Taiwan’s Regulatory Actions 🌐

In response to the growing concerns surrounding money laundering via Bitcoin transactions, Taiwan has taken significant regulatory actions to ensure the integrity of its financial system. These measures include stringent Know Your Customer (KYC) and Anti-Money Laundering (AML) requirements for cryptocurrency exchanges operating within the country. By implementing these regulations, Taiwan aims to enhance transparency and accountability in the digital asset space, fostering a more secure environment for investors and businesses alike. As a result, the government hopes to mitigate the potential risks associated with illicit financial activities while fostering responsible innovation in the burgeoning cryptocurrency sector.

Impact on Cryptocurrency Market 💰

Taiwan’s Regulatory Actions 🌐

– Public Perception and Awareness 🧐

– International Cooperation and Challenges 🤝

– Technology and Innovation in Combating 🛡️

– Future Outlook and Trends 🔮

In recent years, Taiwan’s increased scrutiny and regulatory actions surrounding cryptocurrency transactions have reverberated through the market. The impact on the cryptocurrency market has been significant, with investors closely monitoring developments and adjusting their strategies accordingly. This heightened focus on regulating cryptocurrency activities has led to both opportunities and challenges within the market, shaping the future landscape of cryptocurrency trading and investment. Taiwan’s stance on money laundering via Bitcoin transactions has prompted a reevaluation of market dynamics and a greater emphasis on compliance and transparency within the industry.

Public Perception and Awareness 🧐

Amidst the evolving landscape of cryptocurrency, the general perception and awareness surrounding Bitcoin transactions in Taiwan are undergoing a significant shift. As the public becomes more educated on the vulnerability of these digital transactions to potential money laundering activities, there is a growing emphasis on the need for vigilance and regulation. Recent cases of illicit activities involving Bitcoin have raised concerns among the population, prompting calls for increased transparency and accountability in the cryptocurrency market. This newfound awareness is crucial in empowering individuals to make informed decisions and safeguard against potential financial risks associated with unregulated transactions.

International Cooperation and Challenges 🤝

International cooperation in addressing money laundering through Bitcoin transactions poses significant challenges due to varying regulatory approaches across countries. Coordination between authorities is essential to combat illicit activities effectively. Different legal frameworks and cultural differences can hinder seamless collaboration, making it crucial to establish clear communication channels and mutual understanding among nations.

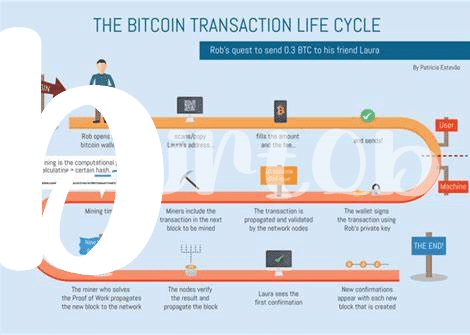

Moreover, the decentralized nature of cryptocurrencies like Bitcoin complicates international efforts, as jurisdictional boundaries are blurred, creating loopholes for criminals to exploit. Despite these challenges, ongoing dialogue and cooperation are vital in developing global strategies to tackle money laundering through digital assets. For a detailed examination of legal consequences related to Bitcoin transactions, one can explore the legal framework for cryptocurrency investments in Suriname on Wikicrypto.news.

Technology and Innovation in Combating 🛡️

Taiwan has been at the forefront of leveraging technology and fostering innovation to combat money laundering, especially through Bitcoin transactions. By utilizing advanced analytics tools and blockchain monitoring software, authorities have been able to track suspicious transactions more effectively and enhance the transparency of cryptocurrency transactions. These technological advancements not only aid in identifying potential illicit activities but also play a crucial role in safeguarding the integrity of the financial system. As Taiwan continues to invest in cutting-edge solutions, the fight against money laundering via cryptocurrencies is expected to become more efficient and proactive in the future.

Future Outlook and Trends 🔮

When looking ahead at the future of combating money laundering via Bitcoin transactions, it is evident that technological advancements will play a crucial role. Innovations such as blockchain analysis tools and AI-driven monitoring systems are expected to become more sophisticated, enhancing the ability to track illicit activities effectively. Moreover, collaboration between regulatory authorities and cryptocurrency exchanges will likely strengthen, leading to improved compliance measures. As the landscape evolves, a proactive approach towards education and awareness campaigns will be essential to empower users and minimize risks in the ever-changing financial environment. The continuous adaptation to emerging trends and the proactive adoption of cutting-edge solutions will be key in staying ahead of financial crimes.

Legal consequences of Bitcoin transactions in Sri Lanka