History 🕰️

In the early stages, the concept of Bitcoin emerged as a revolutionary digital currency, bringing with it the promise of decentralization and financial autonomy. Its origin story is shrouded in mystery, as the pseudonymous creator, Satoshi Nakamoto, published the Bitcoin whitepaper in 2008. The subsequent years saw a gradual but steady rise in interest and participation in the Bitcoin ecosystem, laying the foundation for its transformative impact on various sectors, including banking and finance.

Regulatory Framework 📜

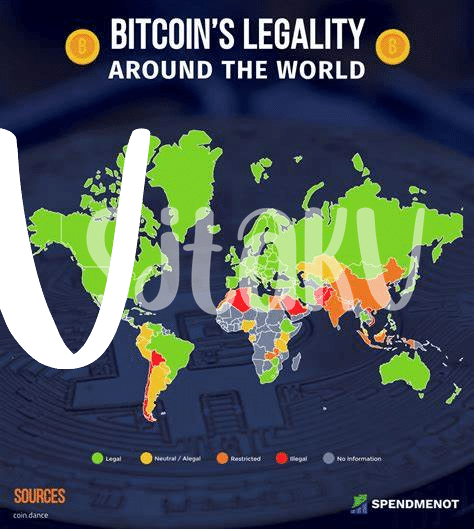

Throughout Panama’s journey in the Bitcoin banking industry, the regulatory framework has played a pivotal role in shaping the landscape. Clear guidelines and oversight from regulatory bodies have provided a sense of security for both businesses and consumers venturing into the realm of digital currencies. By establishing rules and standards, the regulatory framework has laid the foundation for a more transparent and accountable ecosystem. This framework serves as a compass, guiding the industry towards sustainable growth while mitigating potential risks and uncertainties.

As the regulatory framework continues to evolve and adapt to the changing dynamics of the digital banking sector, stakeholders must collaborate to strike a balance between innovation and compliance. Regulatory updates and amendments will be crucial in addressing emerging challenges and ensuring the longevity of Bitcoin banking in Panama. By fostering a conducive environment for industry players to thrive within the boundaries of the law, Panama is poised to position itself as a progressive hub for digital banking innovation.

Impact on Bitcoin Adoption 💰

History 🕰️

Cryptocurrencies, particularly Bitcoin, have been gradually gaining traction in Panama despite initial skepticism. The regulatory landscape plays a pivotal role in influencing the adoption of Bitcoin in the country. As regulations provide a sense of security and legitimacy, more individuals and businesses are willing to explore the potential of digital currencies. This shift towards a more regulated environment has contributed to a growing awareness and acceptance of Bitcoin as a viable form of financial transactions.

Regulatory Framework 📜

The regulatory framework governing Bitcoin in Panama has significantly influenced the pace of adoption among the population. By establishing clear guidelines and rules for the use of cryptocurrencies, the government has instilled confidence in the reliability and legality of Bitcoin transactions. This transparency fosters a favorable environment for individuals and businesses to engage with Bitcoin, ultimately leading to increased adoption rates within the country.

Challenges Faced 🤔

In navigating the Bitcoin banking landscape in Panama, various challenges loom ahead. The uncertainty surrounding regulatory developments presents a hurdle for both industry players and potential investors. Exchange rate volatility, security concerns, and the inherent risks associated with digital assets add layers of complexity to the burgeoning Bitcoin banking sector. Moreover, the need to strike a balance between compliance and fostering innovation poses a delicate balancing act for regulators and industry stakeholders alike.

As the sector continues to evolve, addressing these challenges head-on will be crucial for the sustainable growth and maturation of the Bitcoin banking industry in Panama. By overcoming these obstacles through proactive measures and strategic collaborations, the ecosystem can foster a more conducive environment for fostering financial inclusion and technological advancements in the realm of digital finance.

Future Outlook 🔮

The future outlook for the Bitcoin banking industry in Panama is filled with promise and potential. As regulations continue to evolve and adapt to the changing landscape of digital currencies, there is a growing sense of confidence and stability within the market. This bodes well for the future growth and development of the industry, as more businesses and individuals alike are likely to embrace Bitcoin and other cryptocurrencies as a legitimate form of banking and financial transactions. With a forward-looking approach and a commitment to innovation, the future of Bitcoin banking in Panama appears bright and full of opportunities for continued growth and success.

Innovation Opportunities 💡

In a rapidly evolving industry like Bitcoin banking, there are abundant opportunities for innovation. With the right regulatory support and a forward-thinking approach, new advancements in technology, security measures, and customer experience can be explored. These innovation opportunities pave the way for creative solutions to address current challenges and enhance the overall efficiency and accessibility of Bitcoin banking services. By embracing these opportunities, stakeholders in the industry can position themselves for sustainable growth and competitive advantage.

To delve deeper into the regulatory landscape of Bitcoin banking services in different regions, explore how regulations impact market dynamics and the adoption of cryptocurrencies in the financial sector. For instance, the bitcoin banking services regulations in Russia serve as a case study on the evolving approach to cryptocurrency regulations, providing insights into potential future trends and best practices. Similarly, the bitcoin banking services regulations in the Philippines offer valuable perspectives on compliance requirements and the implications for businesses operating in this space.