Understanding the Basics of Bitcoin Investment 💰

Bitcoin, a digital currency revolutionizing the financial world, offers unique investment opportunities. Delve into the realm of Bitcoin investment to grasp its intricacies and potential for growth. Learn how to navigate the market, understand price fluctuations, and identify investment avenues. Expand your financial knowledge and embark on the exciting journey of Bitcoin investment with confidence.

Setting up Your Investment Fund Strategy 📈

When it comes to crafting your investment fund strategy, it’s crucial to align your goals, risk tolerance, and time horizon. Diversification is key to mitigating risks while maximizing potential returns. Consider factors like asset allocation, market research, and staying informed on industry trends. A well-thought-out strategy can guide your decision-making process and help navigate the dynamic landscape of Bitcoin investments.

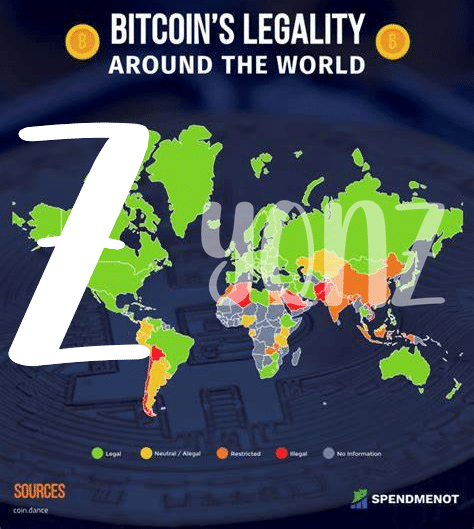

Regulatory Considerations and Compliance Essentials 📜

Navigating the regulatory landscape is crucial when setting up a Bitcoin investment fund. Understanding the compliance essentials ensures that your fund operates within the legal framework, promoting trust and credibility. By staying updated on regulatory considerations, you can proactively adapt your strategies to meet evolving requirements. Compliance with regulations not only safeguards your fund but also contributes to a sustainable and secure investment environment. Embracing these essentials demonstrates a commitment to ethical practices and responsible investing in the emerging world of digital assets.

Choosing the Right Investment Platform 🖥️

Choosing the right investment platform is crucial for your Bitcoin investment fund. It’s essential to consider factors like user-friendliness, security features, and transaction fees. Look for a platform that aligns with your investment goals and provides a seamless trading experience. Additionally, ensure the platform complies with regulatory requirements to safeguard your investments. For more information on bitcoin investment funds regulation in Ghana, check out this helpful resource: bitcoin investment funds regulation in Ghana.

Security Measures to Safeguard Your Investments 🔒

When it comes to safeguarding your investments, it’s crucial to implement robust security measures. This involves using secure wallets, enabling two-factor authentication, and staying vigilant against potential threats. Regularly updating your security protocols and avoiding sharing sensitive information online are also key steps in protecting your investment assets. By adopting a proactive approach to security, you can minimize the risk of unauthorized access and ensure the safety of your Bitcoin investments.

Monitoring and Adjusting Your Investment Portfolio 📊

When it comes to monitoring and adjusting your investment portfolio, it’s essential to stay vigilant and informed. Regularly assessing the performance of your investments allows you to make educated decisions on whether to hold, sell, or buy more assets. Consider factors like market trends, news developments, and your fund’s performance against benchmarks. By staying proactive and adaptable, you can fine-tune your portfolio to align with your investment goals and risk tolerance effectively. Remember, patience and consistency play key roles in successful portfolio management 💼.

For more information on the regulatory aspects of Bitcoin investment funds in Gabon, refer to the bitcoin investment funds regulation in Georgia.