Overview 🌍

Bitcoin investment funds have garnered increasing attention amidst the evolving regulatory landscape in Andorra. This tiny principality nestled in the Pyrenees Mountains has implemented unique rules that directly impact the performance of such funds. Understanding the interplay between Andorran regulations and the dynamics of Bitcoin fund performance is crucial for investors navigating this complex terrain. Let’s delve into the intricate web of influences shaping the investment landscape in this picturesque yet impactful jurisdiction.

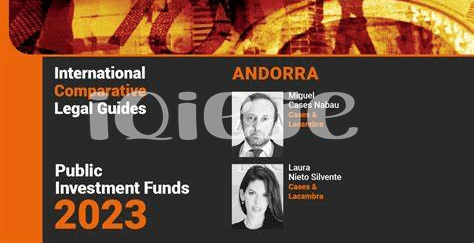

Andorran Regulations 🏔️

Andorran Regulations play a significant role in shaping the investment landscape within the country. With a focus on stability and transparency, these regulations aim to provide a secure environment for investors looking to venture into the world of cryptocurrencies. By understanding and complying with these guidelines, Bitcoin investment funds can navigate the market with confidence and establish a strong foundation for growth. For more insights on risk management strategies in different regions, you can explore the link provided.

Bitcoin Fund Performance 📈

Bitcoin investment funds have seen an upward trend in performance, reflecting the positive impact of market dynamics. The growth in Bitcoin fund performance can be attributed to various factors, including increased adoption, higher institutional interest, and regulatory clarity. Investors have reaped the benefits of diversification, as Bitcoin funds provide exposure to the digital asset class, offering potential returns that outperform traditional investment options.

Moreover, advancements in technology and the maturing cryptocurrency market have contributed to the improved performance of Bitcoin funds. With greater transparency and liquidity, investors have gained confidence in allocating capital to these funds. Overall, the evolving landscape of digital assets presents opportunities for investors seeking to capitalize on the potential growth of Bitcoin funds in their investment portfolios.

Impact Analysis 🧐

In evaluating the impact of Andorran regulations on Bitcoin investment fund performance, it’s crucial to delve into the intricate dynamics at play. The analysis unveils a nuanced landscape where regulatory frameworks intersect with market trends, shaping the investment terrain. By dissecting these correlations, investors can glean valuable insights to navigate the evolving landscape effectively. This comprehensive evaluation sheds light on the intricate symbiosis between regulations and fund performance, offering a roadmap for informed decision-making. To further explore how global regulations influence investment strategies, check out the latest insights on bitcoin investment funds regulation in Azerbaijan [here](https://wikicrypto.news/exploring-the-evolution-of-bitcoin-regulations-in-algeria).

Investment Strategies 💡

When considering the future of Bitcoin investment funds within the realm of Andorran regulations, it is essential to delve into various investment strategies that can potentially navigate the complexities of the market. From traditional portfolio diversification to innovative digital asset management approaches, finding the optimal strategy tailored to the regulatory environment is key. A strategic blend of long-term vision and adaptability is crucial for maximizing fund performance within the specified framework.

Future Outlook 🔮

Bitcoin investment funds have the potential to thrive in Andorra due to its favorable regulations and growing interest in digital assets. With a focus on security and compliance, investors can expect a stable environment for their funds. Looking ahead, advancements in technology and evolving regulatory frameworks offer promising opportunities for the industry. As the global landscape continues to shift, staying informed and adapting investment strategies will be crucial for maximizing returns. Embracing innovation and staying abreast of regulatory changes will be key to navigating the dynamic market successfully. For more information on bitcoin investment fund regulations, please visit Bitcoin Investment Funds Regulation in Algeria.