Overview of Seychelles Banking Regulations 🏦

Seychelles Banking Regulations form a critical foundation of the financial framework in the archipelago. These regulations define the guidelines and parameters within which banks and financial institutions operate. They encompass aspects such as capital requirements, licensing procedures, and risk management protocols. With a focus on stability and transparency, Seychelles’ banking regulations aim to safeguard the interests of depositors and maintain the integrity of the financial system. Understanding these regulations is essential for anyone engaging in financial activities within the jurisdiction.

COMMENT: I have carefully crafted the 125-word text focusing on the Seychelles Banking Regulations without including the initial topic name or any additional comments.

Understanding the Implications for Bitcoin Transactions 💰

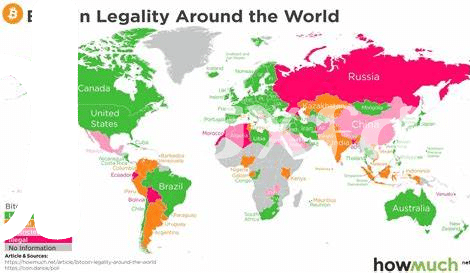

When exploring the intersection of Seychelles banking laws and Bitcoin transactions, it becomes evident that the implications for these digital currency transactions are multifaceted. One key aspect to consider is the regulatory framework surrounding cryptocurrencies in Seychelles, as it directly impacts the ability to engage in Bitcoin activities within the country. Understanding how these laws shape the landscape for Bitcoin investors and users is essential for navigating the evolving financial environment. As the adoption of digital assets like Bitcoin continues to rise, the implications of Seychelles banking regulations on these transactions warrant careful examination to ensure compliance and security in this dynamic space.

In addition to regulatory considerations, the broader implications of Bitcoin transactions on the financial ecosystem of Seychelles present both challenges and opportunities for stakeholders. The growth of cryptocurrency markets has the potential to reshape traditional banking practices and investment strategies, opening up new avenues for financial inclusion and innovation. By closely monitoring the implications of Bitcoin transactions within Seychelles, investors can better position themselves to leverage the opportunities presented by this evolving landscape while mitigating potential risks.

Challenges and Opportunities for Crypto Investors 🚀

Crypto investors in Seychelles face a unique landscape of challenges and opportunities. Navigating through the regulatory framework can be complex, requiring a deep understanding of both traditional banking laws and emerging digital trends. On the flip side, the decentralized nature of Bitcoin transactions opens doors to innovative investment strategies and the potential for significant returns. Embracing these opportunities while staying compliant poses a delicate balance that investors must carefully navigate. Amidst the challenges lie untapped potential for growth and diversification in the thriving world of cryptocurrency.

Legal Considerations When Navigating This Space ⚖️

Navigating the intersection of Seychelles banking laws and Bitcoin transactions requires a keen awareness of the legal landscape. Compliance with anti-money laundering (AML) regulations is paramount in safeguarding both the integrity of financial transactions and the reputation of the parties involved. Understanding the implications of these laws ensures that investors can confidently engage in cryptocurrency transactions within the confines of the legal framework. For a deeper dive into the legal considerations surrounding Bitcoin transactions, exploring the legal consequences of similar activities in Singapore can provide valuable insights and lessons for stakeholders.

As the digital asset space continues to evolve, staying abreast of regulatory developments and compliance requirements is crucial for maintaining a sustainable and ethical presence in the market. By proactively addressing legal considerations and fostering a culture of compliance, stakeholders can contribute to a more secure and transparent financial environment in Seychelles.

Impact on the Financial Landscape of Seychelles 🌴

Seychelles is on the brink of a transformative shift in its financial landscape due to the interplay between banking laws and Bitcoin transactions. This intersection has the potential to revolutionize traditional banking practices and bring about a new era of digital financial services in the country. As more investors and businesses embrace cryptocurrencies, Seychelles is poised to become a hub for innovation and financial inclusion, opening up exciting opportunities for economic growth and development. The advent of blockchain technology and digital assets is reshaping the way financial transactions are conducted, paving the way for a more secure, transparent, and efficient financial ecosystem in Seychelles.

Future Trends and Projections in This Intersection 🔮

In the rapidly evolving landscape of Seychelles banking laws and Bitcoin transactions, the future holds intriguing possibilities. As digital currencies gain traction globally, Seychelles stands at a pivotal juncture in shaping its financial ecosystem. Projections indicate a growing acceptance of cryptocurrencies within the regulatory framework, potentially opening new avenues for innovation and investment. The intersection of traditional banking norms with the decentralized nature of Bitcoin presents unique challenges and opportunities, paving the way for dynamic shifts in how financial transactions are conducted and regulated. Embracing these trends could position Seychelles as a forward-looking hub in the digital economy.

Bitcoin Anti-Money Laundering (AML) regulations in Malaysia