into the world of crypto, admired for its pioneering status and solid reputation. Meanwhile, Ethereum has been drawing in those with a keen interest in tech and innovation, eager to explore beyond crypto’s original blueprint. It’s a global conversation that’s growing every day, making the crypto landscape rich and diverse. 📈🔍

📊 Comparative Analysis of Market Capitalization

When we dive into the numbers, the story between Bitcoin and Ethereum becomes even more fascinating. Think of market capitalization as how much money has been put into these cryptocurrencies by people and businesses. It’s a bit like tracking the popularity of a video game by seeing how many people have bought it. Now, Bitcoin, being the first to arrive at the party, naturally got a lot of attention early on. This meant more people were willing to invest in it, pushing its market cap to impressive heights. On the flip side, Ethereum, though a bit late to the scene, brought something new to the table with its smart contracts and dApps, catching the eye of tech enthusiasts and forward-thinkers. However, catching up to Bitcoin in terms of market cap is a tough hill to climb, emphasizing the gap in their adoption rates. Despite this, both have shown they are not just a flash in the pan, with their market caps reflecting both the trust and the speculative interest of investors globally. For those looking deeper into the strategies behind these investments, who created bitcoin investment strategies offers an intriguing look into how early decisions are paving the way for future financial landscapes. It’s like watching two runners in a marathon; one had a head start, but the other has stamina and a few tricks up its sleeve, making this race far from over.

💼 Institutional Investments: Bitcoin Vs. Ethereum

When it comes to attracting big money, think of Bitcoin as the popular kid in school that everyone wants to hang out with. It’s the first of its kind, making it a favorite for big companies and savvy investors who see it as a safer bet. Bitcoin’s been around the block, and its proven track record has made it a go-to for those looking to dip their toes into the crypto world. On the flip side, Ethereum is like the smart newcomer with cool project ideas that could change the game. It offers something different thanks to its ability to support applications and contracts on its platform. But, it’s playing catch-up in the popularity contest, trying to persuade the big wallets that it’s worth their investment.

Here’s a quick look at how they stack up in the eyes of big investors:

| Feature | Bitcoin | Ethereum |

|---|---|---|

| Market Reputation | 🥇 Strong & Stable | 🥈 Growing & Evolving |

| Investment Appeal | 🛡️ Safe Haven Asset | 🚀 High Potential Returns |

| Technological Edge | 🧱 Proven Blockchain | 🤖 Smart Contracts & DApps |

Despite Ethereum’s innovative edge with technology, Bitcoin still leads when it comes to winning the confidence of heavyweight investors. This dance between old trust and new potential keeps the crypto world exciting and unpredictable.

🛠️ Technological Developments Shaping Future Adoption

In the ever-evolving world of cryptocurrencies, technological advancements are like the tools in a kit, each designed to build a stronger, wider bridge to tomorrow’s digital economy. Think of Bitcoin and Ethereum not just as digital money, but also as pioneers on a digital frontier, each racing to lay down the tracks for future travelers. On one hand, Bitcoin simplified the path to secure digital transactions, creating a roadmap others could follow. Its blockchain technology has become a cornerstone, inspiring trust and ensuring that every coin’s journey is recorded. You could say that learning what can you buy with bitcoin versus ethereum is like getting the passport to this new world. But then, there’s Ethereum, bringing its own set of tools to the party. It goes beyond just transactions; it’s about building applications on its platform, which could change how we interact online. From creating your digital identity to verifying ownership without a middleman, Ethereum’s vision adds another layer of possibility to the digital domain. As both coins continue to evolve, fueled by technological advances, they’re not just shaping their own futures—they’re paving the way for a whole new digital era. Imagine a world where buying a car, voting in elections, or even owning a piece of digital art is all done securely and transparently on these blockchains. This isn’t just about who has the most coins; it’s about who is building the most accessible, secure, and innovative tools for tomorrow. By understanding what can you buy with bitcoin versus ethereum, you’re not just watching from the sidelines; you’re part of the revolution.