Introduction of Bitcoin and Its Implications in Kiribati 🌏

In Kiribati, the emergence of Bitcoin has sparked curiosity and potential opportunities for financial innovation. The introduction of this digital currency brings forth a new era of possibilities, challenging traditional monetary systems and creating avenues for global transactions. As Kiribati navigates this new landscape, the implications of Bitcoin extend beyond just financial gains, delving into the realms of technology, security, and economic empowerment for its citizens. This shift marks a significant turning point for Kiribati, opening doors to a digital future with boundless possibilities.

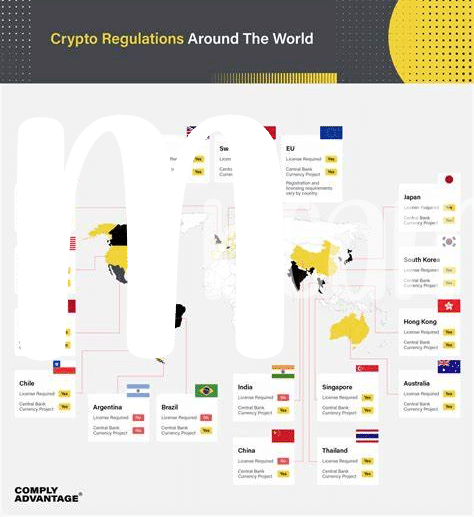

Current Legal Status and Regulations Surrounding Bitcoin 💼

Bitcoin’s presence in Kiribati poses a unique intersection of technological innovation and legal considerations. In navigating the landscape of bitcoin regulation, Kiribati faces the need to balance the potential benefits of cryptocurrency with the need for consumer protection and financial stability. The current legal status and regulations surrounding bitcoin in Kiribati are evolving as policymakers grapple with the complexities of this digital currency. Understanding the legal framework is essential for stakeholders to operate within the confines of the law and foster a conducive environment for bitcoin adoption across the nation.

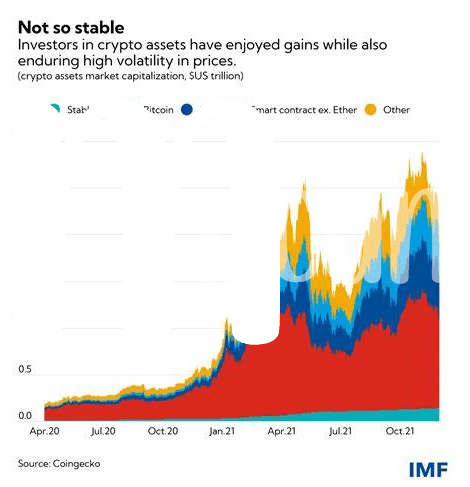

Impact of Bitcoin on Kiribati’s Economy and Society 💸

Bitcoin has started to make waves in Kiribati, bringing about a shift in the country’s economic and social landscapes. The introduction of Bitcoin has introduced new opportunities for financial inclusion, allowing for greater accessibility to digital transactions and investments. This has the potential to empower individuals and businesses, enabling them to participate in the global economy with more ease and efficiency. Additionally, the use of Bitcoin in Kiribati has the capacity to drive innovation and entrepreneurship, fostering a more dynamic and resilient economic environment for the nation’s future development.

Challenges and Hurdles in Adopting Bitcoin in Kiribati ⚖️

Challenges arise in Kiribati around technological infrastructure and access to reliable internet necessary for widespread Bitcoin adoption. Coupled with limited financial literacy and apprehensions regarding digital currencies, educating the population becomes paramount. Moreover, regulatory frameworks that ensure consumer protection and prevent illegal activities are crucial to building trust in Bitcoin transactions within the nation. Understanding and addressing these challenges will be instrumental in fostering a conducive environment for Bitcoin integration in Kiribati.

For more insights into the regulations surrounding Bitcoin banking services in other regions, particularly Italy, you can refer to this informative article on bitcoin banking services regulations in Kazakhstan.

Successful Case Studies of Bitcoin Use in Kiribati 📈

Amidst the coral-fringed shores of Kiribati, Bitcoin has found a niche in everyday transactions. From remote villages to bustling urban centers, locals have embraced the digital currency for its convenience and security. With success stories echoing across the archipelago, businesses have flourished, and financial inclusion has taken on new meaning. These case studies showcase the transformative power of Bitcoin in a country forging a path towards economic resilience and innovation.

Future Prospects and Potential Changes in Bitcoin Regulation 🚀

In the evolving landscape of Bitcoin regulation in Kiribati, there are anticipations of potential changes that could shape the future prospects of digital currency within the nation. As global trends and advancements in technology continue to influence financial frameworks, policymakers in Kiribati may navigate towards adapting regulatory measures that accommodate the growing presence of Bitcoin. These adjustments could serve to enhance transparency, security, and innovation in the digital financial sector.

Link: Bitcoin banking services regulations in Jordan with anchor “bitcoin banking services regulations in Italy”