Afghan 🏛️ Laws for Bitcoin Banking Compliance.

Afghanistan’s legal framework concerning Bitcoin banking compliance navigates a complex terrain. The evolving landscape requires meticulous adherence to regulations, reflecting the country’s commitment to financial security. Understanding these laws is imperative for entities operating within the Bitcoin banking sphere, ensuring transparency and accountability within the Afghan financial system. As the regulatory environment evolves, stakeholders must remain vigilant and adaptable to meet compliance requirements effectively.

Security 🔒 Measures in Bitcoin Transactions.

When it comes to ensuring the safety and integrity of Bitcoin transactions, various security measures are paramount. Implementing robust encryption techniques, utilizing secure wallets, requiring multi-factor authentication, and regularly monitoring transactions for any suspicious activity are essential steps to safeguarding Bitcoin transactions. Additionally, conducting thorough due diligence on counterparties and staying updated on the latest cybersecurity threats can further enhance the security posture of Bitcoin banking operations.

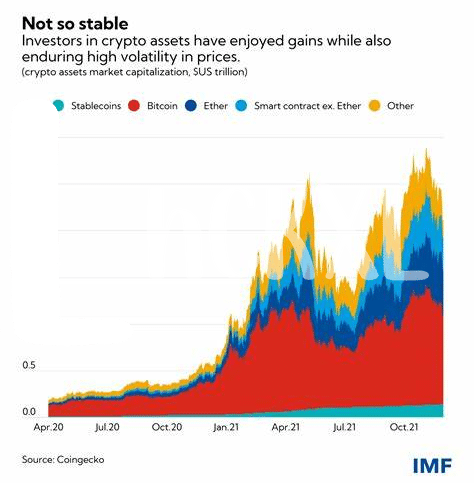

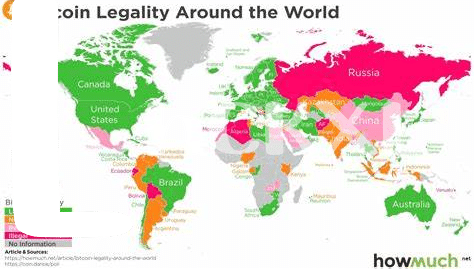

Impacts 🌍 of Global Regulations on Afghan Banking.

The ever-evolving landscape of global regulations significantly impacts the operations and practices of Afghan banking institutions. When it comes to Bitcoin banking in Afghanistan, these external regulations play a crucial role in shaping the compliance requirements, security protocols, and overall viability of financial services offered within the country. As Afghan banks navigate through the complex web of international standards and guidelines, they must constantly adjust their strategies to ensure alignment with the latest regulatory updates and frameworks. These impacts not only influence the day-to-day operations of Bitcoin banking in Afghanistan but also set the tone for future developments and partnerships on a global scale.

Challenges 🧗 Faced by Bitcoin Banks in Afghanistan.

Bitcoin banks in Afghanistan face a myriad of challenges in navigating the complex regulatory landscape. From stringent compliance requirements to the ever-evolving security threats in digital transactions, these institutions are constantly on the lookout for innovative solutions. Moreover, the lack of clear guidance from both local and global regulatory authorities adds another layer of complexity to their operations. Despite these hurdles, Bitcoin banks in Afghanistan are resilient and continue to adapt to ensure the safety and security of their customers’ assets.

To learn more about the legal consequences of bitcoin transactions in Zimbabwe, visit legal consequences of bitcoin transactions in Zimbabwe.

Future 🔮 Outlook for Bitcoin Banking Compliance.

In the realm of Bitcoin banking compliance, the path ahead holds a mixture of opportunities and challenges, paving the way for a dynamic landscape. With evolving regulations and technological advancements, the future outlook for compliance in Afghan Bitcoin banking is poised for transformation. Embracing innovation while maintaining adherence to regulatory frameworks will be key in navigating this dynamic space.

Recommendations 📝 for Navigating Afghan Regulatory Landscape.

To navigate the regulatory landscape in Afghanistan, it is crucial for Bitcoin banks to stay informed and proactive in compliance. Engaging with local authorities, seeking legal counsel, and establishing clear internal policies can help navigate the evolving regulatory environment. Additionally, regular training for staff on compliance protocols and staying updated on industry best practices are essential. Emphasizing transparency and cooperation with regulatory bodies can build trust and credibility, ultimately facilitating smoother operations in the Afghan banking sector.

Insert link to bitcoin banking services regulations in Albania with anchor “legal consequences of bitcoin transactions in Yemen”: legal consequences of bitcoin transactions in Yemen