Government’s 🏛️ Regulatory Approach to Bitcoin Innovations

Government regulations play a crucial role in shaping the landscape for Bitcoin innovations. By establishing clear guidelines and oversight, the government aims to foster a secure environment for the development and adoption of digital currencies. Striking a balance between promoting innovation and safeguarding consumer interests is at the core of regulatory frameworks designed to govern the realm of Bitcoin services.

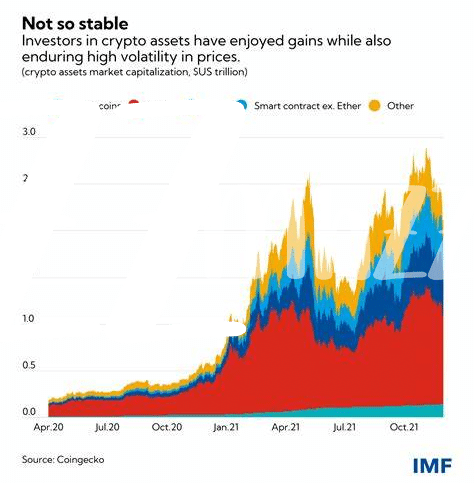

Bitcoin’s 📈 Impact on Traditional Financial Systems

Government’s regulatory approach to Bitcoin innovations is a critical factor in understanding the digital currency’s impact on traditional financial systems. As Bitcoin continues to gain traction, its disruptive potential challenges established banking norms, leading to a reevaluation of financial structures and services. This shift prompts regulatory bodies to navigate the complexities of balancing innovation with protecting consumers from potential risks associated with decentralized currencies.

Balancing 🤝 Innovation and Consumer Protection

In the realm of Bitcoin regulation, striking a delicate balance between fostering innovation and ensuring consumer protection remains a paramount challenge for governments worldwide. As new advancements in blockchain technology continue to unfold, policymakers are tasked with creating regulatory frameworks that encourage the growth of the digital currency landscape while safeguarding individuals against potential risks. This intricate dance between promoting innovation and upholding consumer rights requires a nuanced approach that considers the evolving nature of cryptocurrencies and the dynamic needs of the market. By navigating this fine line with dexterity and insight, regulators can cultivate an environment where innovation thrives without compromising the security and well-being of consumers.

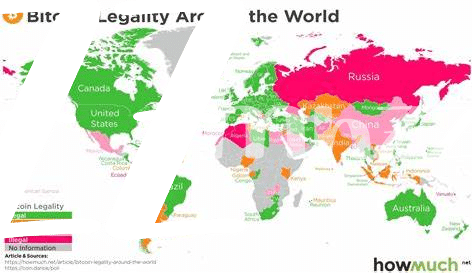

Global 🌍 Perspectives on Bitcoin Regulation

When considering global perspectives on Bitcoin regulation, it’s crucial to acknowledge the diverse approaches taken by different countries. While some nations embrace and regulate cryptocurrencies, others maintain a cautious stance or even prohibit their use. Understanding how various governments navigate the challenges posed by this decentralized digital currency provides valuable insights into the complexities of harmonizing regulatory frameworks in a borderless financial landscape. Explore more about the evolving dynamics of Bitcoin banking services regulations in Luxembourg on bitcoin banking services regulations in Luxembourg.

Challenges 💼 in Regulating Decentralized Cryptocurrencies

Decentralized cryptocurrencies present a unique challenge when it comes to regulation due to their nature of operating outside traditional financial systems. The lack of a central authority governing these currencies makes it difficult for governments to enforce standard regulatory measures. Additionally, the anonymity and cross-border nature of decentralized cryptocurrencies further complicate the regulatory landscape, raising concerns about money laundering, fraud, and tax evasion. Finding a balance between fostering innovation in this space and ensuring consumer protection remains a key obstacle for regulators worldwide. Overcoming these challenges requires a collaborative effort between governments, regulatory bodies, and industry stakeholders to establish a framework that supports the growth of decentralized cryptocurrencies while mitigating associated risks.

Future ⏩ Prospects for Bitcoin Governance

Bitcoin governance faces a shifting landscape as governments globally evaluate their regulatory approaches. The future holds complex challenges, such as ensuring innovation while safeguarding consumers and financial stability. Striking a balance between flexibility and oversight will be critical in navigating the evolving cryptocurrency space. Collaboration between regulators, industry players, and users will play a significant role in shaping the governance framework for Bitcoin in the years ahead. As the market and technology continue to mature, adapting regulatory frameworks to meet these dynamic needs will be essential for fostering trust and sustainability in Bitcoin services.

—

bitcoin banking services regulations in Madagascar with anchor “bitcoin banking services regulations in Libya”