Growing Concerns Surrounding Money Laundering Activities 💰

In recent years, the financial world has been plagued by an increasing number of suspicious activities related to the illegal transfer of funds. These growing concerns surrounding money laundering activities have caught the attention of regulatory authorities and financial institutions globally. The sophistication and stealth with which money launderers operate pose a significant threat to the integrity of the financial system, prompting a collective effort to enhance enforcement measures and tackle this pervasive issue head-on.

Regulatory Framework for Combating Financial Crimes 🛡️

The regulatory framework in Switzerland has been meticulously designed to address the growing concerns surrounding financial crimes. With a strong emphasis on combating money laundering activities, authorities have established stringent guidelines and protocols to ensure transparency and accountability in the financial sector. The measures implemented serve as a shield against illicit activities, promoting a secure environment for investors and stakeholders alike. Through continuous monitoring and enforcement, the regulatory framework plays a pivotal role in safeguarding the integrity of the Swiss financial system.

The Rise of Bitcoin in Swiss Financial Markets 📈

The adoption of Bitcoin in Swiss financial markets has seen a notable uptick in recent years. With its decentralized nature and potential for high returns, Bitcoin has attracted a growing number of investors and businesses in Switzerland. This surge in interest has led to a proliferation of Bitcoin-related services, including exchanges, wallets, and payment processors, transforming the Swiss financial landscape. The increasing acceptance of Bitcoin as a legitimate asset class has prompted discussions among regulators and industry players on the implications and potential risks associated with its widespread use in the country.

Challenges Faced by Authorities in Enforcement 🤔

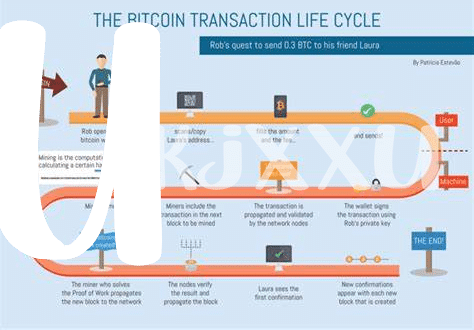

Authorities in Switzerland face a myriad of challenges when it comes to enforcing money laundering laws in the Bitcoin market. One significant obstacle is the decentralized nature of cryptocurrencies, making it harder to track illicit activities. Additionally, the anonymity provided by Bitcoin transactions poses a challenge in identifying and prosecuting money launderers. Moreover, the rapid evolution of technology necessitates constant adaptation of enforcement strategies to keep pace with emerging trends in financial crimes. Addressing these obstacles requires a concerted effort from regulatory bodies and law enforcement agencies to stay ahead in the fight against money laundering in the digital realm.

Insert link: legal consequences of bitcoin transactions in uruguay

Impact of Money Laundering Laws on Bitcoin Adoption 💼

Money laundering laws play a pivotal role in shaping the landscape of Bitcoin adoption in the Swiss financial markets. These regulations serve as a double-edged sword, offering a sense of security and legitimacy to potential investors while also imposing stringent compliance measures on the cryptocurrency industry. The impact of such laws extends beyond mere enforcement, influencing the overall perception and acceptance of Bitcoin within the traditional financial system. As Switzerland continues to navigate the intersection of digital currencies and anti-money laundering regulations, the evolution of these dynamics will undoubtedly shape the future trajectory of financial crimes in the country.

Future Outlook for Combating Financial Crimes in Switzerland 🔍

Switzerland is poised to strengthen its efforts in combating financial crimes with a forward-looking approach. The ongoing advancements in technology and regulatory frameworks are expected to enhance the country’s ability to detect and prevent money laundering activities effectively. By prioritizing collaboration between authorities, financial institutions, and technology experts, Switzerland aims to stay ahead in the fight against financial crimes, ensuring a secure and transparent financial environment for both traditional and emerging markets alike. For more information on the legal consequences of Bitcoin transactions in the United Kingdom, visit here.