Current Bitcoin Regulations in Brunei 🇧🇳

Brunei is navigating the intricate landscape of Bitcoin regulations. The country is carefully examining how to balance innovation with prudential oversight in the realm of digital currency. As the global discussion around cryptocurrencies continues to evolve, Brunei’s current regulations are being closely scrutinized for their effectiveness and adaptability in shaping the future of Bitcoin banking within its borders. This time of regulatory assessment presents both challenges and opportunities for stakeholders at the intersection of finance and technology.

It is imperative for Brunei to consider the dynamic nature of the cryptocurrency market and the potential risks and benefits associated with Bitcoin transactions. By fostering a regulatory environment that promotes innovation while safeguarding consumers, Brunei can position itself as a forward-thinking player in the evolving landscape of digital finance.

Impact of New Regulations on Bitcoin Users 💼

Bitcoin users in Brunei are at the cusp of significant changes with the introduction of new regulations. The evolving landscape could bring about both challenges and opportunities for individuals engaging with cryptocurrencies. As the regulatory environment matures, users must adapt to safeguard their investments and navigate the shifting dynamics of the digital asset space. It is essential for users to stay informed and proactive in response to these changes to ensure a secure and sustainable future in the realm of Bitcoin banking.

Possible Challenges Faced by Bitcoin Banks 🏦

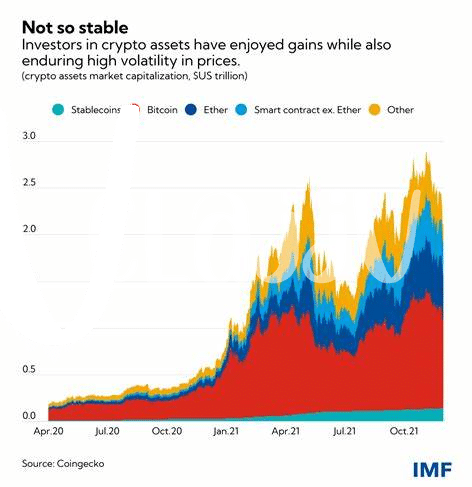

Bitcoin banks in Brunei face various challenges as the industry evolves. These challenges may include navigating complex regulatory frameworks, ensuring cybersecurity measures are robust, and managing customer expectations amidst market volatility. Additionally, establishing trust and credibility in a relatively new sector can be a hurdle for Bitcoin banks seeking to build a strong reputation and attract a broader customer base.

Opportunities for Growth in the Bitcoin Industry 💹

In the expanding Bitcoin industry, numerous opportunities for growth are emerging, fueling excitement and innovation. As more individuals and businesses embrace digital currencies, the potential for new products and services continues to flourish. This dynamic landscape not only attracts investors seeking lucrative prospects but also spurs technological advancements that could reshape the future of finance. For further insights on the challenges and opportunities in Bitcoin banking regulations, refer to [bitcoin banking services regulations in bulgaria](https://wikicrypto.news/challenges-and-opportunities-bitcoin-banking-in-bolivia).

International Comparisons of Bitcoin Banking Regulations 🌍

International Comparisons of Bitcoin Banking Regulations involve examining how different countries approach regulating digital currency transactions. By looking at how countries like the US, Japan, and the UK handle Bitcoin regulations, we can gain insights into potential strategies Brunei might adopt. Understanding the varying approaches and their impacts can help policymakers make informed decisions on shaping the future landscape of Bitcoin banking in Brunei.

Recommendations for Adapting to Future Bitcoin Regulations 🔮

When it comes to adapting to future Bitcoin regulations, it is crucial for stakeholders in Brunei to stay informed and updated on any upcoming changes. One key recommendation is for Bitcoin banks to enhance their compliance measures and transparency to ensure they are in line with regulatory requirements. Additionally, fostering open communication channels with relevant authorities can help in navigating any potential challenges that may arise. Embracing technological advancements and investing in robust security protocols will be essential for Bitcoin banks to thrive in a rapidly evolving regulatory landscape.

To stay ahead in the realm of Bitcoin banking regulations, continuous monitoring of industry developments and engaging in proactive dialogue with regulators will be vital for ensuring compliance and fostering a sustainable growth environment. Moreover, collaborating with other stakeholders in the industry to share best practices and insights can play a significant role in shaping the future of Bitcoin banking regulations in Brunei. By staying agile, adaptive, and collaborative, Bitcoin banks can position themselves to seize emerging opportunities and navigate potential challenges effectively.