Aml Regulations in Tunisia: 💼

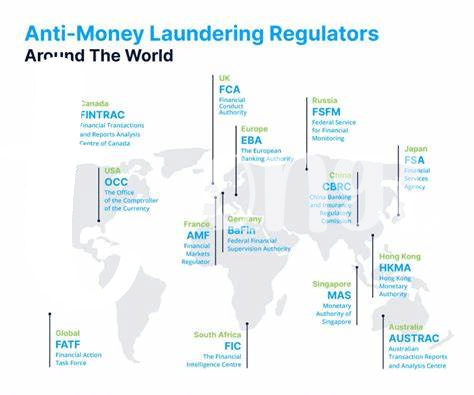

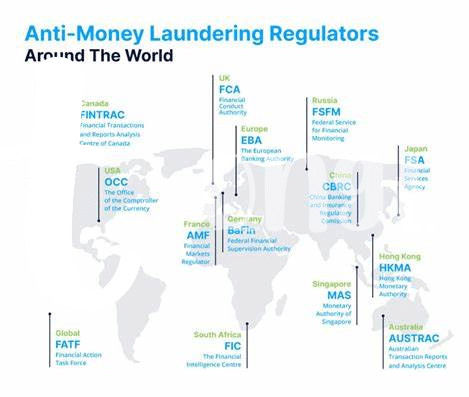

Tunisia upholds a robust framework of Anti-Money Laundering (AML) regulations aimed at safeguarding the financial system and combatting illicit activities. The country has implemented stringent measures to ensure compliance with international standards, demonstrating a commitment to ensuring transparency and accountability.

These regulations provide clear guidelines for financial institutions and businesses operating in Tunisia, outlining their responsibilities in detecting and preventing money laundering and terrorist financing activities. By adhering to these AML regulations, organizations can contribute to the stability and integrity of the financial sector while fostering trust and confidence among stakeholders.

Challenges Faced by Bitcoin Compliance: 🛑

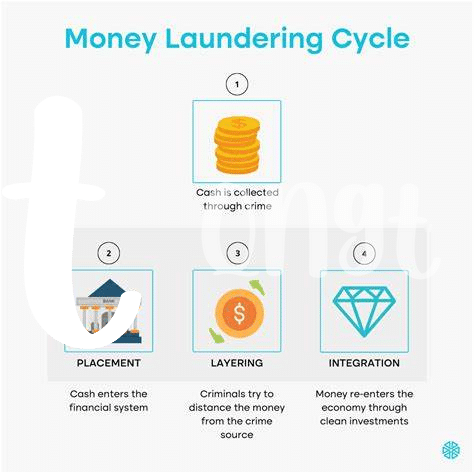

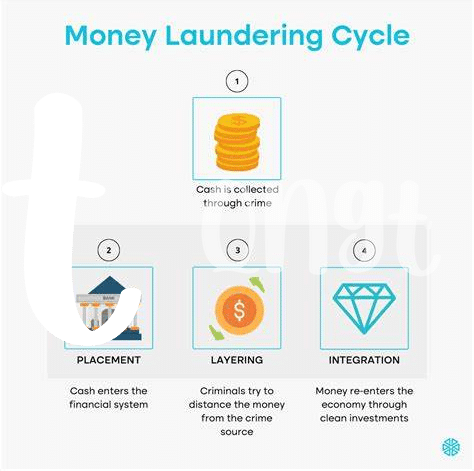

Bitcoin compliance faces various challenges in the ever-evolving landscape of regulations and technology. One of the key obstacles is the lack of uniform AML standards across different jurisdictions, leading to confusion and complexity for businesses operating globally. Additionally, the anonymous nature of Bitcoin transactions poses a challenge in tracing and verifying the source of funds, increasing the risk of money laundering and illicit activities. Moreover, the rapid pace of technological advancements often outpaces regulatory frameworks, making it challenging for compliance efforts to stay ahead and adapt effectively. These challenges highlight the critical importance of staying informed, proactive, and agile in addressing compliance issues within the Bitcoin ecosystem.

Importance of Aml Training for Businesses: 📚

Training is an essential component for businesses to effectively navigate AML requirements. By investing in comprehensive AML training, employees can enhance their understanding of regulatory obligations, recognize potential risks, and foster a culture of compliance within the organization. Training sessions provide practical knowledge and tools to identify, report, and mitigate money laundering activities, ensuring that businesses remain proactive in safeguarding against financial crimes. Continuous education empowers staff to stay updated with evolving regulations and best practices, ultimately strengthening the overall AML framework.

Role of Technology in Aml Compliance: 💻

Technology plays a pivotal role in facilitating AML compliance in the realm of Bitcoin transactions. With the use of advanced software solutions, businesses can now streamline their monitoring processes and quickly identify suspicious activities. Automated tools help in analyzing vast amounts of data in real-time, allowing for prompt detection and response to potential risks. Furthermore, blockchain technology itself offers inherent transparency, making it easier to trace the flow of funds and ensure compliance with regulations. By leveraging technological innovations, companies can enhance their AML practices and stay ahead of evolving threats in the digital currency landscape. To delve deeper into the impact of AML laws on Bitcoin investors, check out this insightful article on bitcoin anti-money laundering (aml) regulations in Thailand.

Building Strong Aml Policies and Procedures: 🏛️

Building strong AML policies and procedures is crucial in ensuring compliance with regulations. By clearly outlining guidelines and protocols, businesses can establish a framework that helps in detecting and preventing money laundering activities. These policies should be comprehensive, regularly updated, and communicated effectively throughout the organization. Implementing robust procedures ensures that all staff understand their roles and responsibilities in maintaining a compliant environment. Moreover, conducting regular audits and assessments can identify any gaps or weaknesses in the existing policies, allowing for timely improvements. By prioritizing the development of strong AML policies and procedures, businesses can enhance their overall risk management and safeguard against illicit financial activities.

Collaboration for Effective Aml Solutions: 🤝

Collaboration plays a crucial role in achieving effective AML solutions within the Bitcoin landscape in Tunisia. By fostering partnerships between regulatory bodies, financial institutions, and technology providers, a unified approach can be established to combat money laundering and ensure compliance. Sharing information, best practices, and resources can enhance the overall AML framework and promote a more robust and interconnected system. Through collaborative efforts, stakeholders can address evolving threats, implement innovative technologies, and collectively work towards a safer and more transparent financial ecosystem. This synergy enables a proactive stance against illicit activities while ensuring regulatory alignment and adherence to global AML standards.

Insert Link: bitcoin anti-money laundering (aml) regulations in turkey