Government’s Stance Towards Bitcoin 💼

In the fast-evolving landscape of digital currency, the government’s perspective on Bitcoin is crucial. Understanding how authorities view and approach Bitcoin can provide valuable insights into the future of cryptocurrency regulations. From concerns about financial stability to the potential for innovation, the government’s stance towards Bitcoin will shape the regulatory framework for digital banking. Balancing the opportunities and risks presented by Bitcoin, policymakers seek to navigate this decentralized currency within the established financial system.

Regulatory Challenges in the Digital Era 🌐

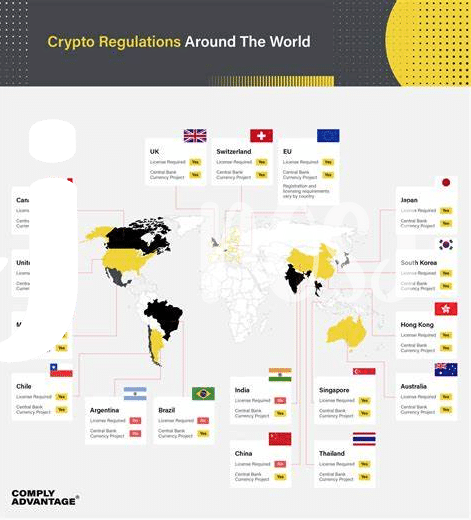

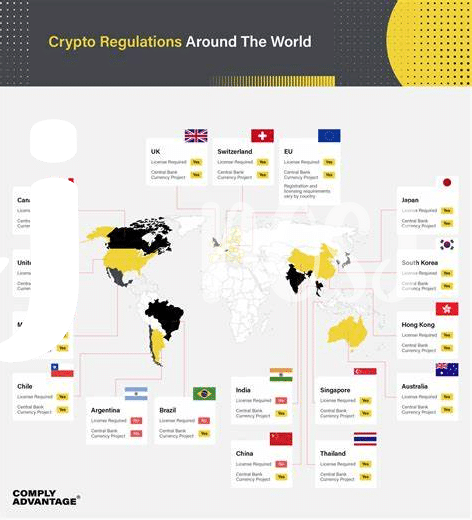

In the fast-evolving realm of digital finance, regulatory challenges loom large for both government agencies and financial institutions. The borderless nature of cryptocurrencies, like Bitcoin, presents unique hurdles in terms of oversight and enforcement. Striking a balance between enabling innovation and ensuring consumer protection remains a key concern. Additionally, the rise of decentralized finance (DeFi) platforms introduces novel complexities, testing the traditional regulatory frameworks in place. As the financial landscape continues to digitize, policymakers face the daunting task of crafting regulations that foster innovation while safeguarding against potential risks in this new era of banking.

As technology advances at a rapid pace, regulators must adapt swiftly to keep pace with the shifting landscape of digital transactions. The emergence of cryptocurrencies has challenged conventional notions of monetary governance, requiring governments to rethink their approaches to financial oversight. Enhancing transparency and accountability in the digital realm is paramount to mitigate risks such as money laundering and fraud. Moreover, the interplay between regulatory measures and technological developments underscores the need for proactive and adaptive regulatory frameworks that can effectively contend with the evolving complexities of the digital age.

Impact of Government Regulations on Banks 💰

Government regulations play a crucial role in shaping the operations and practices of banks within the realm of Bitcoin banking. These regulations influence how banks engage with cryptocurrencies, handle transactions, and ensure compliance with anti-money laundering protocols. By implementing clear guidelines and oversight, governments seek to enhance transparency, security, and integrity in the rapidly evolving landscape of digital finance. This regulatory framework not only affects the way traditional financial institutions navigate the integration of Bitcoin but also sets the tone for the future of banking in the digital age.

Balancing Innovation with Financial Stability ⚖️

Government regulations play a crucial role in ensuring that the innovative advancements in Bitcoin banking are balanced with financial stability. As digital currencies continue to evolve, it is essential for regulatory frameworks to adapt in a way that fosters growth while mitigating risks. Striking a harmonious equilibrium between encouraging innovation and safeguarding financial systems is a delicate task that governments around the world are actively navigating. To explore how this balancing act is unfolding in the realm of Bitcoin banking, particularly in Iceland, where regulations are paving the way for compliance innovations, visit this insightful resource: bitcoin banking services regulations in Iceland.

Public Perception of Government Intervention 🧐

Public perception of government intervention in the realm of Bitcoin banking is a nuanced subject, reflecting varied viewpoints among the public. Some individuals view government involvement as necessary to safeguard financial systems and prevent illicit activities, while others see it as encroaching on the decentralized nature of cryptocurrencies. This dichotomy underscores the ongoing debate over the extent to which regulatory oversight should shape the future of Bitcoin banking. As public awareness and understanding of digital currencies evolve, so too will sentiments towards government intervention in this rapidly changing landscape.

Future Outlook for Bitcoin Banking Regulation 🚀

Looking into the future, the regulation of Bitcoin banking is poised for continued evolution as governments strive to strike a delicate balance between fostering innovation in financial technology and ensuring the stability of the banking sector. With the digital landscape constantly evolving, regulatory frameworks will need to adapt accordingly to address emerging challenges and opportunities. As public awareness and understanding of cryptocurrencies grow, the role of government oversight in Bitcoin banking is likely to become more nuanced and sophisticated in the years ahead. The future outlook for Bitcoin banking regulation holds promise for a more mature and robust regulatory environment that supports the widespread adoption of digital currencies while safeguarding against potential risks and abuses.

bitcoin banking services regulations in hungary