Legal Landscape 🏛️

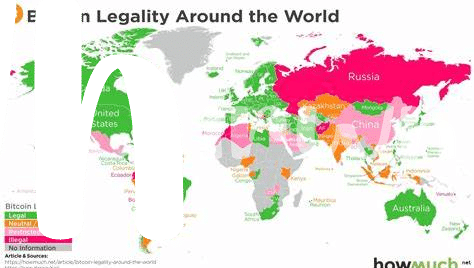

The legal landscape surrounding Bitcoin payments in Nigeria is a dynamic and evolving terrain. As the digital currency gains traction in the country, businesses accepting Bitcoin must navigate a complex framework of regulations and guidelines. Understanding the legal implications is crucial to ensure compliance and mitigate potential risks. Legal considerations encompass areas such as contract law, anti-money laundering regulations, and data protection laws. It is essential for businesses to stay abreast of any developments in legislation that may impact their operations in the realm of cryptocurrency payments.

Tax Implications 💰

Businesses embracing Bitcoin payments in Nigeria will find themselves navigating the intricate web of tax implications that come with this innovative payment method. The dynamic nature of cryptocurrencies poses challenges for tax authorities in determining the appropriate tax treatment for transactions. Understanding how profits, losses, and transactions involving Bitcoin are taxed is crucial to ensure compliance with Nigerian tax laws. Moreover, businesses must stay abreast of any regulatory updates to adapt their tax strategies accordingly. By proactively addressing tax implications, businesses can mitigate risks and foster a smoother integration of Bitcoin payments into their operations.

Regulatory Compliance 📝

Ensuring compliance with the regulations set forth by the governing bodies in Nigeria is paramount for businesses accepting Bitcoin payments. From anti-money laundering protocols to data protection laws, businesses must stay up to date with the evolving regulatory landscape. Implementing robust compliance measures not only safeguards the business but also builds trust with customers and stakeholders. By prioritizing regulatory compliance, businesses can navigate the complex legal frameworks and contribute to the growth of the digital economy in Nigeria.

Consumer Protection 🛡️

When it comes to ensuring consumer protection in the realm of accepting Bitcoin payments in Nigeria, businesses must prioritize transparency and accountability. This includes clearly outlining terms and conditions, offering efficient customer support, and safeguarding against potential fraud or misuse of funds. By establishing secure protocols and adhering to regulatory guidelines, businesses can instill confidence in consumers who choose to transact using Bitcoin. Additionally, staying informed about the evolving landscape of digital currencies and implementing best practices will help mitigate risks and build trust with customers. In order to learn more about legal consequences of bitcoin transactions in Nauru, you can visit here.

Security Measures 🔒

When considering accepting Bitcoin payments, businesses in Nigeria must prioritize implementing robust security measures to safeguard against potential cyber threats and fraud. This includes using encryption protocols, secure wallets, multi-signature authentication, and regularly updating software to address vulnerabilities. Furthermore, educating employees on cybersecurity best practices is crucial to prevent unauthorized access to digital assets and sensitive information. By proactively investing in security measures, businesses can build trust with customers and protect their financial assets from potential risks.

Future Outlook 🔮

In the rapidly evolving landscape of digital payments, the future outlook for businesses accepting Bitcoin in Nigeria holds promise and challenges alike. As technology continues to advance, businesses must stay vigilant in adapting to regulatory changes and ensuring compliance with emerging laws and guidelines. Embracing innovative security measures and prioritizing consumer protection will be key in fostering trust and reliability in Bitcoin transactions.

To explore further on the legal consequences of Bitcoin transactions, you can refer to the regulations in Nepal as well as the implications in Monaco by clicking on legal consequences of bitcoin transactions in Monaco. Keep abreast of developments in this space to navigate the complexities of digital currencies effectively.