Impact of Regulations on Bitcoin Banking Services 🌐

Regulations play a crucial role in shaping the landscape of Bitcoin banking services. They provide a framework for operations, instill trust in the system, and protect consumers. However, they also pose challenges, such as compliance requirements and potential restrictions. Understanding and navigating these regulations are vital for the sustainable growth and acceptance of Bitcoin banking services worldwide.

Compliance Challenges Faced by Bitcoin Banks 💼

Regulations in the Bitcoin banking sector present various challenges that institutions must navigate. The evolving landscape of compliance requirements demands constant vigilance to ensure adherence. These challenges can range from complex reporting protocols to the need for robust security measures to safeguard against fraudulent activities. Despite these hurdles, Bitcoin banks are devising innovative strategies to streamline their compliance processes and enhance customer trust. The industry is witnessing a dynamic shift as players seek to address these challenges while also fostering a culture of transparency and accountability.

Within this intricate ecosystem, Bitcoin banks in various regions are faced with unique compliance challenges that demand tailored solutions. For instance, in Gambia, regulatory frameworks may differ from those in Eswatini, necessitating a nuanced approach to ensure compliance without stifling innovation. Understanding and adapting to these localized regulatory environments is crucial for Bitcoin banks to thrive in the ever-changing landscape of financial services. The industry’s resilience and capacity for innovation will play a pivotal role in shaping its trajectory amidst regulatory pressures.

Innovation and Adaptation Strategies in the Industry 🚀

🚀 In the rapidly evolving landscape of Bitcoin banking services, industry players are constantly striving to innovate and adapt to meet the challenges posed by regulations. One key strategy that has emerged is the development of technological solutions that enhance compliance and security measures while also improving user experience. By leveraging cutting-edge blockchain technology and data analytics, Bitcoin banks are not only ensuring regulatory adherence but also exploring new ways to streamline operations and provide more seamless services to their customers. These innovation and adaptation efforts are crucial in staying ahead in a highly competitive and dynamic market environment.

Amidst regulatory pressures, Bitcoin banking services are also focusing on creating strategic partnerships with traditional financial institutions to strengthen their position and broaden their reach. This collaborative approach not only facilitates knowledge-sharing but also opens up new avenues for growth and diversification. By embracing change and proactively addressing regulatory requirements, the industry is poised to navigate the complexities of the financial landscape and emerge stronger and more resilient in the face of evolving regulations and market trends.

Customer Perspectives on Regulated Bitcoin Services 💰

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Curabitur gravida purus non sapien finibus varius. Ut eu sapien quis tellus interdum gravida. In Customer Perspectives on Regulated Bitcoin Services 💰, individuals are increasingly seeking secure and compliant options for managing their digital assets. The transparency and accountability offered by regulated bitcoin banking services are gaining traction among customers, providing a sense of confidence and reliability in the evolving landscape of cryptocurrency regulations.

As the industry continues to mature, customer expectations are shifting towards a more regulated and trustworthy environment, reflecting a broader trend towards mainstream acceptance of digital currencies. To learn more about the impact of bitcoin banking services regulations in Gambia, check out this insightful article on bitcoin banking services regulations in Gambia.

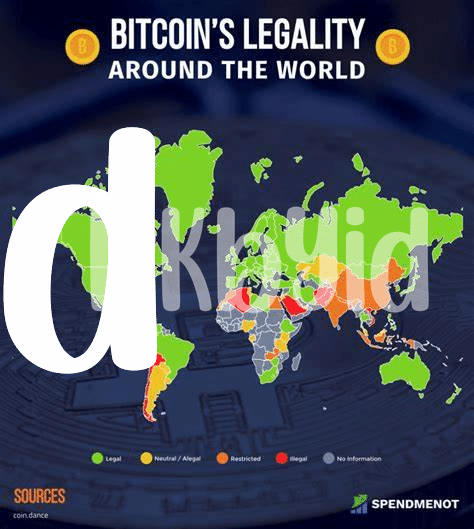

Global Regulatory Trends and Their Implications 🌍

In today’s rapidly evolving financial landscape, global regulatory trends play a pivotal role in shaping the future of Bitcoin banking services. The ever-changing regulatory environment presents both challenges and opportunities for industry players worldwide. From enhanced security measures to increased transparency requirements, these trends have significant implications for how Bitcoin banks operate and serve their customers. It is crucial for stakeholders to stay abreast of these regulatory developments and strategically adapt to ensure compliance and sustainable growth in the dynamic digital currency space.

Future Outlook for Bitcoin Banking under Regulations 🔮

Bitcoin banking services are set to navigate a dynamic landscape under evolving regulatory frameworks. The future outlook for the industry suggests a blend of adaptation and innovative solutions to meet compliance standards while fostering growth. As global regulatory trends continue to shape the ecosystem, Bitcoin banks are poised to redefine their operations to cater to changing requirements and enhance customer trust and security.

To delve deeper into the impact of regulations in the Bitcoin banking sector, explore the specific regulations governing Bitcoin banking services in Eswatini through the link bitcoin banking services regulations in Ethiopia. By understanding the regulatory nuances in different regions, stakeholders can better anticipate challenges and opportunities in the domain.