Current Bitcoin Investment Regulations in Afghanistan 🌍

In Afghanistan, the current landscape of Bitcoin investment regulations reflects a delicate balance between fostering innovation in digital assets and upholding financial security. The evolving nature of the global cryptocurrency market presents unique challenges and opportunities for Afghan investors, as they navigate the regulatory framework governing their digital investments. Understanding the nuances of these regulations is crucial for both local and international players looking to engage in Bitcoin funds within Afghanistan’s financial ecosystem.

Potential Impacts of Regulatory Changes on Investors 💼

In light of evolving regulatory landscapes, investors in the Bitcoin market stand on the precipice of significant changes. As policymakers in Afghanistan mull over potential adjustments to investment regulations, the implications for investors will be profound. Factors such as compliance requirements, investor protection mechanisms, and overall market stability will all play pivotal roles in shaping the investment landscape. Understanding how these regulatory shifts may impact investors is crucial for navigating the future terrain of Bitcoin investment funds.

Global Trends Shaping the Future of Bitcoin Funds 💹

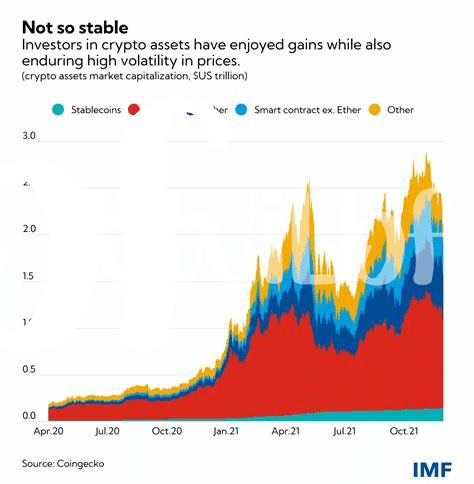

In the ever-evolving landscape of finance, various global trends are reshaping the future of Bitcoin investment funds. From the increasing institutional adoption to the growing acceptance of digital assets as legitimate investment vehicles, the momentum behind Bitcoin funds is undeniable. Additionally, regulatory developments around the world are playing a pivotal role in shaping the future of these funds, influencing investor confidence and market dynamics. As technological advancements continue to enhance the efficiency and security of fund management processes, the intersection of technology and finance opens up new possibilities for investors and fund managers alike.

Challenges and Opportunities for Afghan Investment Firms 💡

Afghan investment firms face a dynamic landscape of challenges and opportunities. As the regulatory environment evolves, firms must navigate uncertainties while seizing new avenues for growth. Amidst political and economic shifts, opportunities emerge for agile firms to differentiate themselves and attract a diverse investor base. Strategic partnerships and technological advancements offer tools for firms to streamline operations and enhance client experiences, fostering long-term sustainability and competitive edge in the market.

For more insights on navigating the legal complexities of investing in Bitcoin funds globally, including in Australia, visit bitcoin investment funds regulation in Australia.

Exploring the Role of Technology in Fund Management 📲

Technology is revolutionizing fund management, enhancing efficiency 🚀, and transparency while reducing costs. Investment firms in Afghanistan can leverage advanced algorithms and artificial intelligence to make data-driven decisions swiftly and accurately. Blockchain technology offers secure transaction processing, ensuring trust and reducing risks for investors. Embracing digital platforms allows for seamless customer interactions and streamlined operations. By adopting innovative technological solutions, Afghan investment firms can stay competitive in a rapidly evolving financial landscape.

Recommendations for a Sustainable Regulatory Framework 🌱

In considering the future landscape of Bitcoin investment fund regulation in Afghanistan, it is crucial to lay the groundwork for a sustainable regulatory framework that balances innovation with investor protection. Embracing transparency and accountability within the regulatory landscape can foster trust among market participants while promoting responsible investment practices. Moreover, collaborating with international regulatory bodies and adopting best practices from jurisdictions with evolved regulatory frameworks can further bolster the integrity and credibility of Bitcoin investment funds in Afghanistan.

By establishing a dynamic regulatory framework that adapts to the evolving nature of financial technologies, Afghan authorities can cultivate a conducive environment for investors to engage with Bitcoin funds confidently and securely. Through proactive measures and continuous evaluation, the regulatory framework can facilitate the growth of the digital asset market while safeguarding against potential risks and ensuring compliance with global standards. The commitment to fostering a sustainable regulatory ecosystem will not only benefit investors but also contribute to the overall stability and growth of the financial sector in Afghanistan.

bitcoin investment funds regulation in Angola