Introduction to Jamaica’s Aml Regulations 🇯🇲

Jamaica’s Anti-money Laundering (AML) regulations play a crucial role in safeguarding the country’s financial system from illicit activities. These regulations are designed to detect and prevent money laundering, terrorist financing, and other financial crimes. By implementing robust AML measures, Jamaica aims to maintain the integrity of its financial sector and uphold international standards.

Ensuring compliance with Jamaica’s AML regulations is essential for financial institutions and businesses operating in the country. By adhering to these regulations, entities can help combat illegal activities and protect the overall stability of the financial system. Jamaica’s AML framework serves as a proactive approach to addressing potential risks and enhancing the transparency and accountability of financial transactions.

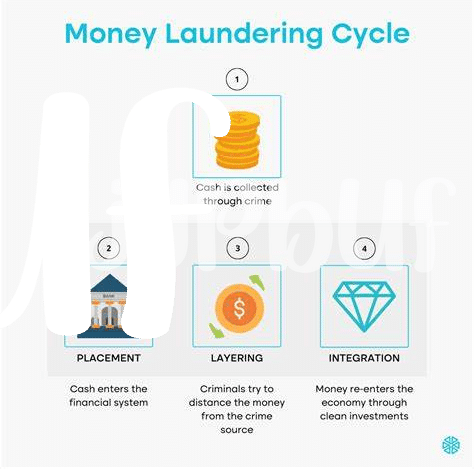

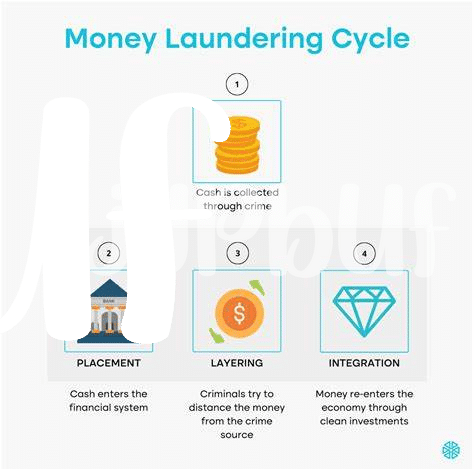

Importance of Combatting Money Laundering 💰

“Combatting money laundering plays a vital role in preserving the integrity of financial systems worldwide. By enforcing stringent regulations and monitoring suspicious activities, countries can safeguard against illicit funds being laundered through various channels. This effort helps maintain transparency, trust, and stability in the financial sector, ultimately benefiting both the economy and society at large.”

“In today’s interconnected world, the fight against money laundering has become more critical than ever. As criminals continuously devise sophisticated ways to exploit financial systems, staying ahead through robust anti-money laundering measures is imperative. Through collaborative efforts and technological advancements, countries can enhance their capabilities in detecting and preventing illicit financial activities, reinforcing the importance of combating money laundering in the digital age.”

Compliance Challenges for Bitcoin Businesses 🔒

Bitcoin businesses in Jamaica face unique compliance challenges due to the evolving nature of cryptocurrency regulations. The decentralized and pseudonymous characteristics of Bitcoin transactions often present obstacles in verifying the identities of involved parties and tracking the source of funds. Moreover, ensuring compliance with anti-money laundering (AML) and know your customer (KYC) requirements can be complex for businesses operating in the digital asset space. The dynamic nature of cryptocurrencies also adds another layer of difficulty, as regulatory frameworks struggle to keep pace with the rapidly changing landscape of virtual assets. Implementing robust compliance measures becomes paramount to address these challenges effectively and uphold the integrity of the financial ecosystem.

Role of Technology in Detecting Suspicious Transactions 📊

The role of technology in detecting suspicious transactions is pivotal in Jamaica’s efforts to combat money laundering effectively. By leveraging advanced software and analytics tools, financial institutions and Bitcoin businesses can swiftly identify unusual patterns and potential risks. Automation streamlines the process of monitoring transactions, flagging suspicious activities for further investigation. With the rapid evolution of financial technologies, staying abreast of the latest tools and techniques is crucial for enhancing anti-money laundering measures. Learn more about the challenges and solutions in the realm of Bitcoin transactions through this insightful resource on bitcoin anti-money laundering (aml) regulations in Jordan.

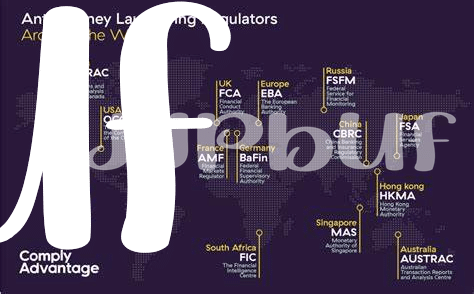

Collaborative Efforts with International Partners 🤝

Jamaica recognizes the global nature of money laundering and the necessity for cross-border collaboration to effectively combat financial crimes. By engaging in cooperative efforts with international partners, Jamaica can enhance its ability to detect and prevent illicit financial activities. Sharing information, best practices, and resources with other countries strengthens the overall integrity of the financial system and contributes to a more unified approach in addressing money laundering challenges on a global scale. By fostering partnerships with various stakeholders worldwide, Jamaica solidifies its commitment to upholding robust anti-money laundering measures and promoting transparency in financial transactions.

Future Directions for Jamaica’s Aml Framework 🌐

In shaping the future direction of Jamaica’s AML framework, a key emphasis will be on enhancing cross-border cooperation with international counterparts to combat evolving financial crimes effectively 🌐. By strengthening information-sharing mechanisms and aligning regulatory efforts, Jamaica aims to stay ahead of emerging money laundering risks and bolster the resilience of its financial system. This proactive approach reflects a commitment to adapt to the dynamic nature of illicit financial activities and underscores the importance of global partnerships in safeguarding against money laundering threats.

Insert the link to bitcoin anti-money laundering (AML) regulations in Italy with anchor “bitcoin anti-money laundering (AML) regulations in Iceland” using the