Legal Framework 📜

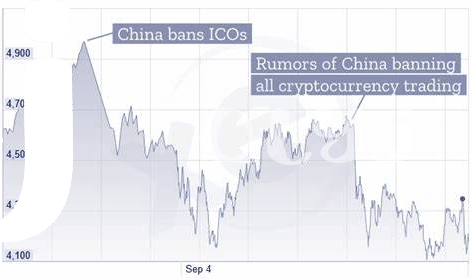

Cryptocurrency laws in China are multifaceted, reflecting the evolving nature of digital assets. From the government’s stance on initial coin offerings to the treatment of virtual currencies under existing regulations, the legal framework surrounding cryptocurrencies remains intricate and ever-changing. Despite the inherent volatility in the market, Chinese authorities have implemented measures to safeguard investors against fraudulent activities and unauthorized access to digital funds. These legal protections aim to foster a secure environment for cryptocurrency transactions within the country.

Bitcoin Theft Cases 🕵️♂️

Bitcoin theft cases have become a growing concern in the cryptocurrency world, stirring fear and uncertainty among investors. Reports of hacks, phishing schemes, and Ponzi schemes have plagued the industry, highlighting the vulnerability of digital assets to malicious actors. High-profile incidents, such as the Mt. Gox exchange collapse, serve as stark reminders of the risks involved in holding and trading Bitcoin. These cases underscore the importance of robust security measures and heightened vigilance in safeguarding digital assets against potential thefts.

Regulatory Measures 🛡️

Cryptocurrency theft in China has prompted regulatory bodies to implement stringent measures to protect Bitcoin investors. The government has enforced strict guidelines and policies to safeguard against fraudulent activities and unauthorized access to digital assets. Regulatory measures include mandatory identity verification processes, monitoring of cryptocurrency exchanges, and the imposition of penalties for non-compliance. These initiatives aim to minimize the risk of theft and enhance the security of cryptocurrency transactions within the country. Additionally, collaboration between regulatory authorities and industry stakeholders is crucial to ensure effective enforcement and continuous improvement of regulatory frameworks.

Investor Awareness 🚨

Maintaining informed and vigilant investors is crucial in the realm of cryptocurrency. Being aware of the potential risks and security measures can greatly aid in preventing theft and fraudulent activities. Educating investors on safe practices, such as utilizing secure wallets and implementing two-factor authentication, is key to safeguarding their digital assets and ensuring a secure investment experience. By promoting awareness on the evolving landscape of cryptocurrency and the various tactics employed by cybercriminals, investors can make more informed decisions and mitigate potential risks effectively. Stay informed and stay safe in the rapidly changing world of digital currencies.

Legal consequences of bitcoin transactions in Cameroon should also be considered to understand the regulatory framework surrounding cryptocurrency transactions in specific regions.

Recourse for Victims 💰

Victims of cryptocurrency theft in China face a challenging road ahead, but there are avenues for recourse. Authorities in China have taken steps to address such incidents, offering legal channels for victims to seek justice and potentially recover lost funds. It is crucial for affected investors to promptly report any thefts to relevant law enforcement agencies and seek assistance from legal professionals well-versed in cryptocurrency regulations. While the process may be complex and time-consuming, pursuing recourse can provide a glimmer of hope in recovering financial losses and holding perpetrators accountable for their actions.

Future Security Enhancements 🔒

There are ongoing efforts within the cryptocurrency space to bolster security measures and enhance protections for investors. New technologies such as advanced encryption methods and decentralized storage solutions are being explored to safeguard against theft and hacking attempts. Collaborations between industry stakeholders and cybersecurity experts aim to stay ahead of evolving threats and provide a more secure environment for cryptocurrency transactions and investments.

To learn more about the legal consequences of bitcoin transactions in Cambodia, visit legal consequences of bitcoin transactions in Central African Republic for insights into the regulatory landscape in these regions.