Regulatory Challenges 🌐

Navigating the complex landscape of regulatory challenges in cross-border Bitcoin transfers involves not only understanding international laws but also keeping up with evolving guidelines. Compliance requirements can vary across jurisdictions, adding layers of complexity to cross-border transactions. From issues related to know-your-customer (KYC) policies to anti-money laundering (AML) regulations, businesses engaging in Bitcoin transfers must stay vigilant and adaptable. Ensuring seamless compliance in a dynamic regulatory environment requires robust systems and a proactive approach to risk management. As the regulatory landscape continues to evolve, staying informed and agile is crucial for facilitating secure and compliant cross-border Bitcoin transfers.

Impact on Financial Inclusion 🌍

Cross-border Bitcoin transfers have the potential to enhance financial access and inclusion for individuals in Chad, particularly those underserved by traditional banking systems. By leveraging the power of blockchain technology, these transfers can offer quicker and more cost-effective solutions compared to traditional remittance services. This can enable individuals to participate more actively in the global economy, fostering economic growth and stability within the region. The ability to send and receive funds across borders easily and securely can help bridge the financial gap for many individuals, empowering them to better manage their financial resources and participate in various financial activities.

Technological Solutions and Innovations 💡

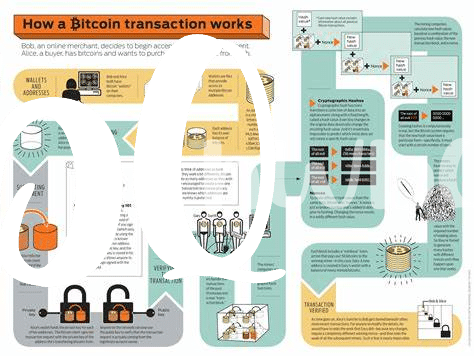

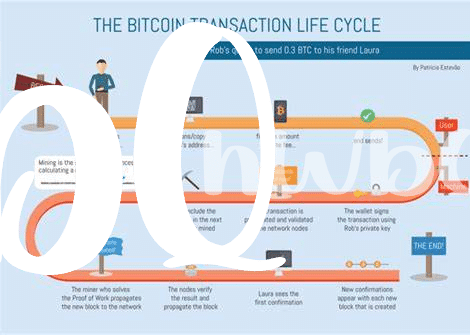

Technological advancements continue to play a vital role in facilitating cross-border Bitcoin transfers. From blockchain technology ensuring secure transactions to innovative digital wallets simplifying the process, these solutions are reshaping the landscape of international financial transactions. Moreover, the integration of artificial intelligence and data analytics is enhancing the efficiency and transparency of cross-border Bitcoin transfers, opening up new possibilities for individuals and businesses alike.

Risks of Non-compliance 🚨

In the rapidly evolving landscape of cross-border Bitcoin transfers, non-compliance poses significant risks to individuals and institutions alike. Failure to adhere to international laws and regulations can lead to severe penalties, legal ramifications, and reputational damage. Non-compliance not only heightens the potential for financial loss but also undermines trust and credibility within the global cryptocurrency community.

To gain a deeper understanding of the legal consequences of Bitcoin transactions, particularly in China, it is crucial to explore the risks and liabilities associated with such operations. Understanding and mitigating these risks is essential for ensuring the security and legitimacy of cross-border Bitcoin transfers. For further insight into this complex issue, you can refer to the legal consequences of Bitcoin transactions in China provided by wikicrypto.news.

Benefits of Cross-border Bitcoin Transfers 💸

Cross-border Bitcoin transfers offer individuals in Chad the opportunity to efficiently move funds across borders, facilitating international commerce and financial transactions. This form of digital currency enables quick and cost-effective transactions, bypassing traditional banking systems. Moreover, it promotes financial inclusivity by providing access to financial services for individuals who may be excluded from traditional banking. The seamless nature of cross-border Bitcoin transfers enhances economic opportunities and fosters global trade, benefiting both senders and recipients.

Future Outlook and Recommendations 🔮

As the landscape of cross-border Bitcoin transfers continues to evolve, it is crucial to keep a close eye on the future. Recommendations for stakeholders in Chad include staying abreast of regulatory updates, fostering collaborations with international partners to enhance compliance efforts, and investing in robust cybersecurity measures. Embracing emerging technologies, such as blockchain analytics tools, can provide valuable insights into transaction monitoring and risk mitigation. Additionally, advocacy for clearer regulatory frameworks and industry standards can help create a more stable and secure environment for cross-border Bitcoin transfers in Chad. Looking ahead, proactive engagement and strategic planning will be key in navigating the ever-changing global landscape of digital assets.

For further insights on the legal consequences of bitcoin transactions in Cambodia, please refer to the legal consequences of bitcoin transactions in Cambodia.