Current Legal Status of Bitcoin 📜

Bitcoin’s legal standing in Madagascar is currently a topic of interest and speculation among stakeholders. With no specific regulations in place, Bitcoin operates in a gray area in terms of legality and oversight. This ambiguity poses challenges for both users and authorities, leading to a complex landscape that demands clarity and direction. As the global cryptocurrency market continues to evolve, Madagascar faces the task of navigating the legal implications of Bitcoin within its jurisdiction. Understanding the current legal status is crucial for anyone engaging with or considering investments in Bitcoin in Madagascar.

Regulatory Challenges and Considerations 🕵️♂️

When it comes to the regulatory landscape surrounding Bitcoin in Madagascar, there are several key considerations that stakeholders must navigate. The evolving nature of cryptocurrency poses unique challenges for policymakers, particularly in terms of ensuring consumer protection and preventing illegal activities. Addressing issues related to taxation, money laundering, and investor security requires a delicate balance to foster innovation while upholding regulatory standards.

As the digital currency ecosystem continues to expand globally, Madagascar faces the task of crafting regulatory frameworks that are not only effective but also adaptable to the rapidly changing landscape of digital assets. Collaboration between government agencies, industry players, and experts is crucial to develop policies that support the growth of Bitcoin while safeguarding the interests of all stakeholders.

Impact on Financial Landscape and Investments 💰

The adoption of Bitcoin in Madagascar has significantly impacted the financial landscape and investment opportunities in the country. With the emergence of Bitcoin, individuals and businesses are exploring new avenues for transactions and wealth management, showcasing a shift towards decentralized and digital financial solutions. This innovation has sparked interest among investors, leading to a surge in investments in Bitcoin and other cryptocurrencies, thus reshaping the traditional financial ecosystem and opening up avenues for diversification and growth within the market.

Potential for Future Regulatory Developments 🚀

The evolving landscape of regulatory frameworks surrounding Bitcoin in Madagascar opens doors to potential future developments aimed at enhancing consumer protection, fostering innovation, and ensuring financial stability. As authorities continue to assess the implications of digital currencies, the dynamics of regulating Bitcoin will likely involve a delicate balance between fostering growth in the cryptocurrency market and mitigating potential risks associated with its decentralized nature. Collaborative efforts among policymakers, industry stakeholders, and regulators may pave the way for adaptive regulatory approaches that cater to the unique characteristics of Bitcoin within the Malagasy financial ecosystem. Constant dialogue and proactive regulatory adjustments are crucial in navigating the complexities of this innovative space.

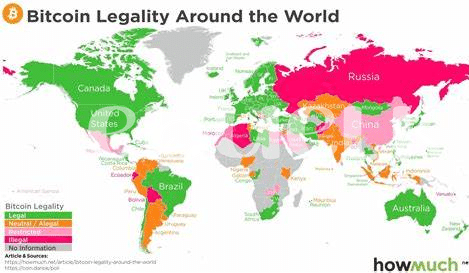

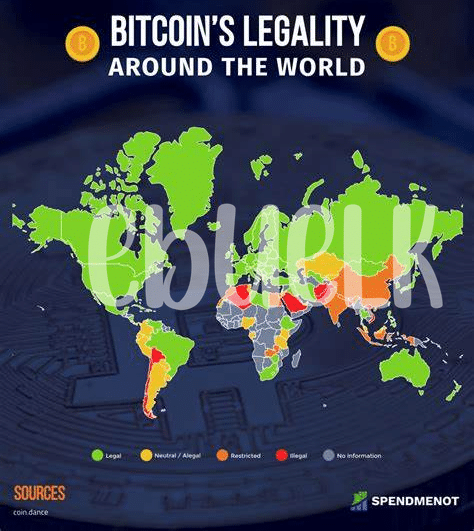

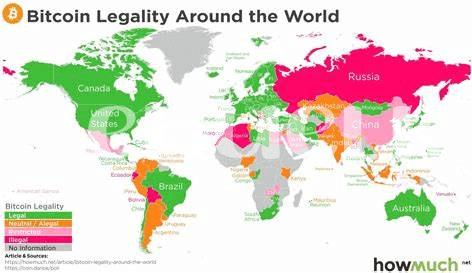

Comparison with Global Bitcoin Regulations 🌍

Bitcoin regulations vary significantly across the globe, showcasing a spectrum of approaches to integrating this innovative digital asset into existing legal frameworks. Different countries have adopted divergent stances towards Bitcoin, ranging from stringent prohibitions to embracing it as a legitimate form of currency. Countries like Japan, for example, have enacted comprehensive regulatory measures to legitimize Bitcoin exchanges, whereas others, such as China, have imposed strict bans on cryptocurrency trading. The regulatory landscape is dynamic and complex, with each nation navigating the intersection between technological innovation, financial stability, and investor protection when formulating their Bitcoin regulations.

In contrast to the varied approaches at a national level, global Bitcoin regulations show a patchwork of policies that reflect an evolving understanding and response to the challenges posed by decentralized digital currencies. International forums and organizations, such as the Financial Action Task Force (FATF), play a crucial role in facilitating cooperation and harmonizing standards to address the borderless nature of cryptocurrencies. While some countries lead the way in setting regulatory precedents, others observe and adapt based on emerging trends and best practices in the global regulatory environment.

Expert Insights and Recommendations for Stakeholders 🤝

Stakeholders in the Bitcoin ecosystem in Madagascar should prioritize education and advocacy efforts to enhance understanding and awareness of the regulatory landscape. Engaging with policymakers and regulatory bodies can help shape favorable frameworks that balance innovation and consumer protection. Moreover, fostering collaboration between industry players, financial institutions, and government entities can lead to comprehensive guidelines that promote responsible adoption of Bitcoin and other digital assets is bitcoin legal in laos?. Implementing robust compliance measures and risk management practices will be crucial for maintaining the integrity and stability of the cryptocurrency market in Madagascar. Additionally, continuously monitoring and adapting to global regulatory trends and best practices can help anticipate and address challenges effectively.