Legal Status 📜

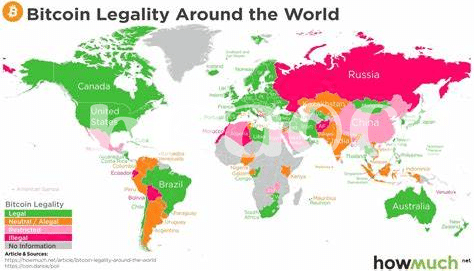

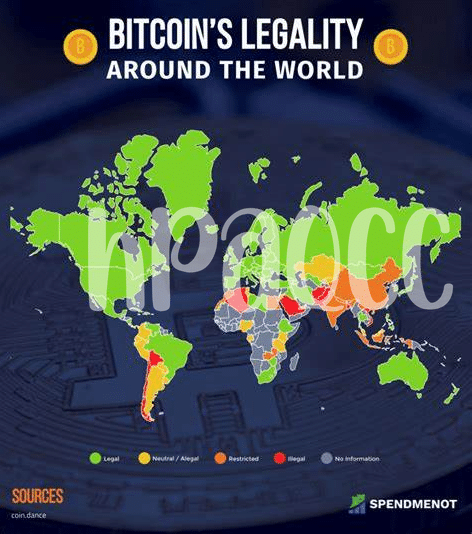

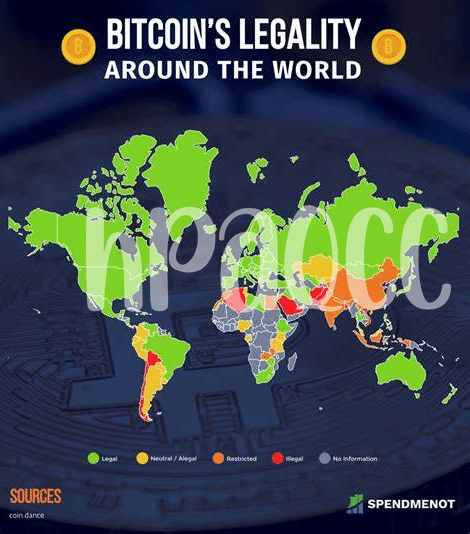

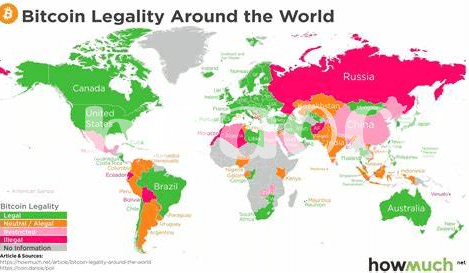

In the realm of Bitcoin transactions within Monaco, the legal landscape portrays a dynamic evolution. The governance surrounding the utilization of cryptocurrencies has garnered significant attention, shaping the contours of financial interactions. Clarity on the legality of such operations establishes foundational pillars for a secure and flourishing digital economy. Understanding the intricate interplay between traditional regulations and emerging technologies becomes pivotal to navigate this domain effectively. As Monaco unfolds its stance on Bitcoin transactions, a narrative of legal legitimacy intertwines with the innovative spirit of monetary decentralization.

Regulatory Framework 🏛️

In Monaco, the regulatory framework surrounding Bitcoin transactions plays a vital role in shaping the landscape for digital assets. The laws and guidelines set by authorities help ensure transparency and security within the cryptocurrency market. Understanding these regulations is essential for individuals and businesses engaging in Bitcoin transactions to operate within the legal boundaries.

Moreover, compliance requirements in Monaco aim to safeguard investors and prevent illicit activities such as money laundering and fraud. By adhering to these regulations, participants in the cryptocurrency space contribute to the overall integrity and stability of the market. Staying informed about the regulatory framework and compliance obligations is key to navigating the evolving landscape of Bitcoin transactions in Monaco.

Compliance Requirements 🧾

Compliance requirements in Monaco for Bitcoin transactions are designed to ensure adherence to anti-money laundering and know-your-customer protocols. Individuals and businesses engaged in cryptocurrency activities must register with the relevant authorities, maintain detailed transaction records, and follow due diligence processes when dealing with clients. These requirements serve to promote transparency, protect against illicit financial activities, and uphold the integrity of the financial system. Adhering to these compliance measures not only safeguards the reputation of participants in the cryptocurrency market but also contributes to the overall legitimacy and acceptance of digital assets within the regulatory landscape.

Tax Implications 💸

While cryptocurrency transactions like Bitcoin offer a sense of anonymity, the tax implications in Monaco play a crucial role for individuals and businesses. Monaco’s tax regulations are known for their leniency, with no personal income tax, capital gains tax, or wealth tax. However, the absence of specific guidelines on cryptocurrency taxation leaves room for interpretation. Depending on how Bitcoin is classified – as a currency, asset, or commodity – the tax treatment can vary significantly. As such, seeking professional advice and keeping detailed records of transactions are vital to ensure compliance with Monaco’s evolving tax landscape.

To delve deeper into the legal aspects of Bitcoin payments, check out this intriguing article on is bitcoin legal in montenegro?.

Enforcement Measures ⚖️

Bitcoin transactions in Monaco are subject to specific enforcement measures to ensure compliance with regulatory standards. Authorities actively monitor and investigate any potential illicit activities involving the cryptocurrency within the jurisdiction. The enforcement measures aim to deter money laundering, terrorism financing, and other unlawful behaviors associated with digital assets. Penalties for violations can range from fines to legal actions, highlighting the seriousness of maintaining transparency and accountability in Bitcoin transactions. By enforcing these measures, Monaco reinforces its commitment to combat financial crimes and uphold the integrity of its financial system.

Future Outlook 🔮

As the world of cryptocurrency continues to evolve, the future outlook for Bitcoin transactions in Monaco appears promising. With advancements in technology and increasing acceptance of digital assets globally, the potential for further integration of Bitcoin in Monaco’s economy is significant. This could lead to a more streamlined and secure transactional environment for individuals and businesses alike. Embracing innovative financial solutions has the potential to shape Monaco’s position in the digital economy positively. Embracing the opportunities and challenges that lie ahead will be crucial in navigating the future landscape of Bitcoin transactions in Monaco. is bitcoin legal in maldives?