The Rise of Bitcoin and Its Impact 💡

Since its emergence, Bitcoin has revolutionized the financial landscape, offering decentralized transactions and challenging traditional banking systems. Its impact extends beyond currency, sparking discussions on blockchain technology and digital assets. As individuals and businesses explore the potential of Bitcoin, its rise signifies a shift towards alternative financial solutions and the need for regulatory frameworks to adapt to these innovations.

Understanding Regulatory Environment in Ireland 📜

The regulatory landscape surrounding Bitcoin in Ireland is a dynamic and evolving space. With an emphasis on fostering innovation while ensuring consumer protection, authorities in Ireland are working towards establishing a clear framework for the use of cryptocurrencies. This environment presents both challenges and opportunities, as stakeholders navigate the complexities of regulating a rapidly growing industry. As Ireland positions itself as a hub for fintech innovation, the regulatory environment continues to play a crucial role in shaping the future of Bitcoin and other digital assets.

Challenges and Opportunities for Bitcoin in Ireland 🌱

Bitcoin in Ireland faces a dynamic landscape of challenges and opportunities. Amidst concerns about price volatility and security risks, there is a growing recognition of the potential benefits that cryptocurrencies can offer in terms of financial inclusion and innovation. Regulatory clarity and fostering a supportive environment for blockchain technology are crucial in unlocking the full potential of Bitcoin in Ireland. Embracing these challenges as opportunities for growth can pave the way for a more resilient and prosperous digital economy.

Balancing Innovation with Consumer Protection 🔒

To strike a balance between fostering innovation in the Bitcoin industry and ensuring adequate consumer protection measures, regulatory bodies in Ireland are continuously evaluating and adjusting their approach. The challenge lies in promoting technological advancements while safeguarding the interests and assets of individuals engaging in cryptocurrency transactions. By implementing transparent guidelines and monitoring mechanisms, authorities aim to create a regulatory framework that supports the growth of digital currencies while minimizing potential risks for users and investors. This delicate equilibrium between innovation and protection is crucial for sustaining the integrity and trustworthiness of the Bitcoin ecosystem.

bitcoin banking services regulations in Iraq

Public Perception and Future Trends 🚀

Bitcoin’s journey in Ireland is intertwined with shifting public attitudes and emerging trends. As more people embrace digital currencies, perceptions of Bitcoin evolve. The future holds promise as innovation continues to drive the market forward. With regulatory oversight and consumer protection measures in place, the trajectory of Bitcoin in Ireland is set to align with the changing landscape of financial technologies globally.

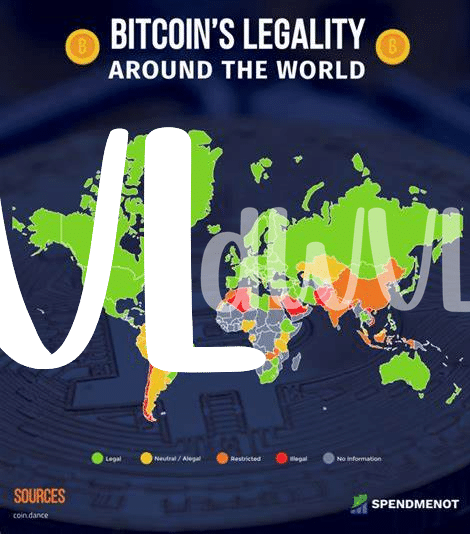

The Evolving Landscape of Bitcoin Regulation 🔄

The landscape of Bitcoin regulation is constantly shifting, influenced by technological advancements, market trends, and regulatory developments. It reflects a delicate balance between fostering innovation and ensuring safeguards for consumers and investors. As cryptocurrencies gain mainstream acceptance, governments worldwide are reassessing their policies to adapt to the evolving digital economy. The regulatory framework for Bitcoin in Ireland, like in many countries, is a work in progress, striving to keep pace with the rapid growth of the cryptocurrency industry.

For more details on Bitcoin banking services regulations in Guyana, refer to the official guidelines on Bitcoin banking services regulations in Iran.