Overview 🌍

In Tanzania, the landscape of digital currency is evolving alongside traditional financial systems. As the use of Bitcoin gains traction, individuals and businesses are increasingly exploring its potential benefits and implications. Understanding the legal, regulatory, and tax aspects of utilizing Bitcoin is essential for navigating this emerging financial ecosystem. With the rapid advancements in technology and the global shift towards digital finance, the adoption of Bitcoin in Tanzania reflects a broader trend towards embracing innovative solutions in the digital era. Stay tuned to delve deeper into the legalities and practical considerations surrounding the use of Bitcoin in Tanzania.

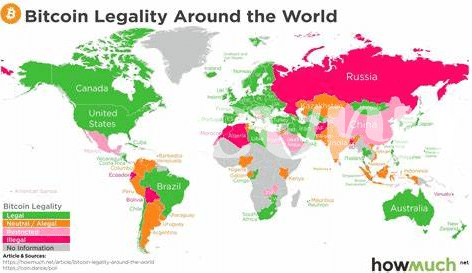

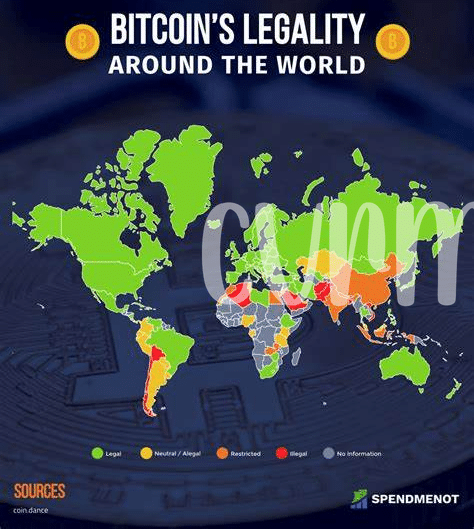

Legal Status of Bitcoin in Tanzania 📜

Bitcoin’s legal status in Tanzania remains a subject of intrigue and debate. The evolving regulatory landscape and varying interpretations have sparked discussions among experts and enthusiasts alike. While the government has not explicitly banned the use of Bitcoin, its status as a legal tender or recognized form of payment remains undefined. This ambiguity poses both challenges and opportunities for individuals and businesses looking to engage with Bitcoin in Tanzania. As stakeholders navigate this regulatory gray area, a clearer understanding of the legal implications can help guide decisions and foster responsible adoption of this innovative digital currency.

Regulatory Challenges and Uncertainties 🤔

Navigating the legal landscape of Bitcoin in Tanzania can be a complex journey. The regulatory challenges and uncertainties surrounding its use create a sense of ambiguity for individuals and businesses alike. With evolving laws and unclear guidelines, it can be tricky to ensure compliance and navigate the potential risks involved. Understanding the regulatory environment and staying informed about any updates is crucial to safely engaging in Bitcoin transactions within Tanzania.

Tax Implications of Using Bitcoin 💰

Bitcoin’s growing popularity in Tanzania comes with tax implications that users must consider. The taxation landscape surrounding digital currencies like Bitcoin is still evolving, creating a level of uncertainty for both authorities and taxpayers. Transactions involving Bitcoin may be subject to capital gains tax, depending on the nature of the transaction and the holding period of the cryptocurrency. Understanding the tax implications of using Bitcoin is crucial to ensure compliance with the law while optimizing financial strategies.

For a detailed analysis of the legal status of Bitcoin in Switzerland, you can explore “is Bitcoin legal in Switzerland?” on WikiCrypto. Understanding the regulatory framework of another country can provide valuable insights into potential future developments in Tanzania regarding cryptocurrency regulations.

Practical Tips for Safely Using Bitcoin 🛡️

When it comes to navigating the world of Bitcoin in Tanzania, ensuring the safety of your transactions is paramount. One key tip for securely using Bitcoin is to always double-check the wallet address you are sending funds to. Scammers can manipulate addresses easily, so verifying the details before any transfer is crucial. Additionally, consider using reputable and secure cryptocurrency exchanges or platforms for your transactions. Keeping your private keys secure and offline, preferably in a hardware wallet, adds an extra layer of protection. Staying informed about potential scams and security threats in the crypto space is essential to safeguard your digital assets.

Future Outlook for Bitcoin in Tanzania 🔮

In the context of Tanzania, the future outlook for Bitcoin appears to be evolving gradually. As technology advances and awareness grows, there is a possibility of increased acceptance and integration of Bitcoin into various sectors of the economy. However, it is important to closely monitor how regulatory frameworks develop and how they impact the use of Bitcoin in the country.

To explore the legal status of Bitcoin in other regions, particularly in Sudan or Syria, check out is bitcoin legal in Sudan? for more insights.