Introduction to Bitcoin Transactions and Tax Implications 📊

Bitcoin transactions have gained popularity for their decentralized nature and potential investment value. When it comes to tax implications, understanding how these transactions are treated is essential. As a form of virtual currency, Bitcoin falls under specific tax regulations that vary from country to country. In Cyprus, the application of capital gains tax to Bitcoin transactions brings about unique considerations for individuals involved in this digital asset. Analyzing the tax implications of Bitcoin transactions can help taxpayers navigate this evolving landscape more effectively.

Understanding Capital Gains Tax Regulations in Cyprus 💰

Understanding Capital Gains Tax Regulations in Cyprus involves familiarizing oneself with the guidelines set forth by the country’s tax authorities. This includes determining how gains from the sale or exchange of assets, such as Bitcoin, are treated for tax purposes. Individuals must be aware of any exemptions, thresholds, or specific rules that may apply to their transactions. Being well-informed about these regulations can help taxpayers navigate their obligations accurately and efficiently.

Specifics of Applying Capital Gains Tax to Bitcoin Transactions 🧾

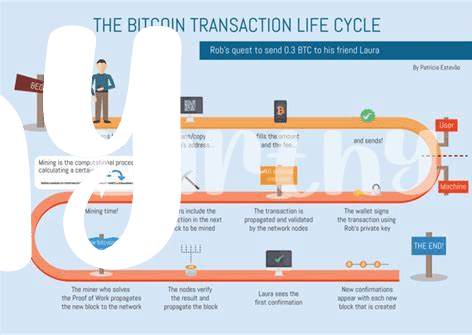

When it comes to the application of capital gains tax to Bitcoin transactions in Cyprus, there are specific factors to consider. The calculation of capital gains tax on Bitcoin involves determining the acquisition cost, the disposal proceeds, and any allowable deductions. Additionally, the length of time Bitcoin was held before being sold or exchanged can impact the tax rate applied. Keeping detailed records of each transaction is crucial for accurate reporting and compliance with tax regulations. Understanding how capital gains tax applies to Bitcoin transactions ensures individuals can fulfill their tax obligations properly while navigating the evolving landscape of cryptocurrency taxation.

Comparing Tax Treatment of Bitcoin to Other Assets 🔄

Bitcoin’s tax treatment differs from traditional assets like stocks or real estate due to its unique characteristics. Unlike physical assets that can be easily valued, Bitcoin’s decentralized nature and market volatility create challenges for tax authorities in determining an accurate valuation for tax purposes. This can lead to uncertainties and potential discrepancies in how Bitcoin gains are taxed compared to other more traditional investments. Understanding these distinctions is crucial for individuals navigating the complexities of taxation in the cryptocurrency space. Seeking expert advice and staying informed on regulatory developments can help optimize tax obligations with Bitcoin while ensuring compliance with relevant laws and guidelines. For further insights on risks associated with unregulated Bitcoin transactions, explore the cryptocurrency exchange licensing requirements in Saint Kitts and Nevis.

Potential Challenges for Individuals Managing Bitcoin Taxes 🤔

Potential challenges individuals may face when managing Bitcoin taxes include tracking transactions accurately, calculating gains or losses amidst price volatility, and staying updated on changing tax laws. Understanding the implications of each transaction is crucial to ensure compliance and avoid potential penalties. Additionally, converting Bitcoin to traditional currency for tax payment purposes can be complex, requiring careful record-keeping to account for every step in the process. Navigating the technical aspects of cryptocurrency taxation alongside existing tax responsibilities adds to the challenge, making it essential for individuals to seek professional advice or utilize specialized tools to streamline the process.

Exploring Strategies to Optimize Tax Obligations with Bitcoin 💡

When it comes to exploring strategies for optimizing tax obligations with Bitcoin in Cyprus, individuals should consider several key approaches. First, keeping detailed records of all transactions is crucial for accurate reporting. Additionally, using tax loss harvesting techniques can help offset gains and minimize overall tax liability. Furthermore, staying informed about any updates or changes in tax regulations related to cryptocurrencies is essential. By employing these proactive strategies, individuals can navigate the complexities of Bitcoin taxation more effectively. For further insights on legal consequences of Bitcoin transactions in different jurisdictions, you can refer to the legal consequences of bitcoin transactions in comoros.