Overview of Bitcoin Banking Regulation in Haiti 🌏

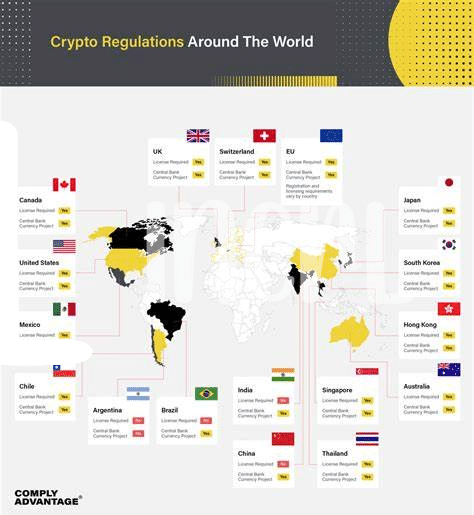

Bitcoin banking in Haiti is regulated within a framework of evolving guidelines, shaped by the country’s economic landscape and international influences. The regulatory environment seeks to balance innovation and risk management, paving the way for the emergence of digital currency services. As Haiti navigates the complexities of integrating Bitcoin into its financial system, key stakeholders collaborate to establish a foundation that supports responsible growth and fosters financial inclusion for its citizens. The regulatory landscape continues to evolve, reflecting the dynamic nature of the global digital economy and the unique challenges and opportunities facing the Haitian financial sector.

Current Challenges Faced by Bitcoin Banks 🛑

Bitcoin banks in Haiti are grappling with fluctuating regulatory landscapes, creating persistent uncertainties. Compliance requirements often pose significant obstacles, constraining operational flexibility and innovation. These challenges, coupled with evolving legal frameworks, demand proactive strategies to navigate the intricate regulatory maze. Finding a delicate balance between compliance and scalability remains a pressing concern for Bitcoin banks in the region. Moreover, the lack of standardized guidelines complicates decision-making processes, requiring continuous adaptation to ensure regulatory alignment and sustainability.

The Role of International Partnerships 🤝

In the dynamic landscape of Bitcoin banking in Haiti, establishing robust international partnerships is crucial for fostering trust and expanding access to financial services. Collaborating with global entities not only bolsters regulatory compliance but also brings in diverse perspectives and resources to navigate the evolving digital economy. By leveraging these partnerships effectively, Bitcoin banks in Haiti can enhance their operational resilience and explore new avenues for sustainable growth and innovation. 🌍💼🌐

Opportunities for Innovation and Growth 💡

Opportunities for Innovation and Growth:

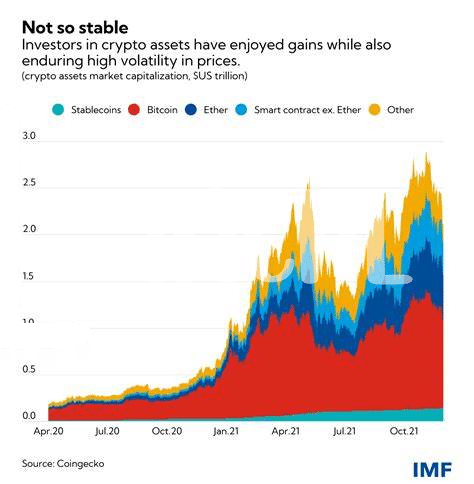

Embracing a forward-thinking approach in the realm of Bitcoin banking can lead to remarkable advancements and expansion within the industry. By fostering a culture of innovation and being open to new technologies, Bitcoin banks in Haiti can position themselves at the forefront of financial evolution. This can not only attract a younger demographic but also create a competitive edge in the market. Moreover, strategic collaborations with tech-savvy startups and financial institutions can pave the way for novel services and products, ultimately driving growth and sustainability in the sector.

Community Engagement and Education Efforts 📚

In Haiti, fostering community engagement and promoting educational initiatives within the realm of Bitcoin banking is essential for widespread adoption and understanding. By organizing workshops, seminars, and outreach programs, individuals can gain insights into the benefits and risks associated with this evolving financial landscape. With proper guidance and resources, community members can make informed decisions and actively participate in shaping the future of Bitcoin banking in Haiti. Through collaborative efforts and continuous learning opportunities, the path towards a more inclusive and knowledgeable financial ecosystem becomes clearer for all involved.

Future Outlook and Potential Impacts 🔮

The future of Bitcoin banking in Haiti holds promise and uncertainty. Regulatory changes can significantly impact the landscape, affecting accessibility and stability of services. Additionally, evolving technologies and global trends play a crucial role in shaping the industry. Collaboration with international partners can bring both challenges and opportunities, influencing innovation and growth. Community engagement and education efforts will be key in navigating these changes and fostering a sustainable ecosystem. The potential impacts of these developments are vast, with implications reaching far beyond the country’s borders.

Bitcoin banking services regulations in guinea