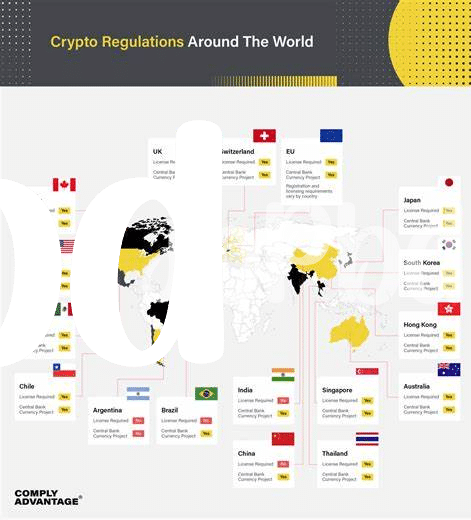

Regulatory Hurdles 🚫

Navigating through the intricate landscape of regulatory hurdles, the future of Bitcoin services in Iceland faces a challenging path ahead. With evolving laws and guidelines, ensuring compliance while fostering growth poses a significant challenge for industry players. The dynamic nature of regulations necessitates proactive strategies to adapt swiftly and maintain operational efficiency amidst the changing regulatory environment.

Market Adaptation 📈

Bitcoin services are evolving to meet the demands of regulatory landscapes, prompting market players to chart new paths for sustainable growth. Adapting to changing regulations requires a deep understanding of the shifting dynamics within the industry. As market forces continue to shape the future of Bitcoin services, companies are embracing innovative strategies to navigate these uncharted waters, fostering a competitive environment that spurs growth and development in the digital currency space.

With a focus on compliance and customer needs, businesses are redefining their strategies to align with regulatory requirements, ensuring transparency and accountability in their operations. The market adaptation thus becomes a strategic imperative for organizations, driving them to innovate and differentiate themselves in a rapidly evolving landscape.

Fostering Innovation 🌱

In the realm of Bitcoin services, the fostering of innovation holds the key to unlocking new possibilities and reshaping the landscape of digital currency. By encouraging creativity and out-of-the-box thinking, companies can pioneer groundbreaking solutions that have the potential to revolutionize the way we transact and interact in the digital sphere. The fostering of innovation not only propels the growth of the Bitcoin market but also paves the way for advancements that could have far-reaching implications beyond borders and boundaries.

Transparency & Accountability 🔍

In the ever-evolving landscape of Bitcoin services, the principles of transparency and accountability serve as crucial pillars. These facets not only cultivate trust among users but also reinforce the integrity of the overall system. By implementing practices that prioritize transparency, such as public ledger records and regular audits, the Bitcoin ecosystem can enhance its reliability and legitimacy. Accountability measures further solidify this foundation by holding entities responsible for their actions, ensuring a higher standard of operational integrity within the industry.

For further insights on regulatory updates impacting Bitcoin banking services, particularly in India, check out this informative article: bitcoin banking services regulations in India

Consumer Protection 🔒

In the realm of Bitcoin services, safeguarding consumer interests is paramount. As Icelandic regulations evolve, a key focal point is ensuring robust measures are in place to protect individuals engaging in cryptocurrency transactions. By implementing stringent protocols and ensuring compliance with consumer protection laws, the landscape can instill trust and confidence among users. Effective oversight not only shields consumers from potential risks but also promotes a secure environment for the widespread adoption of Bitcoin services.

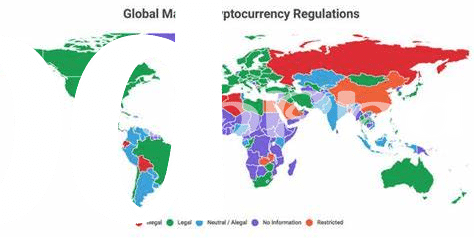

Global Impact 🌍

The emergence of Bitcoin services under Icelandic regulations is poised to have a transformative global impact. As more countries navigate the regulatory landscape surrounding digital currencies, the decisions made in Iceland could set a precedent for others to follow. This ripple effect extends beyond borders, influencing how cryptocurrencies are perceived and integrated into the global financial system.

For more information on Bitcoin banking services regulations in Hungary, visit bitcoin banking services regulations in Honduras.