Current Landscape 🌏

The current landscape of Bitcoin investment funds in China presents a dynamic environment characterized by rapid evolution and shifting market trends. The growth of digital assets has gained significant traction among investors, driving a surge in interest and participation in cryptocurrency investment opportunities. Moreover, the emergence of new financial products and services tailored to the Chinese market reflects a maturing ecosystem that continues to attract both retail and institutional investors seeking exposure to virtual currencies.

As the regulatory landscape evolves, market players are navigating complex frameworks designed to ensure investor protection while fostering innovation in the digital asset space. The interplay between regulatory scrutiny and market dynamics underscores the importance of compliance and risk management for fund managers seeking to navigate the evolving landscape of Bitcoin investments in China.

Regulatory Challenges 🚫

In China, navigating the regulatory landscape for Bitcoin investment funds poses significant challenges. The evolving regulatory framework often lacks clarity, leading to uncertainty among investors and fund managers. Compliance requirements can be stringent and subject to sudden changes, making it crucial to stay updated with the latest regulations and guidelines. Addressing regulatory challenges requires a proactive approach and close monitoring of the legal environment to ensure compliance and mitigate risks effectively.

As the demand for Bitcoin investment funds continues to rise in China, regulators are under pressure to strike a balance between fostering innovation and protecting investors. Collaborative efforts between stakeholders are essential to address regulatory challenges and promote a healthy and sustainable investment environment. Embracing regulatory advancements and leveraging technological solutions can help streamline compliance processes and enhance transparency within the Bitcoin investment fund sector.

Investor Sentiment 📈

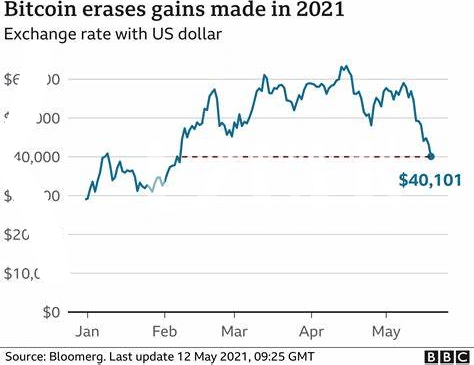

Investor sentiment in the Bitcoin investment landscape in China is a crucial aspect to monitor, as it can heavily influence market dynamics. The eagerness of investors to participate and their confidence in the market can significantly impact the overall performance of Bitcoin funds. Understanding the sentiment of investors, whether optimistic or cautious, provides valuable insights into potential market trends and investment behavior. As the market continues to evolve, keeping a pulse on investor sentiment becomes increasingly vital in navigating the complexities of the Bitcoin investment landscape.

Technological Advancements 📱

Technological advancements play a pivotal role in the evolution of Bitcoin investment funds in China. With the continuous development of blockchain technology, fund managers are exploring innovative ways to streamline operations, enhance security, and improve investor accessibility. The integration of smart contracts, artificial intelligence, and data analytics is revolutionizing how funds are managed and creating new opportunities for investors to participate in the digital asset market. This technological progress is not only reshaping fund management practices but also expanding the possibilities for investors to diversify their portfolios and navigate the complexities of the cryptocurrency landscape.

For further insights on the regulatory landscape of Bitcoin investment funds, particularly in China, refer to this comprehensive guide on key considerations for launching a Bitcoin investment fund in Chile: bitcoin investment funds regulation in Chad.

Global Market Impact 💼

The global market is becoming increasingly intertwined, and the impact of Bitcoin investment funds in China reverberates far beyond borders. As these funds navigate regulatory frameworks and investor sentiment in China, their actions ripple through the broader financial landscape, influencing emerging trends and investment strategies worldwide. The dynamic nature of the market means that developments in China can trigger reactions in distant markets, illustrating the interconnectedness of the global financial ecosystem. This interconnected web underscores the significance of Bitcoin investment funds in China as players with the potential to shape the future of global finance.

Future Growth Potential 🚀

The future growth potential of Bitcoin investment funds in China is undeniably promising, with increasing interest from both institutional and retail investors. As more regulatory clarity emerges and technology continues to advance, these funds are poised for significant expansion in the Chinese market. This growth trajectory not only signals a positive outlook for local investors but also contributes to the broader evolution of the global cryptocurrency investment landscape. For more information on bitcoin investment funds regulations in Colombia, visit bitcoin investment funds regulation in Chile.