Bitcoin’s 🌍 Impact on Burkina Faso’s Economy

Bitcoin’s introduction in Burkina Faso has sparked notable changes in the country’s economic landscape. With its decentralized nature, Bitcoin offers opportunities for individuals to engage in global transactions, bypassing traditional banking systems. This shift has the potential to reshape how financial transactions are conducted in Burkina Faso, opening doors to new possibilities for economic empowerment and financial inclusion. As more people explore the benefits of Bitcoin, its impact on Burkina Faso’s economy is expected to continue evolving, potentially leading to a more integrated and dynamic financial ecosystem.

Adoption 💼 of Bitcoin in Burkina Faso

Bitcoin has been gradually gaining traction in Burkina Faso, with a growing number of individuals and businesses exploring its potential benefits. The adoption of Bitcoin in the country is opening up new avenues for financial transactions, providing alternative means for people to engage with the global economy. As more Burkinabés embrace digital currencies, there is a shift towards a more inclusive and accessible financial landscape. This adoption not only signifies a changing financial ecosystem but also presents opportunities for individuals to participate in the digital economy on a broader scale.

Challenges 🛑 and Opportunities for Economic Growth

In navigating the path of economic growth in Burkina Faso, there are both obstacles and opportunities that come into play. Challenges like limited access to technology and infrastructure pose hurdles, while the potential for increased financial inclusion and innovation through embracing cryptocurrencies present exciting prospects for the country’s economy to flourish and evolve. It is essential for Burkina Faso to leverage these opportunities while addressing the challenges to pave the way for sustainable growth and development.

Financial 💰 Inclusion through Cryptocurrencies

Financial inclusion is a crucial aspect of leveraging cryptocurrencies like Bitcoin in Burkina Faso. By harnessing the power of digital currencies, individuals without access to traditional banking services can now participate in the financial ecosystem. This not only empowers the unbanked population but also fosters economic growth by enabling smoother transactions and increased investment opportunities. Embracing cryptocurrencies paves the way for a more inclusive financial landscape in Burkina Faso, bridging the gap for those marginalized from traditional banking systems.

For further insights into navigating regulatory changes in the Bitcoin sector and understanding the implications for banking services, check out the informative article on bitcoin banking services regulations in Burundi at Wikicrypto News.

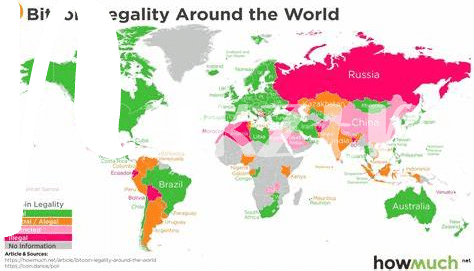

Regulatory 📝 Considerations in Burkina Faso

When exploring the regulatory landscape in Burkina Faso concerning cryptocurrencies, it becomes evident that clear guidelines and frameworks are crucial for the sustainable integration of Bitcoin and other digital assets into the economy. The government’s approach to regulating cryptocurrency activities will significantly impact the level of investment, consumer protection, and overall growth potential within the sector. Collaboration between regulatory authorities, financial institutions, and industry stakeholders is essential to strike a balance between fostering innovation and ensuring compliance with existing laws.

Future 🚀 Prospects and Potential Benefits

Bitcoin and its potential impact in Burkina Faso holds promising prospects for the future economic landscape. As digital currencies continue to gain traction globally, the adoption of Bitcoin in Burkina Faso presents opportunities for financial inclusivity and economic empowerment. With the challenges and regulatory considerations in mind, the future outlook for incorporating cryptocurrencies into the economy offers a pathway towards increased financial accessibility and innovation. The potential benefits of embracing Bitcoin in Burkina Faso extend beyond borders, showcasing a dynamic shift towards a more connected and inclusive financial ecosystem.

Bitcoin Banking Services Regulations in Central African Republic