The Rise of Bitcoin in Bosnia 🌍

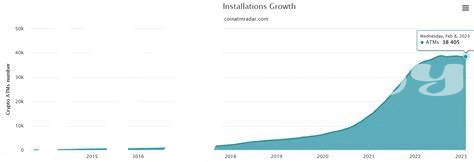

In recent years, Bosnia has witnessed a significant surge in the adoption of Bitcoin among its populace. This digital currency, once a mysterious concept, has now found a growing number of users in the country, eager to explore its potential and benefits. The rise of Bitcoin in Bosnia symbolizes a shift towards embracing technological advancements and decentralized financial solutions, reflecting a global trend towards digital currencies as a viable alternative to traditional banking systems. As more individuals and businesses in Bosnia begin to engage with Bitcoin, its impact on the local economy and financial landscape is becoming increasingly pronounced.

Regulatory Challenges Facing Bitcoin 💼

Bitcoin faces several hurdles in Bosnia due to regulatory challenges, posing significant obstacles for its widespread adoption. The ambiguous legal framework surrounding cryptocurrencies creates uncertainty for both users and financial institutions, inhibiting the seamless integration of Bitcoin into the traditional banking system. These challenges highlight the pressing need for clear regulations that safeguard against potential risks without stifling innovation in the burgeoning digital currency space. By addressing these regulatory issues, Bosnia can potentially unlock the full potential of Bitcoin as a transformative financial tool.

Impact of Legal Uncertainty on Banking 🏦

Navigating through the legal ambiguity surrounding Bitcoin in Bosnia has led to significant challenges for traditional banking institutions in the region. The fluctuating regulatory environment has created uncertainty, impacting how banks interact with customers engaging in Bitcoin transactions. This uncertainty has prompted a shift in how banking services are approached and has highlighted the need for innovative solutions to ensure compliance while adapting to the evolving landscape.

Innovations in Bitcoin Banking Solutions 💡

Bitcoin banking in Bosnia has seen a wave of innovations in its solutions as the financial landscape adapts to digital currencies. From enhanced security protocols to streamlined transaction processes, these advancements are reshaping how individuals and businesses engage with Bitcoin. One notable development is the introduction of user-friendly mobile applications that empower users to manage their digital assets with ease. Moreover, blockchain technology is revolutionizing the transparency and efficiency of banking operations, offering a glimpse into the future of financial services.

To learn more about the evolving regulations and opportunities in the global Bitcoin banking sector, explore the insights on bitcoin banking services regulations in Cameroon at bitcoin banking services regulations in Cameroon.

Future Outlook for Bitcoin Banking 🚀

The dynamic landscape of Bitcoin banking presents exciting possibilities for the future. As technology continues to evolve, so too do the opportunities for innovative financial solutions in the realm of digital currencies. The coming years are likely to witness a surge in alternative banking methods, offering greater accessibility and efficiency for users. As regulations adapt and industry best practices emerge, the future outlook for Bitcoin banking appears promising, paving the way for a more inclusive and streamlined financial ecosystem.

Navigating Legal Compliance as a Bitcoin User 🛂

Navigating legal compliance as a Bitcoin user involves staying updated on the evolving regulatory landscape and ensuring adherence to established guidelines. Understanding the legal framework surrounding Bitcoin transactions is crucial to avoid potential pitfalls and ensure a smooth banking experience. By familiarizing oneself with the regulations governing Bitcoin activities, users can mitigate compliance risks and operate within the boundaries set by authorities. It is essential to proactively engage with regulatory requirements to safeguard financial operations and uphold the integrity of the Bitcoin ecosystem. For more information on bitcoin banking services regulations in Brunei, refer to the official guidelines on bitcoin banking services regulations in Bulgaria.