Overview of Bitcoin Regulations in Iceland 🇮🇸

Iceland has emerged as a unique player in the realm of Bitcoin regulations, setting itself apart with a progressive approach that balances innovation with oversight. The country’s legal framework surrounding Bitcoin is characterized by a forward-looking attitude that seeks to both support and regulate the use of cryptocurrency within its borders. This nuanced approach has positioned Iceland as a hub for cryptocurrency enthusiasts and businesses looking to navigate the evolving landscape of digital assets within a structured regulatory environment.

The regulatory landscape in Iceland provides a solid foundation for Bitcoin users and businesses to operate with confidence, offering clarity on issues such as taxation, trading, and reporting requirements. As one of the early adopters of cryptocurrency regulations, Iceland has paved the way for other nations to explore how to effectively manage the challenges and opportunities presented by the increasing global adoption of Bitcoin. By fostering an environment that encourages innovation while safeguarding against potential risks, Iceland has established itself as a jurisdiction that exemplifies a balanced and pragmatic approach to regulating Bitcoin.

Legal Status of Bitcoin Transactions 💼

The legal landscape surrounding Bitcoin transactions in Iceland has continued to evolve, prompting a closer examination of the regulatory framework governing these digital transactions. With the growing popularity of cryptocurrencies globally, Iceland has sought to clarify the legal status of Bitcoin transactions within its jurisdiction. By articulating the rights and obligations associated with Bitcoin dealings, authorities aim to foster a secure environment for cryptocurrency users and facilitate the integration of digital assets into the wider financial ecosystem. Amidst this regulatory backdrop, individuals and businesses engaging in Bitcoin transactions are advised to navigate the legal terrain with due diligence to ensure compliance and mitigate potential risks.

The legal status of Bitcoin transactions in Iceland underscores the need for a nuanced understanding of the regulatory requirements that govern the use of digital currencies. By aligning Bitcoin activities with existing legal frameworks, stakeholders can contribute to the development of a sustainable and transparent marketplace for cryptocurrencies. As Iceland continues to refine its approach to regulating Bitcoin transactions, stakeholders must remain vigilant and adaptive to evolving legal developments that shape the future of digital finance within the country and beyond.

Impact of Cross-border Bitcoin Laws 🌍

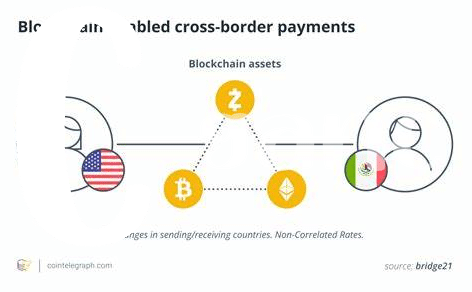

Cross-border Bitcoin laws play a crucial role in shaping the international landscape of digital currency transactions. These laws regulate how Bitcoin can flow across borders, impacting the ease and efficiency of global transactions. With different countries having varying regulations, navigating cross-border Bitcoin laws requires a deep understanding of the legal frameworks in place to ensure compliance and mitigate risks. As Bitcoin operates independently of traditional financial systems, the interplay between national regulations and the decentralized nature of cryptocurrency creates complexities that businesses and individuals must navigate to engage in cross-border transactions securely.

The evolving nature of cross-border Bitcoin laws reflects the increasingly globalized nature of financial transactions. As governments and regulatory bodies adapt to the rise of cryptocurrencies, the impact of cross-border laws extends beyond individual transactions to influence the broader adoption and acceptance of Bitcoin on a global scale. By understanding and adhering to these laws, stakeholders in the Bitcoin ecosystem can foster a more secure and transparent cross-border environment that supports the continued growth and integration of digital currencies into the global economy.

Compliance Requirements for Bitcoin Businesses 📝

Bitcoin businesses in Iceland must adhere to a set of regulations to ensure compliance with the law. These requirements encompass various aspects, from customer identification to record-keeping and reporting. By following these guidelines, businesses can operate legally and maintain transparency in their operations. Additionally, staying informed about any updates or changes in the regulatory landscape is crucial to avoiding penalties or potential legal issues. For more insights on cross-border money transfers involving Bitcoin, check out the guide on bitcoin cross-border money transfer laws in India at wikicrypto.news.

Enforcement and Penalties in Iceland ⚖️

Enforcement and penalties in Iceland related to Bitcoin transactions are enforced in accordance with the country’s existing financial regulations. Authorities closely monitor and investigate any instances of illegal activities involving Bitcoin, such as fraud or money laundering. Penalties for non-compliance with regulations can vary, including fines and possible legal action. It is crucial for individuals and businesses involved in Bitcoin transactions to stay informed about the current laws and regulations to avoid facing enforcement actions. Maintaining compliance with Icelandic laws is essential to ensure the legality and security of Bitcoin transactions in the country. By adhering to regulatory requirements, individuals and businesses can help contribute to a safer and more transparent Bitcoin ecosystem within Iceland.

Future Outlook for Bitcoin Regulations 🔮

The future of Bitcoin regulations in Iceland is expected to evolve as the cryptocurrency landscape continues to develop globally. As more countries establish their own frameworks for digital assets, Iceland will likely adapt its laws to align with these international standards. This proactive approach can provide clarity and stability for businesses operating in the cryptocurrency sector, fostering innovation and investment in the economy.

For further insights on Bitcoin cross-border money transfer laws, you may want to explore the regulations in Ireland and Iran. Understanding the differences and similarities between these jurisdictions can offer valuable perspectives on the varying approaches to regulating cross-border cryptocurrency transactions.