Introduction to Bitcoin Regulations in Fiji 🌴

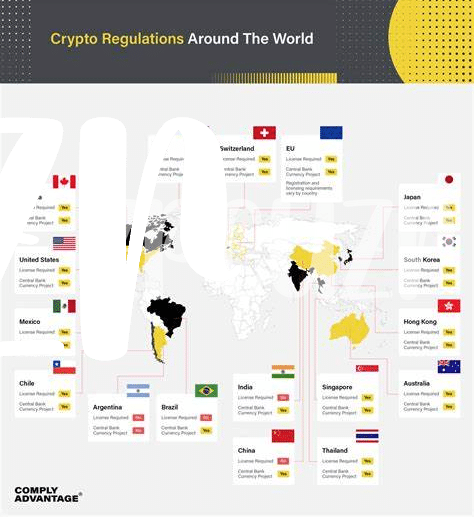

Fiji has recently implemented regulations around the use of Bitcoin, aiming to provide clarity and guidelines for individuals and businesses navigating the cryptocurrency landscape. These regulations encompass areas such as licensing requirements, tax implications, and compliance measures to ensure a secure and transparent environment for digital transactions within the country’s banking sector.

Banks Adapting to New Compliance Measures 🏦

Banks in Fiji are navigating the shifting landscape of compliance requirements with agility and innovation. Adapting to new measures involves a delicate balance between adhering to regulatory standards and enhancing customer experience. Keeping pace with evolving regulations while ensuring operational efficiency is imperative for financial institutions seeking to maintain trust and compliance in the dynamic realm of Bitcoin transactions.

Impact of Regulations on Customer Transactions 💸

Bitcoin regulations in Fiji have brought about notable changes in how banks process customer transactions. These regulations aim to enhance transparency and accountability in financial activities, ensuring that money flows are monitored effectively. As a result, customers may experience smoother transactions with added layers of protection and verification in place, contributing to a more secure and trustworthy banking environment. This shift reflects a growing emphasis on regulatory compliance to safeguard both financial institutions and their clientele in the rapidly evolving landscape of digital currency.

Challenges in Implementing Anti-money Laundering Protocols 🕵️♂️

Challenges in implementing anti-money laundering protocols can pose significant hurdles for banks in Fiji. Ensuring compliance with these regulations requires robust systems to detect and prevent illicit financial activities within the cryptocurrency space. Banks must invest in advanced technology and expertise to effectively monitor transactions and identify potential red flags. Additionally, educating staff members on the latest money laundering trends and techniques is crucial for staying ahead of evolving threats. Striking a balance between regulatory requirements and operational efficiency remains a key challenge for financial institutions in Fiji, highlighting the ongoing need for proactive measures in combating financial crime.

Please insert the link: bitcoin banking services regulations in Estonia

Importance of Cybersecurity in the Digital Age 🔒

In the rapidly evolving digital landscape, cybersecurity plays a pivotal role in safeguarding sensitive information and maintaining trust in financial institutions. With the surge in digital transactions and online banking services, ensuring robust cybersecurity measures is more critical than ever. Protecting customer data from cyber threats not only strengthens the resilience of banks but also enhances overall consumer confidence in utilizing digital financial services. As technology continues to advance, prioritizing cybersecurity measures is essential to mitigate potential risks and safeguard against increasingly sophisticated cyber threats.

Future Outlook for Bitcoin Regulations in Fiji 🚀

Among the potential future scenarios for Bitcoin regulations in Fiji, there is anticipation of increased collaboration between the government and financial institutions to enhance oversight and ensure compliance. This could lead to the development of more comprehensive guidelines tailored to the unique challenges of the Fijian market, fostering a safer and more regulated environment for cryptocurrency transactions. As the regulatory landscape continues to evolve, proactive adaptation and engagement will be key for all stakeholders involved.

insert a link to bitcoin banking services regulations in equatorial guinea with anchor bitcoin banking services regulations in el salvador using the