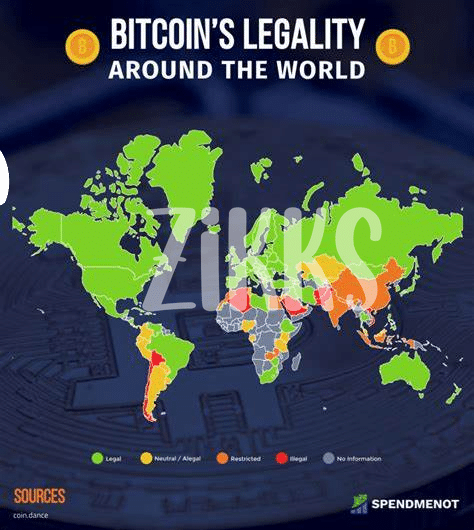

Regulatory Landscape in Cameroon 🌍

Cameroon’s regulatory landscape for digital assets is evolving, reflecting a growing interest in cryptocurrencies like Bitcoin. The country is exploring ways to monitor and regulate the use of these digital assets while balancing innovation and investor protection. Government entities are considering frameworks to address the unique challenges posed by Bitcoin funds, seeking to provide clarity and promote responsible investment practices within the rapidly changing financial landscape. These regulatory developments aim to create a more secure environment for investors while fostering the growth of the digital economy in Cameroon.

Potential Risks Associated with Bitcoin Funds 🔍

Bitcoin funds present a novel investment avenue in Cameroon, but they come with inherent risks that investors should be aware of. Volatility is a key concern, with the price of Bitcoin known to fluctuate significantly within short periods. Additionally, regulatory uncertainty and potential security vulnerabilities in the digital realm pose risks to investors seeking to enter this market. Understanding these risks and developing strategies to mitigate them is crucial for those considering investing in Bitcoin funds.

Investors should also be cautious of scams and fraudulent schemes prevalent in the cryptocurrency space. Without proper due diligence and risk management practices, there is a heightened risk of financial loss or theft when engaging with Bitcoin funds. It is imperative for investors to educate themselves on the risks associated with this asset class and seek professional advice to navigate these challenges effectively.

Investor Protections and Safeguards 🛡️

In the realm of Bitcoin funds, it’s crucial for investors to have avenues for recourse and protection. Safeguards such as transparent reporting practices and secure custody arrangements play a vital role in ensuring the integrity of investments. Additionally, regulatory mechanisms that monitor fund activities can provide a layer of defense against fraudulent schemes, offering investors peace of mind in their financial ventures.

Compliance Requirements for Fund Managers 📝

When it comes to Compliance Requirements for Fund Managers 📝, it is crucial to adhere to the regulatory framework set by the authorities in Cameroon. Ensuring transparency in operations, conducting regular audits, and maintaining proper records are essential aspects that fund managers need to prioritize. Compliance also involves staying updated with any changes in regulations and promptly adjusting operations to align with new guidelines.

Additionally, fund managers must demonstrate a strong commitment to investor protection and safeguarding assets. Implementing robust security measures, conducting due diligence on investments, and providing clear communication to investors are key components of compliance in the management of bitcoin funds.

Tax Implications of Investing in Bitcoin Funds 💰

Considering the tax implications of investing in Bitcoin funds, it is crucial for investors in Cameroon to understand the potential impact on their financial obligations. With the evolving regulatory landscape, staying informed about tax laws related to cryptocurrency investments can help investors navigate the complexities of reporting and compliance. Seeking professional guidance for tax planning and ensuring accurate record-keeping are essential practices for managing tax implications effectively.

Future Outlook and Emerging Trends 🚀

In the ever-evolving landscape of cryptocurrency investments, the future outlook for Bitcoin funds showcases a mix of excitement and uncertainty. Emerging trends suggest a growing acceptance of digital assets, with more traditional financial institutions exploring ways to incorporate cryptocurrencies into their portfolios. This shift could lead to increased regulatory clarity and investor confidence, potentially opening up new avenues for those looking to diversify their investment strategies.

For more insights on Bitcoin investment fund regulations in neighboring countries, consider exploring the guidelines set forth in Burkina Faso. Understanding the regulatory frameworks in place can provide valuable perspectives for investors navigating the landscape of digital asset investments in the Central African region. Bitcoin investment funds regulation in central African Republic