Overview of Cryptocurrency Regulation in Thailand 🇹🇭

Cryptocurrency regulation in Thailand has undergone significant developments in recent years, reflecting the government’s proactive approach to fostering innovation while ensuring consumer protection. The country has set clear guidelines for the operation of cryptocurrency exchanges, aiming to create a secure and transparent ecosystem for digital asset trading. With a focus on combating money laundering and terrorist financing, the regulatory framework emphasizes the importance of compliance with international standards.

Thailand’s regulatory landscape for cryptocurrencies is characterized by a balance between fostering industry growth and safeguarding against potential risks. The authorities have been proactive in engaging with industry stakeholders to develop a comprehensive regulatory framework that promotes innovation while maintaining financial stability. By creating a clear roadmap for compliance and enforcement, Thailand aims to position itself as a hub for blockchain and digital asset businesses in the region.

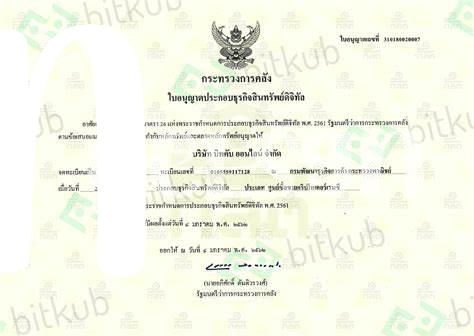

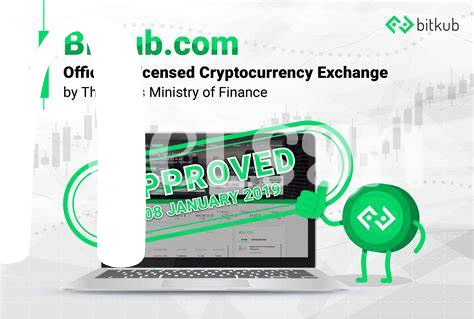

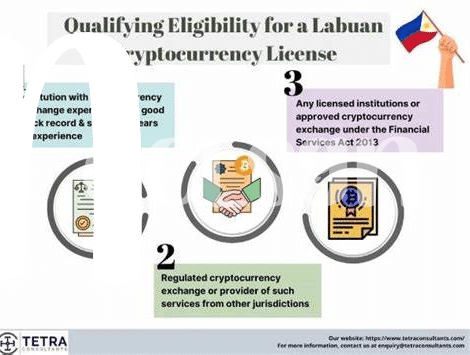

Licensing Requirements for Cryptocurrency Exchanges 📝

In order to establish and operate a cryptocurrency exchange in Thailand, entities must adhere to stringent licensing requirements set forth by the regulatory authorities. These requirements typically encompass financial stability checks, anti-money laundering (AML) procedures, customer identity verification, and cybersecurity protocols. Additionally, applicants are often expected to demonstrate technical proficiency in managing a digital asset platform, as well as compliance with strict reporting and auditing standards. By satisfying these criteria, cryptocurrency exchanges can not only ensure their legal operation within the Thai market but also foster trust among investors and users, ultimately contributing to the growth and stability of the digital asset ecosystem in the region.

Compliance Measures to Ensure Regulatory Adherence 💼

To ensure compliance with regulatory requirements, cryptocurrency exchanges in Thailand implement robust measures such as regular audits, KYC (Know Your Customer) procedures, and AML (Anti-Money Laundering) protocols. Additionally, they engage legal counsel to stay informed about evolving regulations and conduct internal training programs for staff members. Emphasizing transparency and accountability, these compliance measures not only safeguard the integrity of the exchange operations but also foster trust among regulators and users. By proactively addressing compliance obligations, cryptocurrency exchanges in Thailand demonstrate their commitment to operating ethically and in accordance with the law, contributing to a more secure and stable trading environment.

Impact of Regulatory Compliance on Market Participants 💹

The impact of regulatory compliance on market participants in Thailand’s cryptocurrency exchange sector is profound. Adhering to licensing rules and regulations not only ensures legal operation but also instills trust among investors. Market participants benefit from a more stable and transparent environment, leading to increased confidence in the market. By following compliance measures diligently, exchanges can attract more users and facilitate smoother transactions. This symbiotic relationship between regulatory compliance and market participants ultimately contributes to the growth and sustainability of the cryptocurrency ecosystem in Thailand.

insert a link to cryptocurrency exchange licensing requirements in Syria

Addressing Challenges in Obtaining Licensing 🛑

Addressing Challenges in Obtaining Licensing can be a complex process for cryptocurrency exchanges in Thailand. Navigating the regulatory landscape to meet compliance requirements often involves extensive paperwork, thorough background checks, and demonstrating robust security measures. Additionally, adapting to evolving regulations and staying updated on changes can pose a significant challenge for exchange operators. Moreover, the competitive nature of the cryptocurrency industry adds another layer of complexity, as exchanges strive to differentiate themselves while meeting stringent licensing criteria. Overcoming these challenges requires a strategic approach, proactive engagement with regulatory authorities, and a commitment to maintaining high standards of compliance. By addressing these hurdles head-on, cryptocurrency exchanges can position themselves for long-term success in the Thai market.

Future Trends and Developments in Thai Regulations 🚀

In the realm of cryptocurrency regulation in Thailand, we anticipate a wave of progressive trends and developments that promise to shape the landscape of digital asset exchanges. As the authorities continue to refine their approach, we foresee a greater emphasis on fostering innovation while safeguarding investor protection. The regulatory framework is likely to evolve to accommodate emerging technologies and market dynamics, creating a more conducive environment for crypto businesses to thrive. Additionally, collaborations with international counterparts and industry stakeholders may pave the way for enhanced regulatory coherence and global best practices. These advancements signify a pivotal moment for Thailand’s position in the global crypto economy and underscore the country’s commitment to fostering a secure and vibrant digital asset ecosystem.

Insert link to cryptocurrency exchange licensing requirements in Sweden with anchor “cryptocurrency exchange licensing requirements in Tajikistan” here: cryptocurrency exchange licensing requirements in Tajikistan